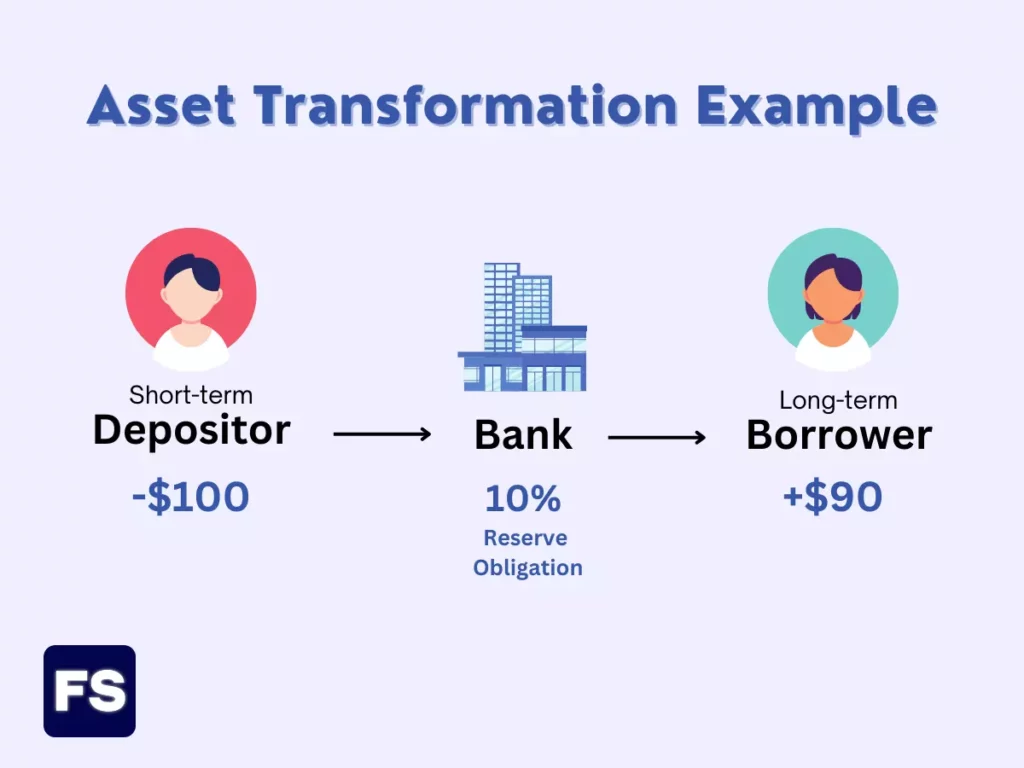

Asset transformation can be described as the process through which banks transform customers’ deposits into loans for borrowers. This is how banks make most of their money.

It is the bread and butter of the banking business model.

However, to fully comprehend banks’ asset transformation function (also called maturity transformation by some) you need to first understand the nature of their balance sheets, and how it’s different than non-financial companies:

How a Bank’s Balance Sheet Works

Banks’ balance sheets work very differently than a normal corporation.

When you go to a bank and deposit your money, that is actually a liability to them. Why? Because they’re in debt with you. You can withdraw the money at any time, which means the bank owes you the money deposited.

On the other hand, the loans given out to consumers and businesses are assets to the bank. These loans (bank assets) generate regular payments to cover the capital, and additional interest payments. This is where the bank makes money.

Where does the bank get the money to give out all those loans?

Your deposits.

In case you didn’t know, banks don’t keep your money parked in a safe waiting for you to withdraw it whenever you please. No…

They take that money and go make some more money off of it. How so? By lending it and charging an interest rate.

This happens especially with savings accounts (where you receive a tiny interest rate for parking your money for a long time), as opposed to checking accounts (where you can move money freely with checks and debit cards).

The system is known as fractional reserve banking.

In March 2020, the 10% reserve requirement was lowered to 0%, essentially removing the reserve requirements altogether. The current system works more as an incentive rather than a requirement, as banks receive interest paid on their reserves.

This doesn’t mean you don’t have access to the money you deposited. It only means if you withdraw your entire balance (or an amount higher than what the bank keeps on hand), the bank will get funds from someone else and give them to you.

Types of Asset Transformation

So, the process of transforming a number of small deposits (bank liabilities) into long-term loans (bank assets) is what we call asset transformation.

There’s no set way to define different asset transformation types. However, we can distinguish them by the depositors and borrowers. For example:

- Retail: Short-term deposits from individual customers lent for longer terms, through mortgages, car loans, and consumer loans.

- Wholesale: Using funds deposited by large institutional investors and companies to fund loans for commercial real estate or infrastructure projects.

- Interbank: Taking overnight deposits from other banks and lending out those funds for longer in the interbank lending markets.

It’s also worth noting customers’ deposits are not the only source of money. Other sources of funds banks use to lend out include:

- Bank capital: Banks raise capital by selling stocks or issuing bonds.

- Wholesale funding: Banks can borrow from other financial institutions, such as other banks or the Federal Reserve.

- Securitization: Banks can pool together assets, such as mortgages, and sell them as securities to investors. They then use those proceeds to lend out to customers.

