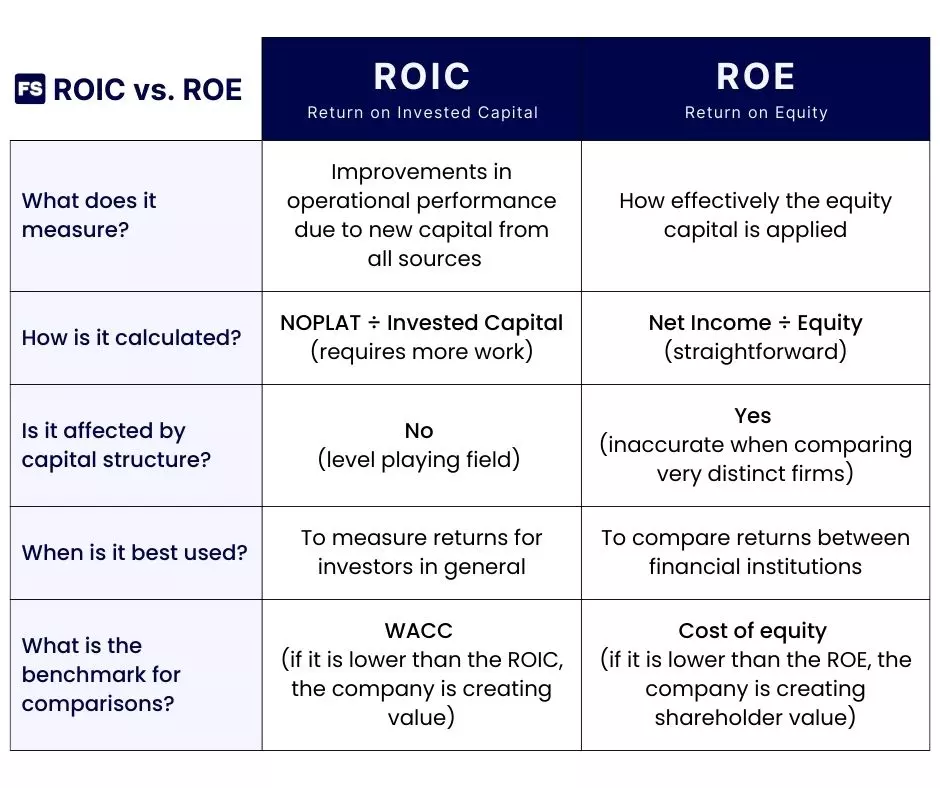

The difference between the Return on Invested Capital and the Return on Equity is that the ROIC measures how effective is the company’s employment of all sources of capital at increasing the operating income, while the ROE compares the capital invested by shareholders to the net income.

In other words, the ROIC is the return on the money of all investors (equity and debt). The ROE is the return for equity investors only.

At first glance, these two metrics seem pretty similar because both gauge a company’s ability to generate gains from its investments. But they don’t tell you exactly the same thing. A closer look reveals some key differences:

Still confused? Keep reading for a more comprehensive answer.

You’ll start by 1) understanding the ROIC, then 2) understanding the ROE, 3) highlighting key differences between them, and finally 4) packing things up with an example. As a bonus, we’ll go through some frequently asked questions.

Ready? Let’s dive in:

#1) What is ROIC

The Return on Invested Capital (ROIC) is a measure of a company’s efficiency in using its invested capital to generate returns.

A ROIC higher than the cost of capital means the business is healthy and growing, while a ROIC lower than the cost of capital suggests an unsustainable business model.

To calculate the ROIC, you divide the after-tax operating profits by the capital all investors have put into the company:

The NOPLAT (Net Operating Profit Less Adjusted Taxes) is the operating income after adjusting for taxes, as the name suggests. It excludes the impact of debt financing, allowing you to compare companies with different total capital structures.

You won’t find it directly in financial statements. To calculate the NOPLAT you need the EBIT and the corporate tax rate: NOPLAT = EBIT x (1 – Tax Rate).

The invested capital is all the money that funds the assets that generate profits for the business. You also won’t find it in the balance sheet. To calculate the invested capital you subtract the current liabilities that don’t require interest payments from the operating assets.

Now, how do they work together?

NOPLAT is the money available to all investors of the company—whether they’re equity investors or debt holders. And the invested capital is all the money these investors have put into the company. The result?

ROIC is independent of capital structure.

It tells you how good a business is at multiplying its investors’ money. A company creates value if its ROIC is higher than its weighted average cost of capital, or WACC.

