No. Invested capital is the sum of the book value of equity and the debt that pays interest to investors minus the non-operating assets. Total assets on the other hand, is the sum of total equity and total liabilities.

Want a more comprehensive answer? Keep reading.

If you’re confused about why invested capital isn’t simply the sum of equity with liabilities, this is for you.

By the end of this article, you’ll know the best two ways to find total invested capital to calculate the EVA or the ROIC (according to the top business schools and investment banks)—and finally understand why it isn’t the same as total assets.

Ready? Let’s dive in:

Understanding Invested Capital

What is invested capital?

You can think of it in two equivalent ways:

- The net assets a company needs to generate NOPAT (Net Operating Profit After Taxes).

- How the company finances those net assets (generally through a mixture of debt and equity capital).

Under the fundamental accounting equation Assets = Equity + Liabilities.

Thus, you can calculate invested capital from the liabilities and equity side of the balance sheet or from the asset side.

The balance sheet has both operating and financing items. The problem? ROIC measures only operating performance. The solution? Both the numerator (NOPAT) and the denominator (invested capital) must separate operating items from financing structure uniformly. More on this later.

Another thing:

The invested capital we’re exploring in this article is different than the one used to calculate MOIC (Multiple on Invested Capital). Why?

MOIC is mostly used in private equity to evaluate fund performance. In that context, invested capital is pretty straightforward—simply the money put into the fund.

Now, how do you calculate the invested capital?

How to Calculate Invested Capital

Invested capital is not given directly in any other financial statement. However, you can use balance sheet items to calculate it. You have two alternatives:

#1) Operating Approach

The operating approach gives you a clear sense of the assets the company is deploying and allows you to track changes in asset efficiency over time.

The invested capital formula is:

Invested capital = Operating assets – Current liabilities

Where:

- Operating assets include not only current assets, such as accounts receivable and inventories, but also long-term (non-current) tangible assets such as net PP&E (Property, Plant, and Equipment), goodwill and other intangible assets, and capital leases. These are the assets the company uses in its operations to generate revenue.

- Current liabilities, more specifically non-interest-bearing current liabilities (NIBCLs), are items like accounts payable, taxes payable, accrued expenses, and other current liabilities that do not require the payment of interest to investors.

This is similar to net working capital, except we’re using operating assets—which are not the same as current assets.

The key to calculating invested capital through the operating approach is to include all the assets the company needs to run its business.

On the other hand, non-operating assets should not be included. These are excess cash, marketable securities, equity investments, and minority holdings in other companies, among other items. Why exclude them?

Because you must keep both the numerator and the denominator under the same conditions when calculating ROIC.

ROIC measures operational performance. Thus, it uses NOPAT as opposed to the net income in the numerator.

You need to do the same in the denominator and focus on invested capital as opposed to total assets.

Excluding non-operating assets gives you a more accurate measure of the return a company generates on the capital it invested in its core business operations.

Now, you may be wondering:

Is cash an operating asset?

Only working cash. That is, money the business has in its bank accounts to run its daily operations.

On the other hand, excess cash is cash or other marketable securities not included as part of working capital.

You should exclude excess cash to be consistent with the focus on operating income as the measure of performance. The interest income the company receives from cash and cash equivalents is not operational revenue.

If you don’t? The return on capital may misleadingly be too low for companies with significant cash balances.

#2) Financing Approach

The financing approach tells you how the business finances its operations.

In this approach, the total invested capital formula is:

Invested capital = Equity book value + Financial debt – Non-operating assets

Where:

- Equity book value is generally share capital (money raised from selling common or preferred stock), retained earnings, and shareholder’s equity.

- Financial debt is all short-term and long-term interest-bearing liabilities. This includes every source of financing the company pays interest on, from bank loans to bonds to operating leases. It does not include all current liabilities though.

- Non-operating assets, as mentioned above, include excess cash, marketable securities, real estate held for investment purposes, and equity stakes in other businesses.

Some literature also suggests this is equivalent to the Book Enterprise Value, which is the sum of equity and net debt.

Why do we use the book value of equity as opposed to its market value?

Because the market value of equity incorporates expectations for the future. It includes the expected value of growth assets, which cannot generate operating income today.

This is why the Price-to-Book ratio is rarely equal to 1—either the company has positive or negative growth prospects implied in its share price.

Understanding Total Assets

What are total assets?

Total assets is the sum of all the tangible and intangible resources the firm owns. It includes cash and cash equivalents, property, land, equipment, facilities, investments, accounts receivable, and intellectual property such as patents and trademarks.

