In this post, we’ll look at what happens to WACC as debt increases.

We’ll start off by defining WACC, and understanding how it works. Then, we’ll describe the effect of financing strategies on the cost of capital. Financing strategies are either equity or debt. Finally, we’ll answer the question in the title, with an extra look at the impact of tax shields.

Let’s dive in:

Understanding the Weighted Average Cost of Capital (WACC)

WACC stands for Weighted Average Cost of Capital. It will tell you how much a firm pays to finance its assets, taking into account two different sources of capital—debt and equity.

When a firm needs to raise funds to finance a new project, it must decide which type of security it will sell to investors.

Some companies have 0 debt and are 100% financed by equity (issuing stock).

Others have little equity and are financed mostly by debt (issuing bonds and getting loans).

Most businesses’ capital structure has a mixture of both. To express the cost of capital in a single percentage, you have to weigh both the cost of debt and the cost of equity proportionally, based on how much financing is acquired through each source.

It’s calculated by multiplying each capital source by its weight in the total capital structure, and then adding both together:

E is the value of the firm’s equity.

rE is the cost of equity (what expected return is required by the firm’s shareholders), which you can calculate using the CAPM.

D is the value of the firm’s debt.

rD is the cost of debt (what expected return is required by the firm’s creditors).

Tc is the corporate tax rate. What’s the point of this? Well, it’s because businesses can deduct interest expenses from their taxes. As a result, to get the net cost of debt, you need to subtract the tax benefits from the interest payments. More on this later.

In theory, WACC is how much it costs to raise 1 additional dollar.

For example, a WACC of 8% means the company must pay an average of $0.08 to source an additional $1. This $0.08 contains the cost of interest on debt and the dividend/capital return stockholders require. It can be either one.

Is a Higher or Lower WACC Better?

Generally speaking, the best capital structure for a business is the one that minimizes the WACC.

Why is a lower WACC better?

For two reasons:

A firm is worth the present value of all of its future cash flows.

How do you discount those future cash flows to the present? With the rate of return required by investors—the WACC.

Thus, if you can change the capital structure to have a lower WACC, you can increase the value of your company.

How so?

Because the future cash flows will be discounted at a lower rate of return, which increases the final value.

For example, say a company will pay future cash flows of 1,000 every year in perpetuity. They financed the generation of those cash flows by paying their investors 5%. How much is the company worth today?

PV is the present value of the perpetuity. CF is the cash flow. r is the discount rate (in this case, the WACC).

20,000 is the present value of the company if it pays investors 5%. What if the rate is higher? Let’s say 8%:

Notice how the company is worth less with a higher WACC.

A high WACC signals the firm is riskier to invest in. It means investors want a higher return for putting their hard-earned money into the firm. This is typically the case for smaller firms in volatile industries.

The firm pays the returns investors get on their money—either through dividend payments or stock growth, or interest payments on bonds and loans.

A high WACC means the firm pays more. Who wants to pay more?

Meanwhile, a small WACC signals a more established larger firm. It’s a safer investment for stockholders and creditors, therefore they require a lesser return. It’ll also make it easier to move forward with new projects as the costs of financing them will likely be lower than the expected return.

Now, there is one situation in which a higher WACC is better:

If you’re an investor with an appetite for risk.

Generally speaking, the higher the risk, the higher the potential return. The only problem is there’s no return if a firm goes bankrupt, which is more likely when there’s a higher risk. What a paradox, right?

Also, WACC is often used as the discount rate to calculate the present value of projects. A lower rate makes investment profitability easier to achieve.

Effect of Financing Strategies on the Cost of Capital

To minimize WACC, the capital structure has to be a balanced combination of debt and equity.

The simplest way to achieve this in a company that doesn’t have much debt (and instead prefers equity financing) is to increase debt.

Increasing debt reduces the WACC.

Here’s why:

The cost of debt is generally lower than the cost of equity.

As a stockholder, you have additional risks compared to a bondholder:

- The stock market is more volatile than the bond market.

- In case the company goes bankrupt and has to liquidate its assets to pay investors, bondholders will get their money back first.

