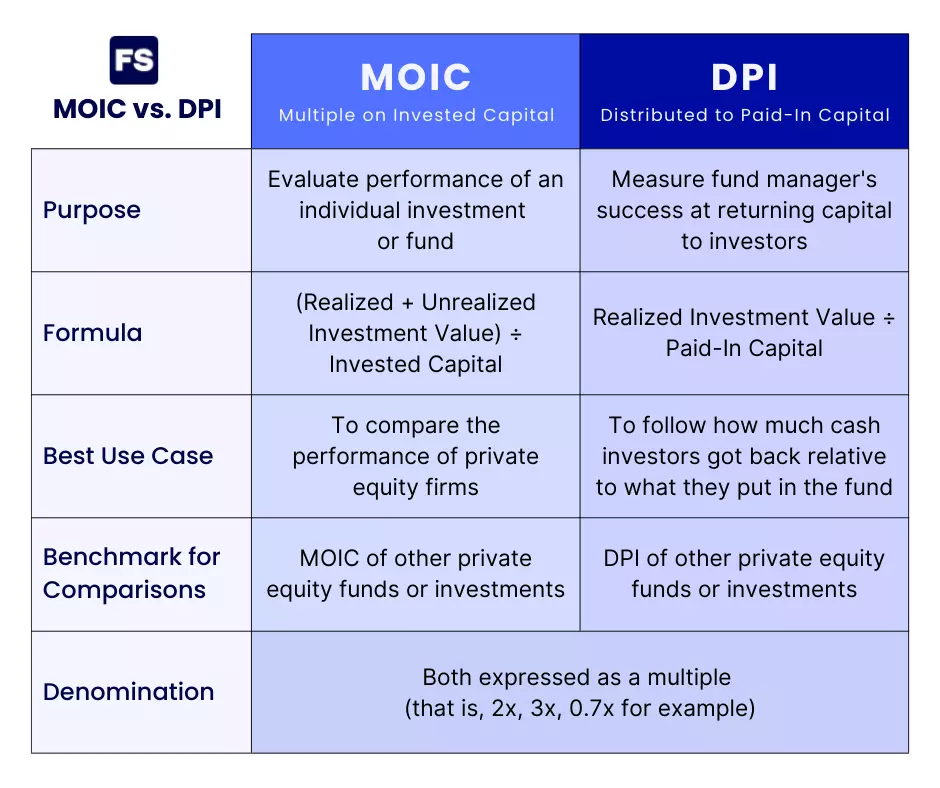

The difference is MOIC takes into account the value of both realized and unrealized gains and compares it to the invested capital. Thus, it is a gross measure of return that doesn’t take into account fund fees. Meanwhile, DPI compares the capital investors have given the fund to the fund (paid-in capital) and the capital they have received back through distributions.

At first glance, the two metrics appear similar. But a closer look reveals key differences:

That’s the gist of it.

For a more comprehensive answer, keep reading:

MOIC Definition

The Multiple on Invested Capital (MOIC) measures the value of an investment relative to the initial investment. As the name implies, it is expressed as a multiple.

It is mostly used in private equity to assess the performance of funds.

Private equity funds gather together capital from investors and acquire equity in companies in hopes of selling that equity stake for more at a future date once the company has grown in value.

A MOIC over 1.00x means the portfolio companies grew in value. Anything below 1 means underperformance. The higher the MOIC, the better.

Unlike the internal rate of return (IRR), the multiple on invested capital ignores the time value of money.

Here’s how to calculate MOIC:

MOIC Formula

The MOIC calculation is as follows:

Where:

- Distributions (realized value): All the capital the fund has paid back (distributed) to investors as a result of exits from portfolio companies. Early in the fund’s life distributions are usually low, increasing over time as investments are exited.

- Residual value (unrealized value): The estimated fair value of all the fund’s active investments (those it hasn’t sold yet). It is generally higher early in the fund’s life cycle and falls over time as the fund exits its investments and distributes capital to investors. It reaches zero once the fund is liquidated.

- Invested capital: The cumulative amount of money the fund has effectively invested in portfolio companies.

The sum of distributions and the residual value is the total fund value at that point in time.

Now, what is DPI?

DPI Definition

The Distributed to Paid-In Capital (DPI) measures how much money the investors of a fund have received relative to how much they put in.

In other words, it is the multiple of the money investors committed to the fund.

It tells you how much an investor has received back in their bank account for every $1 dollar it originally sent to the fund.

Just like the MOIC, the higher the better.

Here’s how to calculate DPI:

DPI Formula

The DPI calculation is as follows:

Where:

- Distributions: As we’ve seen before, it’s the realized gains returned to investors.

- Paid-in capital: The cumulative called capital investors have transferred to the fund. The fund uses the paid-in capital primarily to invest in portfolio companies, but also to pay management fees. Paid-in capital is not the same as invested capital.

DPI increases as the fund finalizes exits and distributes capital to investors. Once it makes all distributions, the fund’s DPI becomes equal to the TVPI.

