Equity financing is more expensive than debt financing because as a shareholder you partake in more risk than a bondholder. Because of this, shareholders want to receive higher returns to compensate for the additional risk they take.

Now, you may be wondering:

Why is equity financing riskier than debt financing? We can build it down to 4 reasons:

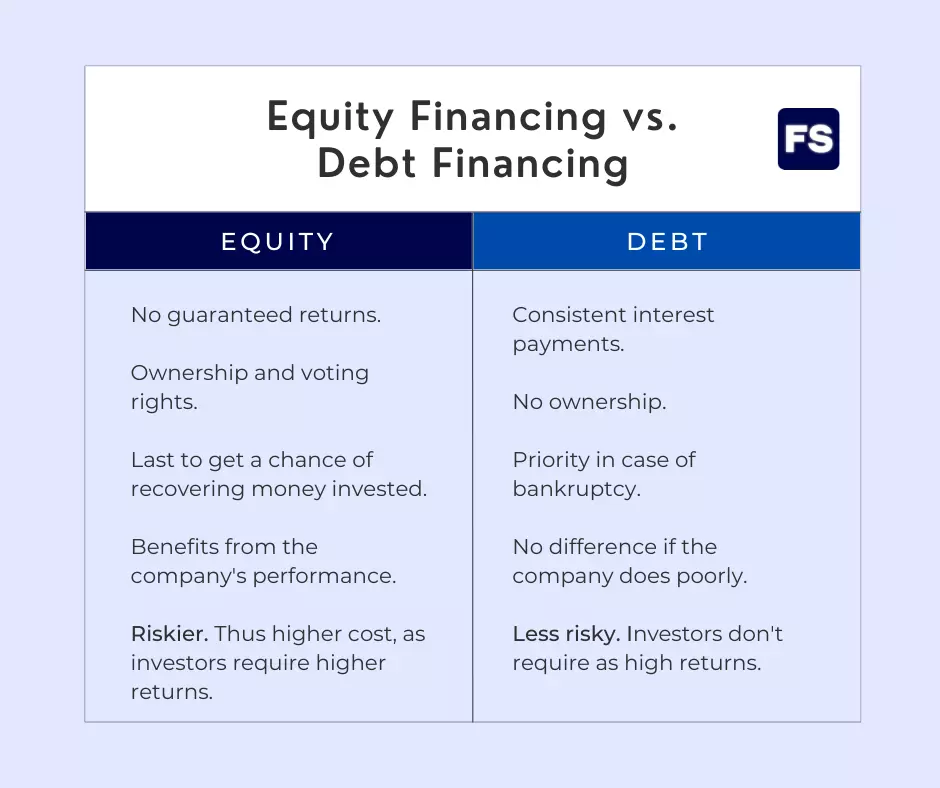

Debt Financing vs Equity Financing

First, let’s briefly go through an overview of the difference between equity financing and debt financing in a firm’s capital structure:

Equity financing is when a business offers ownership holdings to raise money. The most common way to do this is by selling stocks to investors, which are shares of ownership you can buy and sell in the stock market.

For example, if you buy 100 shares of a company’s stock, you own a small percentage of that business (depending of it’s a small business or a large corporation). This means that if the company does well and its stock price shoots up, you can sell your shares for a profit. However, if the business tanks along with the stock’s value, you lose money.

On the other hand, debt financing means borrowing money from a lender, such as a bank or financial institution. The company agrees to pay back the loan, plus interest, over a certain time.

Let’s say a company agrees to take out loans with a bank and pay it back in 10 years. Generally, every month, the bank receives a payment—some of it to pay back the capital amount received, some of it to pay the interest rate on the loan.

Most companies use a mix of debt and equity to finance their operations. Up to a certain point, debt lowers the total cost of capital, which is beneficial.

Debt investors receive a certain string of cash flow in the form of interest, as opposed to equity investors, who may or may not see returns on their investments:

1) Uncertain Returns

Interest payments are constant, unlike the return you get as a shareholder. This can be dividends or capital gains, and they are dependent on a number of things, such as market conditions and the company’s performance.

When a company raises money through debt financing, it agrees to pay back the borrowed money with a (most times) fixed interest rate. This means the lender knows exactly how much they will receive in return for their investment. There’s less uncertainty.

If there’s less uncertainty, there’s less risk, right? Therefore, lenders (debt investors) require a lower return.

On the other hand, shareholders do not have a guaranteed return on their capital. Instead, the value of their investment (the value of their shares) may increase or decrease based on the company’s success.

