RVPI in private equity compares the estimated remaining fair value of the fund’s investments that have not yet been exited, to all the capital the fund has received from investors. It gives you perspective on the performance of the fund’s active investments.

That’s the gist of it.

Still not sure what does RVPI measure? Keep reading for a more comprehensive answer:

But before we dive in, it’s essential that you understand the private equity/venture capital business model.

A private equity fund makes money by collecting capital from investors, acquiring equity stakes in promising companies with that capital, working to improve the operational and financial performance of those portfolio companies, and then selling those stakes years later once the portfolio company grows and increases in value.

The fund aims to sell its equity stake at a higher valuation than the initial investment, generating cash flow and capital gains. It may also receive dividends from the portfolio companies. These capital gains and distributions are returned to the fund’s investors.

And here are some terms you should familiarize yourself with:

- Limited Partner (LP): Investors who contribute capital to a private equity fund but have limited liability and participation in the fund’s decision-making process. These are usually institutional investors and high-net-worth individuals.

- General Partner (GP): The managing entity or individuals that run the fund, make investment decisions, and execute the investment strategy.

- Equity stake: The share of a company an investor holds. It represents the value of the investor’s shares in the company.

- Portfolio company: A company in which a private equity firm has invested money. Private equity firms create a portfolio of companies in which they hold equity stakes.

- Exit: When the PE firm sells its equity stake in a portfolio company to realize its investment and generate returns. Exit strategies include initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales to other investors.

Now, let’s get into what is RVPI in private equity investing:

RVPI Meaning in Private Equity

The Residual Value to Paid-In Capital (RVPI) measures the performance of the unrealized portion of a fund’s value.

It compares how much the fund is yet to pay out to limited partners versus how much the limited partners have put into a fund.

Just like the multiple on invested capital (MOIC), the RVPI is expressed as a multiple as opposed to a percentage. For example, 1.5x, 2.0x, or 0.8x are multiples.

The higher the RVPI the better, as it means the fund is creating value for its investors.

Here’s how to calculate RVPI:

RVPI Calculation

The RVPI formula is as follows:

Where:

- Residual value (also called unrealized value) is the estimated fair value of all the equity stakes a fund holds in its portfolio and hasn’t sold yet. It contrasts with a fund’s distributions (realized value), which is all the capital returned to LPs as a result of the fund’s exits over time.

- Paid-in capital (also named called capital) is all the capital a fund has called (for investment and to pay management, transaction, or director fees) at that time. When GPs assemble a private equity fund, LPs pledge a certain amount, but they only effectively transfer that money to the fund as GPs make capital calls. Paid-in capital is the sum of all the capital calls GPs have made.

An RVPI of less than 1.0x means the fund destroyed value. The value of its active portfolio companies was worth more at the time of the initial investment. But it may also mean most of the fund’s value has been distributed to investors already.

Now that you know what does RVPI mean, let’s further understand its purpose:

Understanding RVPI

The total value of a private equity fund at any time is the sum of its realized value—portfolio companies the fund has exited already—and its unrealized value—equity stakes the fund hasn’t sold yet.

RVPI focuses on the fund’s active investments relative to the contributions of LPs. Thus, it gives you perspective into how much value LPs are yet to receive.

Now, how can you know the value of an asset you haven’t sold yet?

This question applies to the residual value of the fund at any given point in time.

Residual value is an estimate. It is the estimated fair value of the portfolio investments at a given point. It fluctuates over time as GPs call more capital, make more investments, investment valuations change, and exits and distributions occur. These estimates may be high or low, but are rarely exact.

GPs review their estimation for the unrealized assets of the fund every quarter and report it to the LPs.

As the residual value to paid-in capital ratio does not consider returns that have already been distributed, it is more relevant at the beginning of a fund. But that’s precisely where fund performance metrics don’t mean much. Why?

Because multiples fluctuate over the life of a fund. And the multiples in the early years, especially for venture capital, are likely far off from those that will become the final multiples.

RVPI contrasts with Distributed to Paid-In Capital (DPI)—the realized gains of a fund (distributions investors already received) compared to the paid-in capital.

Together, they make up the Total Value to Paid-In Capital (TVPI).

Further reading: TVPI vs. DPI—Do You Understand the Difference?