- A company has no obligation to pay you dividends, as opposed to bonds’ interest payments.

As result, the return you want from the company is higher. You want to be compensated for the risk you’re taking.

Because lenders require less return, increasing debt financing brings the average cost of capital down—which is what we want.

However, we need to look at how an increase in debt affects the cost of capital. Especially, what happens when a company has too much debt:

What Happens to WACC as You Increase Debt?

As we’ve seen, in general, increasing debt in the total capital structure of a company will decrease WACC, as the cost of capital of debt is smaller than that of equity.

Does this mean companies prefer 100% debt financing over equity financing?

No! Increasing debt too much is a bad idea.

As debt increases and the company becomes more leveraged, interest payments increase as well. This raises the risk of the company defaulting on its payments and being declared bankrupt.

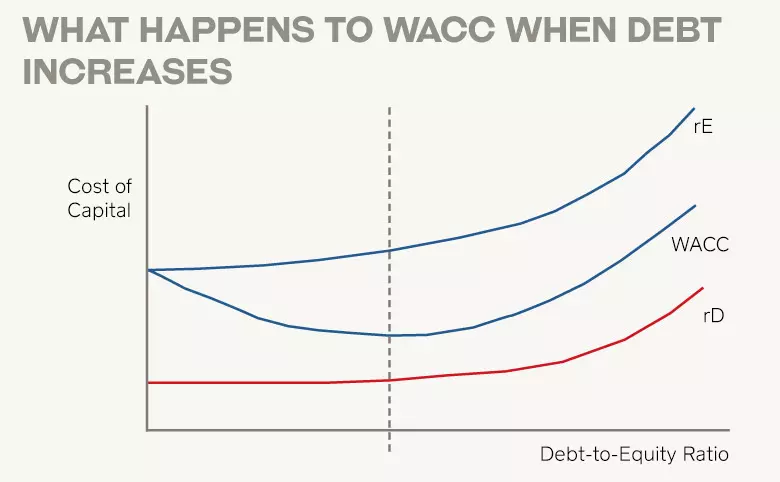

Initially, the weighted average cost of capital will decrease, as the image shows. Why? Because the benefits of having cheaper debt outweigh the increase in the cost of equity due to financial risk.

At some point, the WACC will reach its lowest value—the optimal capital structure represented by the dotted line.

But after that? Both the cost of debt and the cost of equity will increase.

Lenders, like banks and bondholders, want to receive a higher interest rate because the company has more risk of financial distress.

Shareholders also want an increased return (which can be dividends or capital gains) to reflect the additional risk.

This is why, in the graph above, as the debt-to-equity ratio increases, so does both costs of capital, and as result, their weighted average.

If debt increases to the point it exceeds the value of total assets, shareholders’ equity becomes a negative value. As a result, the debt-to-equity ratio is also negative. This is bad.

Tax Shields Explained

Another benefit of debt is tax shields.

All companies have to pay taxes on the income they earn.

However, increasing debt (and consequently interest payments) reduces the amount of taxes a company owes the government.

How so? Because taxes are calculated on profits after the interest payments are deducted.

If the interest payments increase, the net income that taxes are calculated upon reduces. As a result, the amount of corporate tax is smaller too.

This feature of the tax code creates an incentive to use debt.

There are other methods of incorporating tax benefits in the valuation of an investment. For instance, the APV method takes the interest rate tax shield into account directly rather than by adjusting the discount rate as the WACC does.

The Bottom Line

The weighted average cost of capital (WACC) tells us the return shareholders and lenders expect to receive as compensation for the risk of providing capital to a company.

As the name hints, its calculation involves a simple weighted average of the cost of equity and the cost of debt.

As the proportions of equity and debt vary, so will the WACC.

A low WACC is good. How can we achieve that? Increase debt and take advantage of its lower cost compared to equity (due to fewer perks bondholders have, and tax shields).

However, at the same time, an increase in leverage results in a bigger risk of bankruptcy. And this will be reflected in both types of financing vehicles.