Companies with high ROICs and high sales growth generate more shareholder value and interest for their lenders than companies with low returns and growth.

#2) What is ROE

The Return on Equity (ROE) is a profitability ratio that measures how effective the equity capital allocation of a company is by dividing its net income by its shareholders’ equity.

How do you calculate the return on equity? Use the following formula:

You can easily find the net income and equity value in the financial statements of the company you’re analyzing.

Because net income is measured over the year, some analysts calculate the ROE can using the average book value of equity between the end of the current and the prior year.

The ROE tells you how efficiently a company is using its equity to generate profits.

A higher ROE indicates the firm generates more profits per dollar of equity invested—generally a positive sign. You can use it to compare industry peers, or track performance over time.

However, ROE is affected by a capital restructure (unlike the ROIC).

If a company issues debt to buy back its own shares, the book value of equity in the numerator will decrease (while debt increases). This means more financial leverage can increase the ROE number. The problem? More leverage increases the risk of the business too.

A negative return on equity caused by negative net income loses its meaning, as there is no return.

A final thought about the ROE:

The net income is the money available to distribute to shareholders in the form of dividends. (Interest payments being the money for debtholders.)

By dividing it by the money equity investors have put into the company, you get a direct measure of the return for equity investors—excluding debt investors.

Thus, the return on equity is better than the basic version of ROA (return on assets), as the latter mixes up shareholder returns (net income) with capital from both shareholders and lenders (total assets).

#3) Difference between ROIC and ROE

Both the ROE and the ROIC measure the profitability of a company relative to the money from its investors. However:

- The return on equity tells you the profit the company generates with the capital it received from shareholders only.

- The return on invested capital focuses on the profits generated by both debt and equity holders’ investments.

When it comes to how each metric accounts for capital structure:

- ROE mixes operating performance with capital structure, reducing the value of comparisons between companies.

- The ROIC on the other hand, separates the operating performance from the capital structure that finances the business.

Analysts usually compare both metrics to a given benchmark:

- For the ROE, that benchmark is the cost of equity—the rate of return shareholders require. A ROE higher than the cost of equity suggests the business is generating returns sufficient enough to compensate for the risk of equity investments.

- For the ROIC, the benchmark is the WACC. If the ROIC is greater than the WACC, the company is creating value for its investors.

Another difference between the ROIC and the ROE has to do with the unique way the balance sheet of a financial institution works:

For a company, financing costs such as interest payments are non-operational expenses. That is, they aren’t related to how the business makes money and creates value.

For a bank however, financing costs are operational by nature. Banks’ main way of making money is to receive deposits, give out loans, and charge interest.

A bank paying you interest for parking your money with them is an operational expense. A company paying interest to a bank for contracting debt is not.

For a financial institution, deposits are liabilities and loans are assets. This makes it hard to distinguish the items you need to calculate ROIC, as banks deal with so much borrowed capital. It’s better to use ROE.

The ROE is to a financial institution what ROIC is to a non-financial firm.

Looking at the ROE formula, the numerator for a bank is interest income plus non-interest income less expenses and taxes. The denominator—equity value—is the difference between net assets and liabilities, which are registered at their market value (as opposed to their accounting value).

The last noticeable difference between ROE and ROIC happens when the company does a share buyback funded by debt:

- Share buybacks increase earnings per share, as there are fewer outstanding shares in circulation for the same level of earnings, and the return on equity, as the denominator—shareholder’s equity—reduces.

- The ROIC on the other hand, is unaffected by how a business is financed. Buybacks have no impact on the return on invested capital because the restructuring of capital will increase debt but decrease equity by the same amount. ROIC takes both sources of capital into account, as opposed to just equity.

Now, debt isn’t used for buybacks only. Here’s what happens when a company funds a new project with debt:

What Happens to ROE and ROIC as Debt Increases

It’s important to understand how ROE, ROIC, and the cost of debt are interconnected when a company increases debt.

The one thing you need to know is this:

The ROE rises with leverage only if the ROIC is greater than the cost of debt.

Read that again. Confused as to why? Let me explain:

The capital structure of a firm consists of a mixture of equity and debt (both short and long-term), and it explains how the assets were financed.

When a company uses debt, it pays interest to those who provide it with those resources.

Now, what is the effect of this on the net income used to calculate the ROE?

The increase in debt will directly decrease the net income due to the additional interest payments. If the company uses the debt to fund a new cash-generating project, it may increase revenue as well. But it’s indirect.

