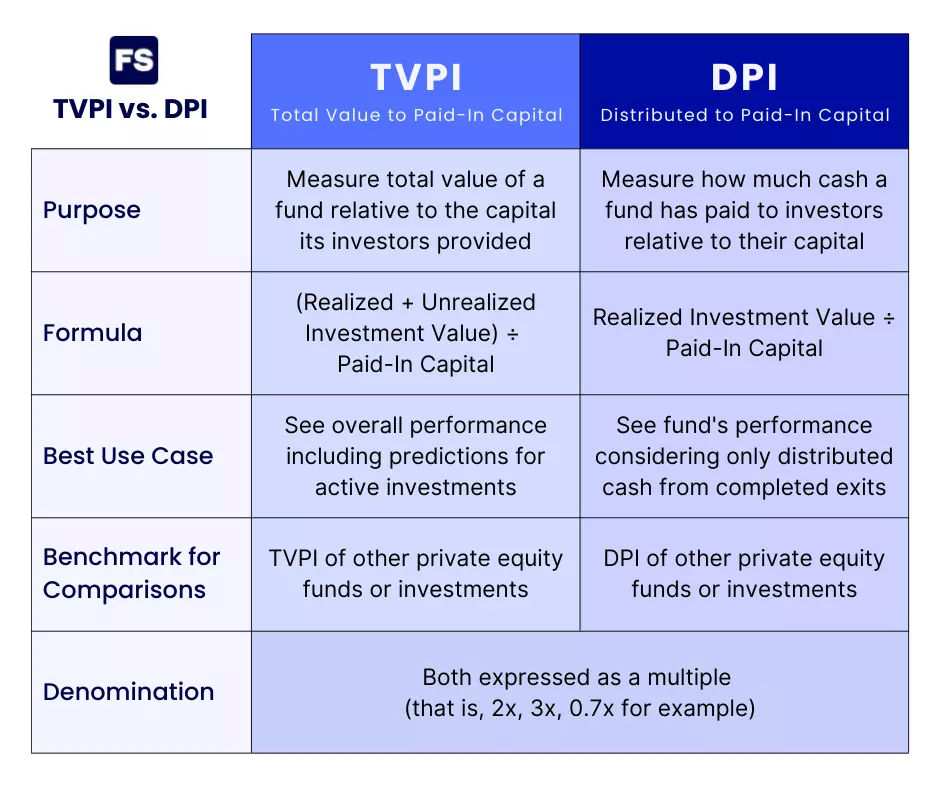

Both TVPI and DPI are widely used in private equity to evaluate fund performance. TVPI compares the total value of a private equity fund (realized and unrealized gains and losses) to the capital the fund has received from its investors. DPI does the same but only considers realized gains. Thus, DPI is a component of TVPI.

At first glance, the two metrics appear similar. But a closer look reveals key differences:

That’s the gist of it. For a more comprehensive answer, scroll down.

In this post, we’ll go over both ratios in detail in the context of private equity and venture capital, then tackle their differences. Read until the end to understand how TVPI and DPI are actually dependent on each other.

Ready? Let’s dive right in:

What Is TVPI

The Total Value to Paid-In Capital (TVPI) measures the performance of all past and current investments of a private equity fund relative to the money investors have contributed to the fund.

A venture capital or private equity fund pools together money it receives from investors. Then it takes that money and provides companies that need it with capital in exchange for an equity stake. The fund becomes part owner of the company. The goal? To later sell that stake for more in the future—if the portfolio company grows and increases in value.

TVPI is expressed as a multiple, that is 2.0x, 3.1x, or 0.8x, for example.

The higher the TVPI the better, as it means the fund is creating value for its investors. A TVPI of less than 1.0x means the fund destroyed value. That it invested mostly in companies that were worth less at the time of the exit than upon the initial investment.

Investors use TVPI to analyze the return on their investment in a venture fund.

Here’s how to calculate TVPI:

Where:

- Total value: The total value of the fund, which is the sum of the distributions (realized profits) and the residual value (unrealized future profits) at a given point in time.

- Distributions: Also called realized value. It’s the money the fund has paid back (distributed) to investors as a result of successful exits from portfolio companies. Early in the fund’s life distributions are usually low, increasing over time as investments are exited.

