Return on Invested Capital. Return on Investment.

Wondering how the hell are these two things different? Then this is for you.

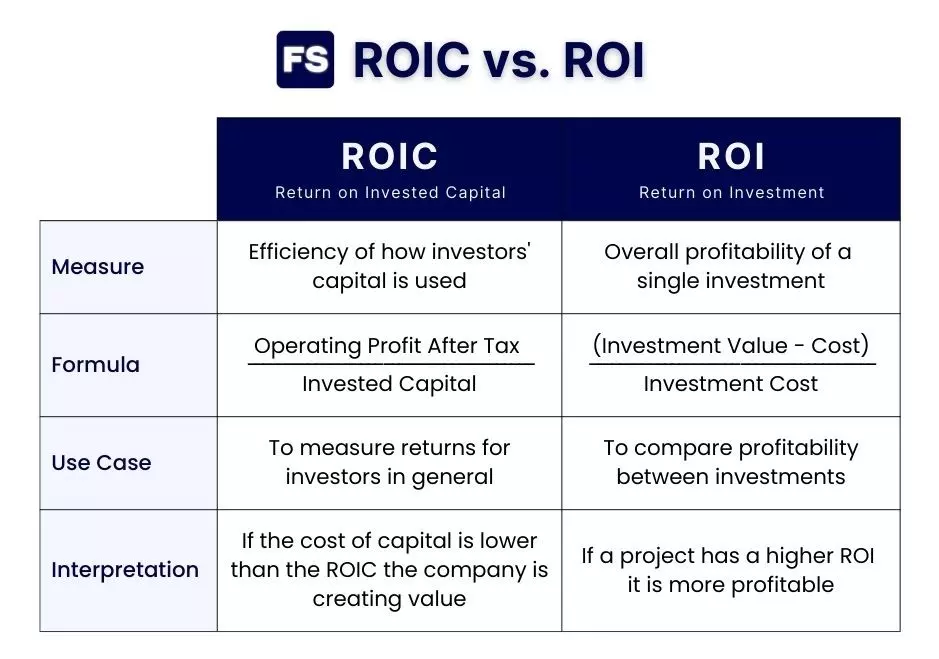

The ROIC measures how efficiently a company employs the capital it received from its investors (both equity and debt financing) to generate net operating profits. The ROI is a more general calculation of profitability that compares the initial investment of a project, endeavor, or campaign, to its current value.

At first glace, both metrics seem similar. But a closer look reveals some key differences:

Still confused? Keep reading for a more comprehensive answer.

We’ll go through what is the ROIC, what is the ROI, the key differences between them, and pack things up with an example.

Ready? Let’s dive in:

Understanding ROIC

The Return on Invested Capital (ROIC) is a financial metric that measures the effectiveness of a company’s capital investments.

How do you calculate it?

In the numerator, you have the operating income (EBIT) after taxes. This measures the performance of the underlying business, without the impact of taxes and financing decisions.

Why not use the net income? Because interest expenses are excluded from the net income, which means it is the cash available to shareholders only. The goal of ROIC is to take debtholders into account too.

In the denominator, you have the invested capital, which are the resources needed to conduct the business of the firm. You can also think of it as the total capital employed in the financing of the business.

The invested capital formula is:

If a company has a Return on Invested Capital of 10%, it means for every dollar of its investors’ money it has employed, it generates 10 cents of profit. Is this good?

It depends on how much its investors require as a return—the cost of capital.

You need to compare the WACC, or Weighted Average Cost of Capital (typically used as a discount rate), to the ROIC to determine to see if the company is allocating capital to good projects.

If the WACC is lower than the ROIC, the company is creating value for its investors through projects with a positive net present value of future cash flows.

If the WACC is higher however, the business is destroying value, as it is unable to find growth opportunities good enough to generate returns above the cost of the capital that funds the investment in those opportunities.

This is what determines what a good ROIC is, as opposed to some arbitrary number.

Understanding ROI

The Return on Investment (ROI) is a profitability ratio that measures the return an investment generates relative to its cost.

The ROI is a simple and widely understood metric that gives you valuable insights into the effectiveness of investments and supports decision-making.

It helps you track a business’ profit margin and evaluate a new product line, marketing campaign, or investment property.