Finally, we need to talk about qualitative asset transformation:

Qualitative asset transformation is not necessarily transforming something from a liability to an asset, but transforming illiquid assets and improving them to attract investors.

Imagine a bank owns a house and some land it wants to sell. It can restore the original asset, offer additional guarantees, insurance, among other extras, and—therefore—attract investors.

Advantages of Asset Transformation

The benefits of asset transformation for banks include:

- Generate revenue through spreads and fees: Fractional reserve banking allows banks to use funds that would otherwise be unused and idle, to generate returns on new loans. The difference between the interest rate your bank pays you for keeping your money in a savings account, and the interest rate they get paid every month for lending is called the spread. Along with account fees, this is the money the bank earns.

- Provide liquidity to the economy: Banks provide useful tools such as checking and savings accounts, while also supporting long-term economic growth by providing funding for projects such as homes and business expansions. By using a combination of sources of funding, banks ensure a steady supply of funds to lend out to customers.

Overall, asset transformation is important to support economic growth and stability, and allocate capital better to where it is most needed.

When a central bank wants to implement new monetary policy, it usually involves altering the money supply.

Printing actual physical dollar bills is a very small part of the equation, unlike what most people think.

Instead, central banks control the money supply through commercial banks. Here’s how:

When a commercial bank borrows from the central bank, it creates new money. The commercial bank receives a deposit from the central bank, which it can then lend out to customers. Lowering reserve requirements has the same effect. This stimulates the economy, as more money is in circulation.

Disadvantages of Asset Transformation

There are also potential drawbacks to asset transformation, such as:

- Liquidity risk: What happens if everyone wants their money out at the same time? This is called a bank run, and the bank will likely not have enough liquid assets to meet those demands.

- Increased regulation: To mitigate the risks of a bank run, banks are subject to various regulations and are required to hold a certain amount of liquid assets, such as cash and government securities, to ensure they meet the short-term demands of depositors.

- Interest rate risk: If interest rates rise, the value of the long-term assets decreases, which can cause losses for the institution. In general, banks are always prepared to deal with unfavorable interest rate fluctuations. They can hedge against it using forwards.

- Digital transformation: Upcoming P2P lending platforms connect borrowers directly with investors, eliminating the need for a traditional bank as a financial intermediary. This will lower the costs for borrowers and increase returns for investors.

These risks are nothing new and will always be part of the banking business. Regulatory oversight exists to help mitigate them. Still, digital asset transformation is the new competition for traditional banks.

Asset Transformation Example

Let’s say you open a savings account with XYZ bank and deposit $20,000.

The bank offers you a 1% interest rate on your money if you let it sit for one year, so they pay you about $17 every month.

You aren’t the only one depositing your money at bank XYZ. 9 other people also deposited $20,000 the same week you did, under the same 1% 1-year agreement.

Let’s also imagine the bank is required to keep only 10% of customers’ deposits.

Your deposits together make up $200,000, which means the bank can use 90% of that (180k dollars) to give out loans.

On the other side of town, two people just agreed upon a house purchase and the buyer is going to finance the purchase with a $150,000 mortgage from bank XYZ.

The bank grabs the portion of the cash you and fellow depositors deposited that doesn’t go to reserves ($180k), and gives $150k to the borrower so he can pay the previous owner of the house.

The bank will charge a 5% interest rate on the mortgage loan.

This means the bank is paying $2,000 in interest to savers, and receiving $7,500 from the borrower every year ($150k*5%). A $5,500 profit, without taking into account service fees.

What happens if you want to withdraw your money?

Because you agreed to keep it parked for a year (savings account), the bank will penalize you—by charging a fee or ceasing to pay interest—if you decide to withdraw the money earlier than expected. This discourages most people from early withdrawal, giving the bank more time to put the money to work.

If you still decide to move forward because you really need the money, there are people depositing every day. That’s where the bank will get the money to give you. Fees help too.

This is the process of asset transformation. The bank takes in short-term funds, such as money deposited into savings accounts, and lends it out for longer terms, like mortgages or car loans.

The bank helps the home buyer achieve his dream of buying a new house, and at the same time, supports economic growth by paying out interest on deposits.

The Bottom Line

What is asset transformation by financial intermediaries?

The process of asset transformation refers to the conversion of short-term deposits (bank liabilities) into long-term borrowings (bank assets). Financial intermediaries (banks) perform this function. It essentially means that when you deposit money in a bank, they don’t let it just sit there. Instead, they borrow it to someone else who needs it to fund a project, boosting the economy and earning revenue with interest.

Why is asset transformation needed?

The asset transformation function of financial intermediaries is key to helping central banks create money to implement monetary policy and stabilize the economy. When a commercial bank borrows from the central bank, it creates new money. How so? Because the commercial bank receives a deposit, which it can then lend out to customers.

What is the role of financial intermediaries in asset transformation?

Banks’ main purpose is to transfer funds from people in a surplus (looking for short-term deposits) to people in a deficit (with long-term financing needs). The difference in maturities between long-term borrowers and short-term liquidity investors allows the bank to earn a spread when the interest rate yield curve is positively sloped. In other words, the bank receives interest on the loans it gives out (higher interest rate) and uses it to pay the depositors (lower interest rate), profiting off the difference.