Unlike invested capital, it’s pretty basic and straightforward.

You easily find the value of total assets in the balance sheet of any publicly traded company, and can use it to calculate the company’s total equity or net worth.

It is an important financial metric used to assess the overall financial health of a business.

Difference Between Invested Capital and Total Assets

A firm’s value is the total debt issued and equity sold to investors.

As a result, invested capital is sometimes calculated as the sum of debt and equity. But if you know how a balance sheet works, you know this sum is equal to the value of total assets, right?

So what’s going on here? Is the invested capital the same as total assets?

Assets = Liabilities + Equity

I understand the confusion the financing approach we saw above can cause when you compare it to the fundamental accounting formula.

Not all liabilities are debt though.

And invested capital includes only debt. More specifically, debt that pays interest.

For example, accounts payable, taxes payable, unearned revenue, and wages payable, aren’t considered debt because they don’t bear interest. There are no investors to which the company pays interest or dividends because of these items.

Why is it excluded? Invested capital is the money investors (debt and equity holders) have put into the company and get a return for it.

Understanding this difference is essential to calculate ROIC and ROA.

Invested Capital vs Total Assets Example

Let’s put these concepts in motion through a quick example.

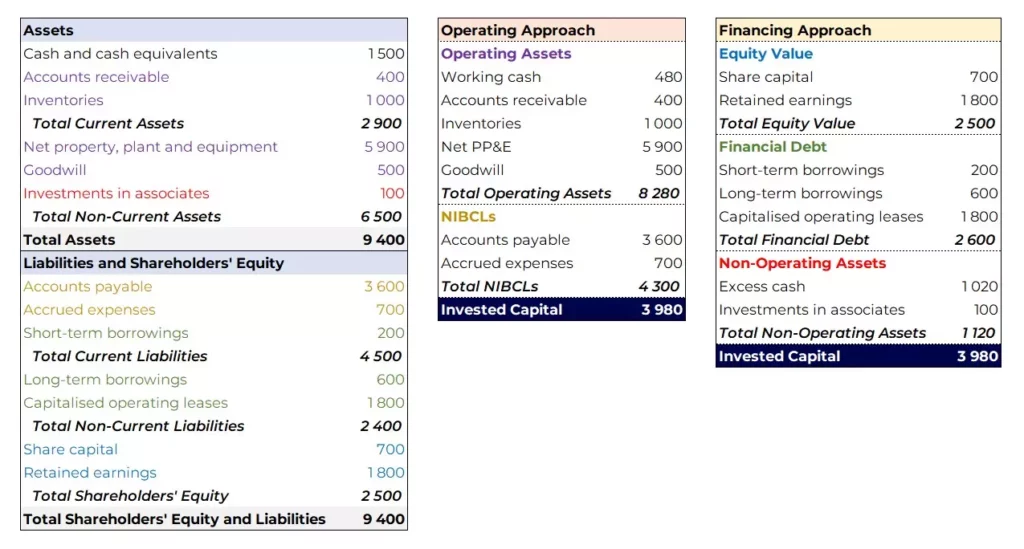

This is the balance sheet of a company in the food retail industry (hence the negative cash cycle) with 24,000 in revenue:

I include both ways of calculating invested capital and assume working cash is 2% of revenues.

As you can see, total assets is 9,400 while the invested capital is 3,980. A big difference.

Key Takeaways

There you have it! Here’s a quick recap:

- Invested capital definition: Invested capital is the total capital required to fund operations, regardless of type (debt or equity). In other words, it is the amount of capital a company has invested in its operations that is required to generate its current level of operating profits.

- How to calculate invested capital for ROIC: To calculate invested capital for ROIC you need to exclude everything that isn’t related to operational cash flow efficiency, since the ROIC calculation uses the NOPAT and not the net income. Hence, you have two options: Operating assets – Current liabilities or Equity book value + Financial debt – Non-operating assets.

- Total assets definition: Total assets is simply the sum of all resources the firm owns. You may confuse it with invested capital because total assets is the sum of equity and liabilities. Invested capital is similar, except it doesn’t include current liabilities that don’t pay interest to investors, nor assets that aren’t fundamental to the business operations.

It’s worth noting that different analysts and institutions may use different definitions of invested capital to adjust the calculation to their specific financial modeling needs.

Still, the approaches above provide a solid framework for calculating invested capital, and understanding how it is different from total assets.