For example, a company can use the ROI to evaluate the production of one product versus another and determine which product’s manufacturing and distribution is the most worthwhile.

How do you calculate it? Here’s the ROI formula:

ROI is expressed as a percentage, which is usually compared among different things you’re evaluating.

A positive ROI indicates the investment generated a profit, as the higher the value the more effectively the use of capital.

A negative ROI indicates a loss. And poor investment decisions.

Difference Between ROIC and ROI

So, what is the difference between ROI and ROIC?

What each metric measures—and how investors use them.

While the Return on Investment focuses on the performance of a specific investment, the Return on Invested Capital evaluates the effectiveness of the company’s overall capital allocation decisions.

Again, you can use the ROI to evaluate a variety of investments—such as the performance of a stock or a specific project, all the way to an IT investment or an organized event.

On the other hand, the ROIC has one purpose only—how much after-tax net operating profit does the company generate for all its investors and the capital they invested?

It tells you how good the company is, as a whole, at choosing profitable investments to employ the capital its investors have given it.

Every different investment decision in which the capital expenditure generates a higher return and a profitable investment improves the ROIC.

Now, aren’t the ROIC and ROI the same? Meaning, the ROIC is a more sophisticated ROI that measures a specific metric—capital allocation efficiency?

Good question. Let’s see:

The numerator in the ROIC formula is the same thing as the ROI numerator, right?

You know the explicit difference between the current investment value and financial investment cost? That’s implied in the EBIT number and comes from the income statement. It starts with the revenue and is subtracted by the cost of sales, general expenses, and depreciation.

The denominator is where the problem arises. If you want the ROI, you divide the difference above by the costs and expenses, as opposed to the invested capital.

This is why ROI measures profitability. And ROIC efficiency.

ROIC isn’t simply a modification of the ROI.

The make this work, the numerator in the ROIC would have to be the difference between the current value of the company and the capital invested in the past. And the denominator would stay as the invested capital. But this measures something different.

Or you could subtract costs from revenue and divide that number by the costs. That’s an ROI measure too, although it’s also estimating something completely different.

ROIC vs. ROI Example

Imagine you’re an investment bank and buy 1% of the shares of a company on its IPO.

Five years later the stock price is 30% above the IPO price. This is your Return on Investment. You can sell the stock and pocket the difference between the initial investment and what you sell it for. Straightforward, right?

Now, when you bought the stock, because it was in the primary market (as opposed to the secondary market), the money goes directly to the company.

The firm can use this funding to exploit the growth opportunities it has identified. And it does so over those five years.

As a result, its operating income after taxes last year is 100.

This result happened thanks to the assets and investments the business made. Where did they get the money to fund those assets? From you.

But you were not the only investor the company raised money with. In fact, the company has equity investors that, not only joined you in the IPO, but also angels from past seed rounds before it went public. On top of that, there are also debt investors, such as banks and bondholders. What a gathering, right?

In total, the company received 500 from everyone across all the investment rounds and financing types. This is the invested capital.

This means your ROIC—in fact, the ROIC of every other investor (debt and equity) too—is 20% for that year alone.

Good, right? Well, not so fast.

Unlike the ROI, you don’t pocket that 20% directly. Remember that you own only 1% of the company, there are dozens of investors from back when the business was just a small startup, and there are debt investors that will receive interest payments.

Most importantly, the company may decide to reinvest in its operations as opposed to distributing dividends.

Again, ROIC measures efficiency while ROI measures straight-up, plain and simple, profitability.

Key Takeaways

Is ROIC the same as ROI?

No. The ROI is a popular financial metric used to evaluate how well an investment has performed. You can use it across different sectors. ROIC shows you how well a company is generating cash flow with its investors’ capital. Thus, the ROIC measures the efficiency and effectiveness of capital investments while the ROI measures profitability.

Is ROIC better than ROI?

They serve different purposes, so it’s not appropriate to say one metric is superior to the other. The Return on Investment (ROI) is an overall performance measure for analyzing the profitability of an investment or multiple investments. You can use it to evaluate different things across different sectors, such as finance, marketing, and real estate. In contrast, the ROIC is used to evaluate the performance of the company when it comes to allocating its investors’ capital to increase operating profits.