Now we’re ready to drill down into the difference between DPI and MOIC:

Difference between MOIC and DPI

Both MOIC and DPI evaluate the performance of the underlying assets in a fund.

The distinction is that DPI focuses on realized gains.

As a result, MOIC is a more general assessment of overall fund performance. Everyone is interested in knowing the MOIC of a PE fund, from analysts, to investors, to the fund itself.

On the other hand, DPI tells you, as an investor, what have you received back relative to how much you put in. Individual investors are the ones most interested in this metric.

In the denominator the MOIC uses the invested capital while the DPI uses the paid-in capital. The difference?

Fund managers use the paid-in capital to buy equity in companies. But they also use it to cover fund fees and general expenses.

This means the DPI already takes into account those extra costs. It is a measure of returns net of fees, as the extra costs increase the denominator and lower the multiple.

This is why investors care so much about the DPI. It tells them how much cash has actually been returned to them, which in the end is what investing is all about. Cash in, cash out.

Meanwhile, the MOIC only considers the portion of paid-in capital used to buy equity in portfolio companies.

Invested capital doesn’t account for the fund’s fee structure. The meaning of this?

MOIC is a pure measure of how good the fund managers are at picking startups to invest in. That’s it.

This highlights, again, the idea that DPI is more investor-focused, while MOIC is a general fund performance metric everyone has an interest in.

Now, one more thing:

Both metrics hold more value towards the end of the fund. Why?

They will both fluctuate over time as exits materialize and the fund gets a better or worse multiple here and there.

In particular, the MOIC has the element of the estimated value of unrealized returns. For each individual holding, the general partner will estimate its value every quarter through industry-standard valuation methods.

The number will be higher or lower, but never the exact true figure because it’s an estimate of the value of an asset that hasn’t been sold.

Let’s go through a quick example to put these concepts in motion:

MOIC vs. DPI Example

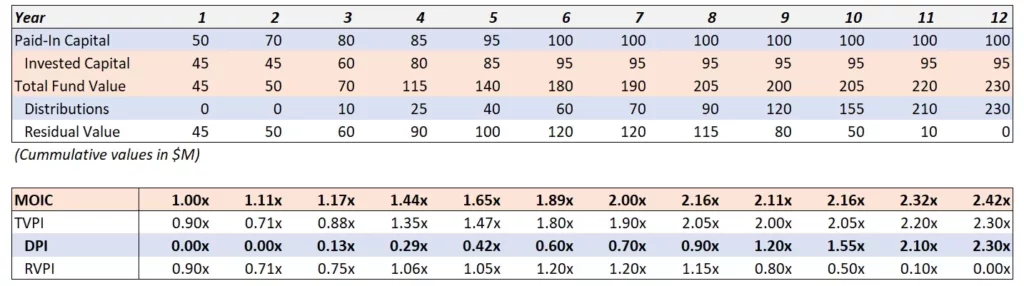

Consider a private equity fund where the investors committed $100M.

Highlighted in blue you have the items that go toward the distributed to paid-in capital ratio. And in orange the items for the multiple on invested capital.

As expected, DPI is zero for the first few years. This is because there are no distributions in those early years. Instead, the fund is focused on executing its investment strategy, and letting those investments play out.

As the years go by and fund analysts notice changes in the performance of the portfolio companies, they adjust the estimates that make up the residual value accordingly.

In this case, the investment strategy is working well. DPI increases as a result.

Also, notice most of the committed capital is called early in the fund’s life cycle—when it is making new investments.

In the end, the MOIC is always lower than the DPI because it doesn’t take into account the administrative costs of running a private equity fund.

Other metrics investors care about include the Total Value to Paid-In Capital (TVPI) and the Residual Value to Paid-In Capital (RVPI). They help you get a sense of how the total value of the fund shifts from being mostly residual value early on to mostly distributions to investors near the end.

Key Takeaways (FAQs)

Is MOIC the same as DPI?

No. The MOIC tells you how good the investment strategy of a fund is by comparing the total value of the fund (realized and unrealized) to the invested capital. DPI on the other hand, compares how much the fund has distributed back to investors relative to how much the investors put in the fund. So it is a measure of the net return for investors.

What does MOIC tell you?

The MOIC tells you how much a fund has generated in the form of capital gains and distributions for every dollar it has invested in portfolio companies.

What is DPI in private equity?

The DPI reflects the capital a fund has returned to investors at a given point in time. These distributions occur over the life of the PE fund as exits occur and holdings are liquidated. Once the fund is fully liquidated and proceeds are distributed to investors, the distributions used to calculate DPI will represent the total return on the investor’s investment. Thus, DPI is a way to assess the fund manager’s success at returning capital to investors.

This means the DPI already takes into account those extra costs. It is a measure of returns net of fees, as the extra costs increase the denominator and lower the multiple.

Should this be changed to “as the extra costs decrease the numerator”