A successful investment will create value and increase the net income because it compensates for the increase in interest expense, right? A failed project on the other hand, will only increase expenses and lower the ROE.

Now, this is where things come full circle:

How can you tell if the investment is good enough to surpass the interest expenses and increase the net income?

The ROIC. The return on invested capital is the cash the new venture generates.

You see, if the return the firm receives from the project (ROIC) is higher than the return it pays to the investors that financed it (cost of capital), the increase in debt results in an increase in the ROE.

In other words, the revenue increases faster than the interest payments, rendering an increase in the net income. And as you know, the net income is the numerator of the ROE, so the final return on equity number increases. (Equity, the denominator, stays the same.)

Now, you may be wondering:

What’s the impact of a debt increase in the NOPLAT used to calculate the ROIC?

There’s no impact. Interest payments don’t affect this metric.

As to equity book value (used in the ROE) and the invested capital (the denominator in the ROIC), both are also unaffected by debt increases. Here’s why:

The reflection of more debt in the balance sheet is an increase in cash—which is an asset, not equity. More specifically, this excess cash is a non-operating asset and therefore not included in the invested capital.

Now, this doesn’t mean companies should max out the leverage they use in their capital structure.

More debt leads to more money servicing that debt, which means a lower net income, increased financial risk and cost of debt, and more pressure on the effectiveness of the invested capital.

#4) ROIC vs ROE Example

Let’s go through a quick example to put these concepts in motion.

Imagine a company with the following balance sheet (in millions of dollars):

| Current assets | 60 | Equity | 40 |

| Non-current assets | 90 | Current liabilities | 35 |

| Non-current liabilities | 75 |

The total assets of $150M include $20M in non-operating assets. Of the total liabilities of 35+75=$110M, $80M is interest-bearing debt.

The income statement (in $M) is as follows:

| Revenue | 100 |

| Cost of goods sold | (60) |

| Selling, general, and administrative expenses | (20) |

| = EBITDA | 20 |

| Depreciation and amortization | (10) |

| = EBIT | 10 |

| Interest expenses | (4) |

| = Earnings before taxes | 6 |

| Income taxes (20%) | (2) |

| = Net income | 4 |

Calculating the ROE is straightforward:

For the ROIC however? It’s not so simple.

You need the NOPLAT, which is the EBIT minus taxes: 10x(1-20%)=$8M.

And the invested capital, which is the debt plus equity book value minus the non-operating assets: 80+40-20=$100M.

If you plug everything into the ROIC formula you get:

How do you interpret these numbers?

- ROE: For every dollar of equity capital invested into the company, it generates a profit of 10 cents. This is how well the company reinvests shareholders’ money to increase earnings.

- ROIC: For every dollar invested into the company in general—whether it is debt or equity financing—it returns 8 cents.

Generally, the ROIC is lower than the ROE because debtholders take on less risk than equity investors, which means their required rate of return is also lower. Since the ROIC includes all sources of capital, debt financing brings the overall return for the invested capital down—similarly to how more debt lowers the WACC.

(Bonus!) ROIC vs ROE FAQs

There you have it!

Now you know the difference between the return on equity and the return on invested capital.

Let’s finish this post with some frequently asked questions:

What is the difference between ROE and ROIC?

ROIC tells you how good a business is at multiplying its investors’ money. ROE tells you how good a business is at multiplying its equity investors’ money, ignoring lenders. Unlike the ROE, the ROIC measures the results of the operations and is the same no matter how the firm finances itself. In general, the higher both metrics are, the better the company is at finding profitable investment opportunities.

Is ROE or ROIC more important?

The ROIC is more important because it doesn’t account for capital structure. It measures performance based on earnings before interest has been deducted, so it’s unaffected by how much leverage the company has. ROE on the other hand varies according to how the business is funded. As a result, companies that carry high debt levels or repurchase shares frequently can have a tall ROE that inaccurately describes the profitability. You cannot use accounting-based performance measures such as the return on equity to make reliable comparisons across businesses with different capital structures.

Should ROE or ROIC be higher?

In general, ROE is higher. Debt investors have priority in recovering their capital in the case a company goes bankrupt. As a result, they require a lower return. Equity providers take on more risk, so they expect to be compensated with higher returns. Guess what? ROE focuses on equity investors. ROIC however, includes both types of capital, which means the cost of debt will lower the overall total return. Ultimately, both metrics are most useful when compared to the cost of capital, as opposed to a stand-alone number.

Have any further questions? Leave them in the comments below and I’ll get back to you as soon as possible.