The gross IRR tells you the rate of return you can expect from an investment, before taking into account the costs the investment fund charges you, as an investor, such as management and performance fees. The net IRR takes these into account, giving you the real return you can expect. The gross IRR is always higher than the net IRR, and if there are no costs, they’re equal.

That’s the gist of it. For a more comprehensive explanation of the difference between net IRR and gross IRR, keep reading:

What is the Internal Rate of Return

The IRR (Internal Rate of Return) measures the profitability of an investment while taking into account the time value of money. The higher the IRR the better the investment.

The IRR tells you the discount rate at which you need to discount cash flows in order for the net present value (NPV) of the investment to be zero. In other words, it is the discount rate that makes the present value of cash flows equal to the initial investment.

To determine the IRR, you extract it from this equation:

The 0 in the formula is the NPV. Ct is the net cash flow the investment generates at time t. I is the cost of the initial investment. T is the number of future cash flows.

The NPV is the difference between the initial cost of an investment and its future cash flows discounted at a certain rate (typically the WACC) to reflect the time value of money. It is widely used for financial modeling and capital budgeting.

Time value of money? Yes, receiving a dollar today is better than receiving a dollar in the future.

To take this into account, fund analysts use discount rates that reflect the riskiness of cash flows.

The IRR is typically a high value, which is what allows an NPV of zero. Why? Because the higher the discount rate, the lower the present value of the cash flows, as they’re deemed riskier. The lower the present value of cash flows, the closer the NPV gets to zero. And subsequently, it turns negative.

Thus, the IRR is the maximum annual return rate investors can require from an investment, before profitability goes down the drain.

Unlike the ROI, for example, the IRR takes into account the timing of cash flows, as opposed to looking at just the final profit/loss after all is said and done.

IRR is super difficult to calculate by hand.

For this reason, most analysts use Excel or a calculator to compute it:

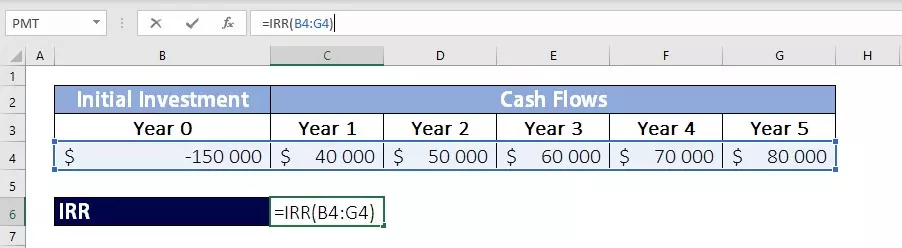

How to Calculate the IRR in Excel

Calculating IRR using Excel is easy.

There’s a formula programmed just for it (IRR). All you need to do is select the expected future cash flows the project will generate in the future, as well as the initial investment (with a negative sign).

In turn, the function will flash you with the discount rate needed to make the NPV of that project zero.

For instance, say your company is considering an investment that will cost $150,000 initially. After that, it will generate $40,000 in the first year and grow by $10,000 every year for the following four years:

This example results in an Internal Rate of Return of 24.89%.

Now, what are net and gross IRR? Investors usually talk about these in the context of investment funds, such as private equity firms or a venture capital fund. (As opposed to a company’s project or personal investment.)

Understanding Gross IRR

The gross IRR is the rate of return on an investment, before taking into account any costs the investment firm charges to investors.

There’s no special gross IRR formula. We can say it is the “standard” formula used above.

Gross IRR focuses on the performance of investments. That is, if you want to decide between two distinct investment firms, looking at the gross IRR will tell you which firm is better at growing your money. The firm makes the best decisions. The best investments.

However, this does not mean you’ll take more money home when you choose the firm with higher gross IRR, as it doesn’t take the fees charged to you and the fund structure into account. Unlike the net IRR:

Understanding Net IRR

The net internal rate of return is similar to the gross IRR, but it takes into account the costs charged to investors.

In the private fund industry these costs include:

- Management fees: Private equity firms charge management fees to cover operational costs, such as salaries, office expenses, and other overhead expenditures. They are typically calculated as a percentage of the total assets under management (AUM), which means they reduce the amount of fund capital available for investment.

- Carried interest: This is a percentage of the profits the firm earns from its investments. It is paid to investment professionals, such as analysts, associates, and partners, as compensation for managing the firm’s investments. It is a powerful tool PE firms use to incentivize their analysts to generate more profits for the fund and its investors. These bonuses make up a significant part of the salary of a fund manager.

- Performance fees: Similar to carried interest, performance fees are a percentage of the returns the firm’s investments earn. The difference? They are typically calculated upon profits earned in excess of a predetermined investment performance threshold. Additionally, the goal is to incentivize investment professionals to outperform certain benchmarks. The better the fund performance, the higher the fee.

This means the gross IRR is always higher than the net IRR. The same applies to the gross MOIC (Multiple of Invested Capital)—another metric widely used in private equity investments.

In the rare case a private equity fund doesn’t charge management fees, carried interest, or expenses, the gross IRR is equal to the net IRR.

There’s no net IRR formula either. To get to this value, you simply subtract the costs from the cash flows in the corresponding years they were charged:

Gross IRR vs. Net IRR Example

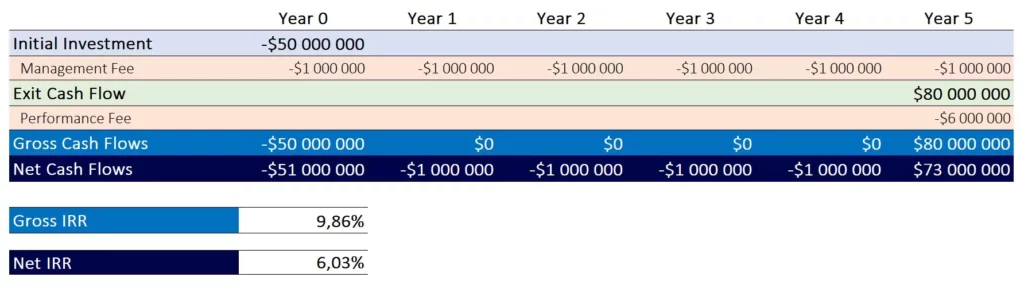

Let’s say a private equity firm makes an investment of $50 million in an up-and-coming tech startup. Fast forward 5 years later and the investment paid off beautifully. The firm is finalizing the sale of its stake for a cash inflow of $80 million.

It charges its investors the industry standard fee arrangement: 2% annual management fee (calculated upon the invested capital), and a 20% performance fee (calculated upon the profits of the investment, which is 80 – 50 = $30 million).

Here’s what that looks like in practice:

The management fee of 2% on $50 million is a cash outflow of $1 million, charged every year.

As to the performance fee of $6 million, which is 20% of the $30 million profit—it is only charged once when the firm sells its stake in year 5.

As you can see, the gross return (9.86%) is higher than the net IRR (6.03%), because it doesn’t take fees into account. What does this mean for you as a fund investor?

Private equity deals offer different returns before and after you account for fees. It is important to keep this in mind when deciding which firm you want to park your money with.

Gross IRR vs. Net IRR FAQs

How do you calculate net IRR from gross IRR?

To calculate net IRR from gross IRR you need to add all the fees charged to investors—whether they’re yearly management fees, or performance fees charged on the exit stage of investments—to the cash flows. Then, run the IRR calculation again.

What does net IRR mean?

The net IRR tells you how much net return you can expect to receive from an investment, expressed as a percentage of the initial committed capital, after taking into account all management and performance fees charged to investors.