When the IRR (Internal Rate of Return) is greater than the WACC (Weighted Average Cost of Capital), it means the investment’s rate of return covers the costs of financing it. Therefore, the project should be accepted.

For a deeper understanding of the logic behind this, keep reading.

We’ll start by understanding the difference between IRR and WACC, the relationship between both metrics (and NPV too), and finally what a higher IRR means for an investor.

Ready? Let’s dive in:

WACC vs. IRR Meaning

Both the WACC and the IRR are financial metrics used in corporate finance to help managers make capital budgeting decisions.

Capital budgeting is the process a business goes through to evaluate future potential projects or investments.

It focuses on actual cash flows as opposed to accounting revenues and expenses. The goal?

To determine when to accept or decline an investment in assets, which projects to prioritize, and how to finance those decisions.

Weighted Average Cost of Capital

The WACC is the total cost of capital of a company, as it takes into account the returns of the company’s shareholders (equity financing), as well as the return of bondholders and lenders (debt financing).

You calculate it by adding the cost of equity multiplied by the percentage of equity financing in the total capital structure, to the after-tax cost of debt multiplied by the percentage of debt financing in the total capital structure.

You can also calculate the WACC using the debt-to-equity ratio.

The lower the WACC, the better for the company, as it minimizes financing costs.

The cost of equity is usually estimated using the CAPM (Capital Asset Pricing Model). Meanwhile, the cost of debt is the effective interest rate banks charge the company for loans, or the bond yield the company pays bondholders.

What makes the WACC vary? A number of things, including the overall market conditions and investors’ sentiment, the industry the company is in, the amount of leverage it uses, and the perceived risk relative to its peers.

Analysts use the WACC to discount future cash flows, calculate the net present value, and estimate a company’s valuation or success of investments.

Internal Rate of Return

The IRR is the annual rate of return an investment is expected to generate over its lifetime.

It is the discount rate that results in a Net Present Value (NPV) of zero. In other words, it’s the rate that makes the present value of the future cash flows equal to the initial investment.

The IRR is a project evaluation technique companies commonly use. The higher the IRR, the better the expected financial performance of an investment, and vice versa.

For example, a business may compare investing in new equipment against expanding an existing factory according to the IRR of each project. They will choose the project expected to perform better and generate a larger return for the corporation.

Again, the IRR gives you a compound rate of return on all interim cash flows on an annual basis. This is different than the ROI metric (Return on Investment), which is the return on a project over its entire life.

So if the IRR is the expected return of an investment, and the WACC is the cost of financing that investment, you want the return (IRR) to be higher than the cost (WACC), right?

The higher the IRR, the higher the expected return to the company.

The WACC is the rate the company uses to discount after-tax cash flows (also considered the hurdle rate, the minimum return required by investors). Managers can decide whether to approve or reject a project by comparing it to the IRR.

If a project’s IRR is greater than the WACC, it means the expected return covers the costs of financing.

The Relationship Between NPV, IRR, and WACC

The NPV (Net Present Value) is the value of future cash flows (positive and negative) over the life of an investment discounted to today. It is the tool of choice for most financial analysts due to its accuracy when analyzing the profitability of investments.

The WACC is commonly used as a discount rate to calculate the NPV. Analysts discount cash flows to the present to highlight the time value of money (money today is worth more than money tomorrow).

Now, what’s the relationship between NPV and IRR?

The NPV is used to calculate the IRR. There’s no specific formula for the IRR calculation. To compute it, you equate the NPV to zero and substitute the WACC for an unknown rate. That unknown rate will be the IRR after you solve the equation to find it.

