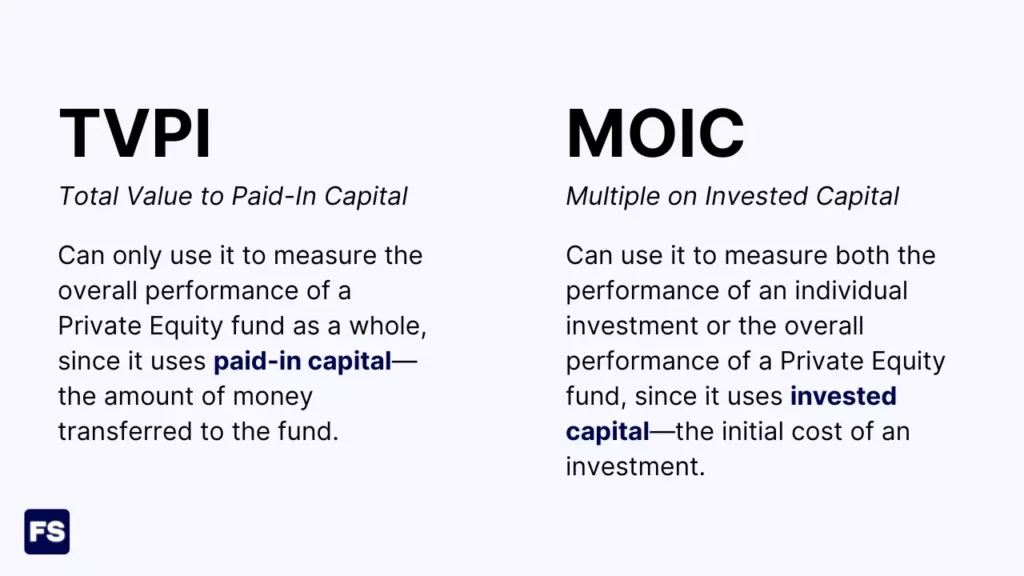

Both TVPI and MOIC measure fund performance using the total value (realized plus unrealized) of private equity investments. The difference is in the denominator. MOIC divides the total value of the investment or fund by the total invested capital, whereas TVPI divides it by the paid-in capital (meaning, the capital that investors have actually transferred to the fund).

Still confused? Keep reading.

We’ll look at the meaning of these concepts within the context of private equity funds and venture capital.

TVPI Definition

The Total Value to Paid-In Capital (TVPI) measures the total value of a fund relative to the amount of capital paid into the fund from its inception to today. It’s an important metric a lot of investors use when looking at the performance of private equity funds.

A TVPI over 1.00x means the investment grew in value. Anything below 1 means the investment shrunk in value.

TVPI is simpler than other performance metrics such as the IRR (Internal Rate of Return), but it ignores the time value of money because it does not consider when the returns are distributed.

Here’s how to calculate TVPI:

Where the Total Value includes:

- Realized value: All the distributions paid out by the fund to its investors (called limited partners). It’s money in the investors’ pockets today. Distributed to Paid-In Capital considers only this as opposed to total value.

- Unrealized value: Also called residual value, or the NAV (Net Asset Value). These are potential returns down the road. It’s an estimate of the fair value of investors’ unrealized returns, and it’s typically calculated by the fund manager.

The Paid-In Capital is the cumulative amount of capital investors have actually wired to the fund’s bank account, which is different than the committed capital. This is where the difference between MOIC and TVPI lies—the denominator—but we’ll expand on it below.

For now? Let’s see what is MOIC:

MOIC Definition

The Multiple on Invested Capital (MOIC) measures the performance of an investment today relative to the initial investment. It is also most commonly used in private equity to evaluate the performance of investments.

The higher the MOIC, the more successful the investment. Why? Because it means the investment generated more value for every dollar of capital originally invested.

As the name implies, MOIC is expressed as a multiple, such as 0.8x or 1.5x. If the multiple is below 1.0x, the invested amount has lost value. Multiples above 1x mean profit.

Unlike the ROI (Return on Investment), the MOIC (and the TVPI) takes into account the value of all investments in the portfolio, including those that have not yet been sold (unrealized value).

Including unrealized gains in the MOIC calculation paints a more accurate picture of the overall performance of a portfolio, as it considers the potential future value of investments. However, unrealized gains are not guaranteed.

Similarly to the TVPI, to calculate the MOIC you divide the sum of the realized value and the unrealized value by the money invested:

Where:

- Realized value: The sum of the total value of all the exits of the firm. In other words, how much did the firm sell its stakes for?