TVPI, DPI, and RVPI

TVPI is the multiple LPs are getting on the capital they’ve given the fund up until a particular point in time. It includes both the capital distributed back to LPs, as well as the residual value of unrealized assets.

This means TVPI is the sum of DPI and RVPI.

As mentioned before, RVPI is higher at the beginning. Why?

Because early in a fund’s life, the majority of its value is unrealized. It lies in active investments in portfolio companies. Thus, most of the fund value is captured by its RVPI while the DPI is low.

As investments mature and are exited, a higher portion of the fund value is realized and reflected in the DPI.

Over time, DPI continues to rise until the fund sells all its equity positions in portfolio companies. The DPI and the TVPI converge, while the RVPI goes toward zero because the number of active investments that require an estimate for their fair value decreases.

Once the fund is fully liquidated (all value has been realized), the DPI and the TVPI are equal. And are the most important indicator of the performance of the PE fund.

This is why RVPI is more commonly used to assess the performance of a fund early on in its life cycle.

However:

Because the residual value is an estimate, a forecast, the higher the residual value and RPI, the more variability the multiples may experience over time.

Lastly, keep in mind that none of these metrics takes the time value of money into account (unlike the internal rate of return). A fund that doubles your money in 3 years and another that does the same in 15 years will have the same TVPI in the end.

Let’s go through a quick example to put these concepts in motion:

RVPI Example

Imagine a private equity fund for which the LPs commit $90M.

The fund identifies a list of companies it wants to invest in. Early-stage startups with lots of potential for growth that happen to fit the investment strategy the GPs delineated.

The GPs make capital calls over time.

And over time, the fund invests $90M in these companies. More in ones, less in others, based on their level of revenue, maturity, and future prospects.

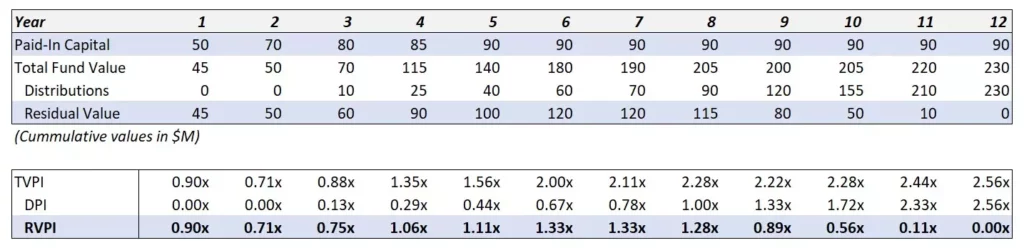

Here are the results our hypothetical fund got:

Note that the rows highlighted in blue are part of the RVPI calculation.

Notice that GPs call most of the capital in the early years of the fund, when it is making new investments.

Also in those early years, most of the value is unrealized. Why? Simply because it’s too early to sell the newly acquired equity stakes. And there are no capital gains.

As the years go by and fund analysts notice improvements in the performance of the portfolio companies, they adjust their estimates for the residual value accordingly. Thus, DPI increases.

It’s most likely that not all of the startups will be doing well, but for this example, on average analysts estimate the companies growing in value.

After around the midpoint of the fund’s life cycle exits start to occur more frequently. And thanks to those exits, LPs can get paid through distributions.

The value of the fund, which in the beginning was mostly unrealized, now shifts to being mostly realized gains from profitable exits.

In the end notice how TVPI and DPI converge, while RVPI goes to zero.

Key Takeaways (FAQs)

What does RVPI tell you?

The Residual Value to Paid-In Capital (RVPI) tells you about the performance of investments. It is mostly used in private equity. It measures the potential return on investment by comparing the estimated value of a fund’s unrealized gains to the amount of capital contributed by investors. A higher RVPI indicates a more successful investment, while a lower underperformance.

How do you calculate RVPI?

By dividing the estimated fair value of the equity stakes in portfolio companies the fund hasn’t sold yet (residual value), to all the capital investors have sent to the fund’s bank account (paid-in capital).

What is the difference between DPI and RVPI?

Both are used in private equity to evaluate fund performance. However, DPI measures the capital returned to investors through distributions relative to the total capital they contributed. On the other hand, RVPI looks at the potential return on investment by estimating the value of active investments in the fund’s portfolio (unrealized gains) to the total capital contributed. In essence, DPI reflects realized gains, while RVPI focuses on potential future returns. Summed together they make up TVPI.