The present value index tells you how promising an investment project is. You calculate it by dividing the present value of a project’s future expected cash flows by its initial investment cost. The higher the result the better. Financial analysts and firms use the present value index to compare different projects.

That’s the gist of it.

For a more comprehensive answer, keep reading:

Present Value Index Definition

The present value index (PVI) is a measure of the attractiveness of a project or investment.

It is also known as the profitability index (PI), the value investment ratio (VIR), the profit investment ratio (PIR), and the benefit-cost ratio.

The PVI helps companies evaluate whether an investment is worth it financially, and if it will generate a positive return.

It also allows them to rank different projects from least to most worth executing. Why?

Because it quantifies the value created per dollar invested, as opposed to simply looking at expected cash flows and investment costs.

The PVI is a modification of the net present value (NPV)—the present of future cash flows minus the cost of the investment (cash outflows).

It is mostly used to evaluate individual projects or investments, while the NPV is used for company valuation as well—along with the free cash flow to the firm (FCFF) methodology and the discounted cash flow (DCF) model.

Now, it’s important to note the net present value index ignores project size. The problem with this?

Projects that require large investments typically have tighter profit margins, which may result in lower PVI results. Smaller projects will typically have higher PVIs.

Remember this when drawing conclusions from the PVI if you’re comparing investments of largely different sizes.

Here’s how to calculate present value index:

Present Value Index Formula

The present value index is computed as the present value of the projected capital inflows divided by the present value of the projected capital outflows. This is what’ll determine the profitability of the project.

The PVI formula is as follows:

Where:

- Present value of cash inflows: This is how much money the new investment is expected to generate every year. Those values are then discounted to the present to account for the time value of money—$1 today is more valuable than $1 one year because you can invest it. Thus, the further in the future a cash flow occurs, the lower its present value. This allows you to compare projects with different lifespans using the PVI.

- Present value of cash outflows: These are the investment costs for the new project. Most times it is only composed of the initial investment, but you can also include cash outflows you estimate will occur over time during the project’s life. You also can factor in these cash outlays beyond year zero in the numerator by subtracting them from the PV of cash inflows.

You must always discount the projected cash flows to the present using an appropriate rate that reflects their risk—typically the weighted average cost of capital (WACC).

Now, how do you interpret the PVI?

A PVI equal to 1 means the investment breaks even. The value of the discounted cash flows (numerator) is exactly equal to what it costs to generate those cash flows (denominator). It’s the minimum acceptable PVI value for the project to be viable. The equivalent of NPV equal to zero.

A PVI below 1 is undesirable. It means the project is not profitable. It costs more than what it will earn.

A PVI greater than 1 means the present value of the future cash flows is greater than the initial investment, thus it is profitable.

The higher the PVI, the better. As it means investors earn more cash for every $1 invested.

Some analysts calculate the PVI by dividing the NPV by the initial investment. But the initial investment is already subtracted from the NPV, so this works as a sort of return on investment in percentage terms.

Lastly, keep in mind the present value index is dependent on the quality of the forecasts for the cash flows. Incorrect assumptions may lead to an inaccurate PVI, which may impact decision-making.

Let’s go through a super quick example to put these concepts in motion:

Present Value Index Example

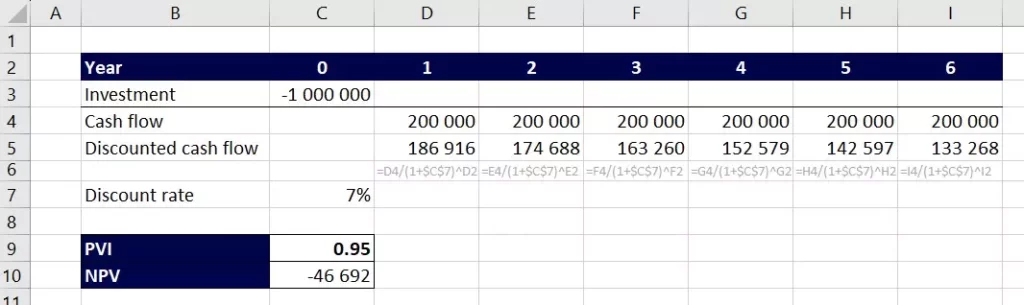

Imagine a company is studying an investment opportunity with the following characteristics:

| Initial investment | $1M |

| Expected annual cash flow | $200K |

| Project duration | 6 years |

| Cost of capital | 7% |

What’s the PVI of this project? Here’s how to find it:

Notice how the investment happens in year zero, not year one.

The discount rate you use to bring the expected cash inflows to the present is the cost of capital of 7%. In other words, the required rate of return by the investors that fund the project.

Below the discounted cash flow, I included a row showcasing the formula for how to discount cash flows.

In this case, the PVI of 0.95 means the NPV is negative and managers should reject this project. This decision could change when considering real options though.

Notice how if we simply accounted for inflows (200×6=$1.2M) and costs ($1M) and ignored the time value of money, the project would seem viable (profit of 1.2-1=$200K).

But you can’t treat money you receive a year from now with the same value as money you’ll receive six years from now, right? That’s why the discrepancy occurs.

Key Takeaways (FAQs)

What is the difference between PVI and NPV?

Analysts use both of these financial metrics to assess if it is worth it to go forward with a project or investment opportunity. The NPV measures the overall profitability of an investment by calculating the difference between the present value of expected cash inflows and outflows. On the other hand, the PVI is a ratio that compares the present value of cash inflows to the initial investment cost. It measures profitability per unit of investment.

What is a good present value index?

A good PVI is at least greater than 1. This indicates the present value of cash inflows (numerator) is enough to cover the initial investment (denominator). Thus, a profitable investment. For every dollar of the initial cost, the asset is expected to return more than a dollar. The higher the PVI, the better. However, the specific threshold for what’s a good PVI varies according to the company, its other investment opportunities, its industry, and the project size.