If the business succeeds, the share price is likely to rise and investors will see a healthy return on their capital. However, if the business performs poorly shareholders could end up losing money. This requires higher risk tolerance.

Because the returns from equity funding are uncertain and can vary widely, it is riskier than debt funding. The result?

As an investor, you require a higher rate of return on your equity investment to compensate for the added risk.

This is what makes equity funding more expensive for companies, as they may have to offer higher dividends or a larger ownership stake to attract investors.

Also, keep in mind:

A company has no obligation to pay you dividends, as opposed to bonds’ interest payments.

2) Diluted Ownership

Equity financing is also more expensive because it entails giving up ownership in the company—which means the investors become shareholders and have a claim to the company’s assets and income.

This means one thing for the company’s founders and current shareholders:

Their ownership and control reduce. They have less say in the company’s decisions.

Get to have a say in the future of the company. This is a valuable responsibility, hence it costs more. Debt, on the other hand, does not give you ownership rights.

As the number of investors in the company increase, each investor gets a smaller share of the profits (in the form of cash dividends). This can make the investment less attractive, especially for early venture capitalists, because a smaller ownership stake means less control over decisions and a smaller share of the profits.

This is why venture capital is such a high-risk high-reward effort.

On the one hand, you get a piece of the pie no matter how big it gets, as opposed to a fixed consistent cash flow over the long term. But at the same time, it’s highly likely you get nothing if the pie is burnt. Nada. Zero. Here’s why:

3) Bankruptcy Proceedings

One more thing that makes equity financing riskier for investors is that they have fewer rights in case of bankruptcy.

If the company is unable to pay its debts and files for bankruptcy, lenders are entitled to be paid first (before shareholders).

Stockholders do not have a legal claim to the company’s assets, only creditors have. As a result, during bankruptcy procedures, there’s a higher chance creditors receive full payment or at least a larger share of the company’s assets, as opposed to shareholders.

In contrast, shareholders are the last to get a piece of the pie. Why? Because their claims on the company’s assets have the lowest priority. As a result, they risk losing everything they invested in the business.

This is especially when you’re a holder of common stock, as opposed to preferred stock.

As you can see equity financing is way riskier than debt financing, right?

So shareholders will want to—rightfully so—be better compensated for the additional risk.

The risk of bondholders losing their money is much smaller. In case the company is in financial distress and has to liquidate its assets to pay investors, bondholders will get their money back first.

4) Tax Advantages of Debt

The tax treatment is another big perk of using debt as a financing option.

Interest is tax deductible, while dividends are not.

This means a business can reduce its taxable income by deducting the interest payments it makes on its loans. The result? They will pay less taxes.

Let’s say you run a business and make a profit of $200,000 for the year. And you had to pay $40,000 in interest on your debt. What does this mean? It means you only pay taxes on $160,000 of that profit.

The number the IRS will use to calculate the taxes you owe is smaller, therefore you owe fewer taxes. This can drastically lower the total cost of borrowing money for your company.

In contrast, dividend payments to equity holders are not tax deductible. The business must pay taxes on the earnings it distributes as dividends to shareholders.

Additionally, we can say shareholders are taxed twice.

One time when the company pays taxes on its earnings before distributing dividends, and a second time because shareholders must pay personal taxes on the dividends they receive.

Let’s say your company profits $100,000 for the year and pays a 20% corporate tax rate, leaving it with a net profit of $80,000. If you decide to distribute all of this net profit to equity investors in the form of dividends, they have to pay additional (personal) taxes on what they receive.

This is especially true for an equity investor in a high tax bracket. They pay a lot in taxes, effectively being taxed twice on the same profits.

In a Nutshell

There you have it! A full breakdown of why equity financing is considered to be more costly than debt financing.

Here’s a recap of why debt financing is cheaper than equity financing:

- Uncertain returns: Shareholders want a higher return for the additional risk of not receiving fixed interest payments, as lenders do.

- Diluted ownership: In order to keep shareholders happy after their control in the company reduces because the company issued more stock to new investors, it must offer higher returns (generally in the form of dividends).

- Bankruptcy proceedings: Shareholders are the last to get paid in case a company goes bankrupt and needs to liquidate its assets. This means they can lose all their money. Meanwhile, this is unlikely to happen for debt funding. As a result, shareholders want better compensation for the extra risk.

- Tax advantages of debt: Interest payments on debt are tax deductible in most countries. This lowers the effective cost of debt financing for companies.