- Unrealized value: The current value of investments the firm hasn’t sold yet. In other words, the unrealized gain (or loss) exists on paper, but the firm has not actually received the money for it. This is an estimate and fluctuates depending on market conditions.

- Amount invested: The total dollar amount of capital invested in the fund’s portfolio companies.

Now that you know what is MOIC in private equity, we’re ready to clarify the difference between the two metrics:

Difference between TVPI and MOIC

TVPI is similar to MOIC in that both tell you the total gross value (realized plus unrealized) of a private equity investment or fund.

The difference?

The denominator.

MOIC divides the total value by the invested capital, whereas TVPI divides it by the paid-in amount.

This has to do with how a private equity firm is funded.

Again, in a private equity fund there is:

- The investor who provides capital (limited partner).

- The entity that manages and finds companies to invest in (general partner).

The investors agree to commit to a certain amount to the fund through a subscription agreement, but they don’t transfer the money immediately.

Instead, the general partners make capital calls over time as they find new suitable investments, and require a portion of the LP’s committed capital to pay for that investment. These are also called drawdowns.

The paid-in capital increases during the fund’s investment period as the limited partners contribute their committed capital.

To further clarify:

- Committed capital: The amount limited partners agree to commit to the fund. It is used to fund investments as well as administrative costs.

- Paid-in capital: The cumulative amount of committed capital that has been drawn down. In other words, that limited partners have actually transferred to the fund.

- Invested capital: The amount of paid-in capital that has actually been invested in the fund’s portfolio companies.

See also: Paid-In Capital vs. Invested Capital—Know the Difference?

This means MOIC is always higher than TVPI. Why?

Because the invested capital will always be lower than the paid-in capital, as there are administrative costs (not included in invested capital) and there may be a time gap between when the money hits the fund’s bank account and when it is actually used to acquire startups.

When all capital calls have been met and the fund is fully funded, the TVPI equals MOIC.

One limitation both metrics have is they ignore the time value of money—the timing of the capital commitments by the limited partners. This means a fund that doubled the invested capital in 5 years will have the same MOIC (2.00x) as a fund that doubled it within 10 years.

Let’s go through an example to put these concepts in motion:

TVPI vs. MOIC Example

Imagine you and I are general partners in a venture capital fund. As such, we are responsible for raising the funds, the investment strategy, and administering the daily operations of the fund.

We convince a group of investors (LPs) to commit $10M.

After that, with the help of our analysts, we identify an investment opportunity in two distinct startups and want to acquire a 20% stake in each.

For startup A the stake costs $5M, for startup B it costs $3M.

We also have administrative costs of $1M. These include the fixed portion of analysts’ salaries, office rent, accounting costs, data and research expenses, and marketing.

As such, we issue a capital call to our limited partners saying we need them to wire 90% of their committed capital. Or $9M. This is the paid-in capital.

They do so, and boom! We execute the investments in the companies. This means the invested capital is $5M+$3M=$8M.

Fast forward 3 years and a big corporation acquires startup A. We receive $12M for our 20% stake. This is a realized gain. An actual cash inflow occurs.

As to startup B, we estimate the total value of the company to be $25M. So, our stake is worth $25Mx20%=$5M. This is an unrealized gain.

What is the TVPI and what is the MOIC?

As you can see, the difference between both metrics is minimal because they measure the same type of performance and are calculated using similar inputs.

Do you actually understand the difference between MOIC and TVPI? Test your knowledge with this short quiz.

Key Takeaways (FAQs)

What does MOIC tell you?

The Multiple on Invested Capital (MOIC) tells you the performance of an investment relative to its initial cost, and it’s commonly used in private equity. It compares the value of the investment on the exit date to the initial amount invested. It takes into account both realized and unrealized gains, but it ignores the time value of money.

What does TVPI tell you?

The Total Value to Paid-In Capital (TVPI) measures the return performance of a fund relative to the paid-in capital. What’s that? In a PE fund, the money investors agree to invest is usually not transferred immediately. It is provided and invested over time as investments are identified. The cumulative amount actually transferred is the paid-in capital. The higher the TVPI, the better, as it means the fund can generate more dollars for every $1 of capital it receives.

TVPI vs MOIC: Which one is better?

Neither is better than the other, as they are both useful metrics for measuring private equity investment performance in different ways. Both take into account cash flow from realized profits and the overall value from the sale of investments in the portfolio, as well as the remaining value of investments that have not yet been sold. The difference? MOIC can be more useful when analyzing individual investments because it focuses on invested capital only, while TVPI is more useful when analyzing the overall performance of a fund as a whole because it takes into account the amount of paid-in capital.