- Residual value: The remaining unrealized value of the fund. It is the estimated fair value of the fund’s active investments (those it hasn’t sold yet). Residual value is usually high early in the fund’s life and falls over time as the fund exits its investments and makes distributions to investors. It reaches zero once the fund is liquidated.

- Paid-in capital: All the capital investors have transferred to the fund. It’s also dubbed called capital. The fund uses the paid-in capital primarily to invest in portfolio companies, but also to pay management fees and cover general fund expenses. Paid-in capital is not always the same as the money investors have pledged to the fund (committed capital).

Now, what is the DPI?

What Is DPI

The Distributed to Paid-In Capital (DPI) measures the performance of a private equity fund by comparing the money from completed exits distributed to investors to the capital the fund has received from investors.

Just like the TVPI, it is expressed as a multiple. Also, the higher DPI the better.

A DPI of 1.0x means the fund has returned to investors exactly how much they’ve transferred to the fund. A DPI of 2.0x means the fund doubled investors’ paid-in capital.

As a private equity fund exits its investments (the portfolio company goes public or is acquired by another company) it returns cash to the investors. The DPI only considers this distributed cash, ignoring the investments that are yet to be sold.

Here’s how to calculate DPI:

See any similarities to TVPI?

It’s the same formula except you don’t take into account the unrealized gains (or losses) of the fund.

Now, let’s further break down how the Total Value to Paid-In Capital and the Distributed to Paid-In Capital differ:

Difference between TVPI and DPI

The difference is that TVPI takes into account the total value of the fund (realized and unrealized), while the DPI only considers the realized value.

This means DPI is a component of TVPI.

To fully understand this, one other metric comes up when discussing TVPI and DPI:

The Residual Value to Paid-In Capital (RVPI) measures the residual value of a private equity fund as a multiple of the capital investors have paid in.

RVPI is the other component of TVPI. Together with DPI, they make up the total value to paid-in capital:

As a fund progresses through its lifecycle, the balance between the DPI and RVPI will shift.

In the end, once the fund exited all companies, once it sold all investments, once there are no unrealized gains left to be realized, only the DPI remains. It becomes equal to the TVPI.

This means once a fund is fully realized, using the DPI or the TVPI yields you exactly the same results.

Some considerations common in both metrics:

- They both ignore the time value of money. A 1.5x multiple may be a good result if the fund life is 5 years, but it’s probably not that good if it is 20 years. Unlike the internal rate of return (IRR), multiples don’t operate on an annual basis.

- The value of the distributions is the actual cash flow that goes to investors. There’s no consideration for taxes, inflation, or reinvestment.

- Until a fund is liquidated, multiples are temporary indications of performance. Why? Because the residual value (unrealized gains) that drives the TVPI is a mere estimate of the fair value of those portfolio companies yet to be sold. These estimates are subject to changes in the valuation of those firms due to changing world conditions. The DPI will also change over time as exits materialize and the fund gets a better or worse multiple here and there.

Key Takeaways (FAQs)

Does TVPI include DPI?

Yes. TVPI is the ratio between the total value of a fund (sum of what has been distributed to investors and the residual value that has been not) and its paid-in capital. DPI compares what has already been distributed to the paid-in capital. Thus, DPI is a component of the TVPI. DPI and TVPI converge as more exits occur and capital is distributed to investors. Once all distributions are made and the fund is liquidated, DPI and TVPI become equal.

What does TVPI tell you?

The Total Value to Paid-In Capital (TVPI) measures the return performance of a fund—including the realized and unrealized value of all its portfolio companies and investments—relative to the money investors have provided the fund with. The higher the TVPI, the better, as it means the fund can generate more dollars for every $1 of capital it receives.

How do you calculate DPI in private equity?

You calculate it by dividing distributions by paid-in capital. Distributions are all the cash payments a fund has returned to its investors, thanks to the capital it receives upon a completed exit from a portfolio company. The paid-in capital is all the money investors have transferred to the fund. The DPI tells you how much cash the investors of a venture capital or private equity fund have actually received relative to how much they put in.