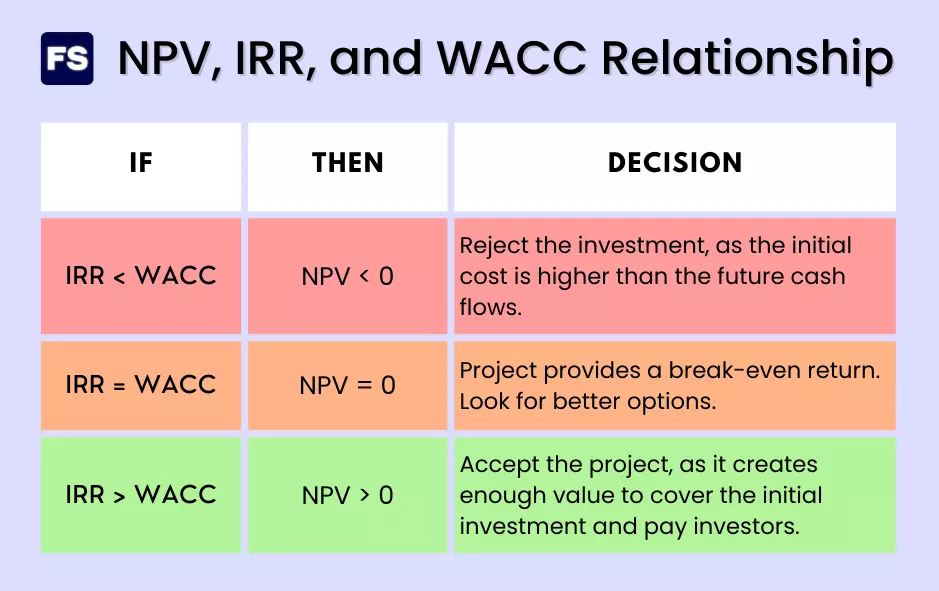

As mentioned before, the WACC is the hurdle rate analysts compare the IRR to for decision-making. And there are 3 scenarios when it comes to WACC vs IRR:

- WACC > IRR: An IRR less than WACC implies the NPV is negative and the present value index is lower than 1, as the costs of financing the project are higher than its expected return. In other words, the initial investment (cash outflow) is higher than the expected cash inflows it will generate. Therefore, the project is unprofitable and should be rejected.

- WACC = IRR: If IRR is equal to WACC, it’s a break-even situation, where the company is earning just enough to cover its costs, and the NPV is zero. The company will either look to cut costs through more affordable financing (for example, use more debt financing as it is cheaper than equity), reassess how its potential investment opportunity creates value, or choose to invest in a higher-return alternative investment.

- WACC < IRR: IRR greater than WACC means the expected return on the project is higher than the company’s cost of capital. The NPV is positive. This is a profitable investment for the company, and the project should be accepted. Why? It creates value for shareholders (and contributes to positive Economic Added Value).

What Does It Mean When IRR Is Greater Than WACC

So, now you know an IRR higher than the cost of capital signals the investment project should be accepted.

What does this mean for investors?

If you discount cash flows at the IRR, the net present value of the project is zero. The business will neither profit, nor lose.

This means the IRR is the maximum return the project can provide the investors financing it. And the WACC is the minimum required rate companies consider when analyzing projects, since it is the base rate of return for the firm as a whole.

If there’s a big gap between the WACC and the IRR, the firm may decide to pay better returns to the shareholders and lenders that are funding the project.

This will increase the WACC, but as long as it is still below the IRR it’s a conceivable decision that will keep shareholders happy. The project will be less profitable, but still profitable.

IRR vs. WACC FAQs

What’s the difference between WACC and IRR?

The difference between WACC and IRR is that WACC measures a company’s cost of capital (from both debt and equity sources), while IRR is a performance metric that measures the expected return of an investment. The WACC tells you the overall return a company pays its investors. The IRR tells you if the company should undertake a project, which is when IRR > WACC.

How does WACC affect IRR?

It doesn’t. But they’re both connected to the NPV of a project. Most analysts use the WACC as a discount rate to bring cash flows to the present and calculate the NPV. Additionally, the NPV is used to calculate the IRR, as it is the discounting rate that results from setting the NPV equal to zero. There is no specific formula to calculate it.

Why should IRR be higher than WACC?

When the IRR is greater than cost of capital, the NPV is positive. Why? Because the expected return of the investment being evaluated—what the IRR measures—is higher than the costs of funding that same project—what the WACC measures. Higher IRR means higher NPV, and more net cash inflow when it’s all said and done.

If WACC increases what happens to IRR?

Nothing. The IRR calculation is not affected by a fluctuation in the WACC. However, it may change the conclusion you get from the IRR. If the WACC becomes bigger than the IRR, it signals a project should be rejected, as the costs of financing it surpass the expected return it will generate.