A negative debt-to-equity ratio means the company is in financial distress. Why? Because it implies shareholders’ equity is negative as well, which means total liabilities exceed total assets. This is bad, as it indicates the company’s net worth is negative.

That’s the gist of it. For a more comprehensive explanation, keep reading:

What is the Debt-to-Equity Ratio

The debt-to-equity ratio is a financial metric that compares the amount of debt (liabilities) a company has to its amount of equity (shareholders’ equity).

Debt is money the company owes to lenders, such as suppliers, banks, or bondholders. Equity refers to the money it raised through the sale of stocks, as well as the net income it generated and its retained earnings.

Calculating the debt-to-equity ratio is straightforward. You simply divide the total amount of debt by the total amount of equity:

Debt-to-Equity Ratio Formula

To calculate this debt ratio, you can find the liabilities and shareholders’ equity values on the balance sheet.

For example, if a company has $100,000 in liabilities and $50,000 in equity, its debt-to-equity ratio is 2. This means that for every dollar of equity, the company has $2 of debt.

What the D/E Ratio Tells You

So, what does the debt-to-equity ratio mean?

A business with a high debt-to-equity ratio may be overly dependent on borrowing to fund its operations. As a result, it becomes harder to build a solid financial base. Why?

Because having too much net debt means the company has more expenses with interest payments, which take a toll on profitability and financial stability.

Excessive long term debt also increases the risk of financial distress. As a result, investors require a higher rate of return for the additional risk of putting their money in the company. The more financial leverage a company has, the higher its cost of capital to fund new projects.

On the other hand, a low debt-to-equity ratio indicates the business is financially stable and has a good balance between total debt and equity.

However:

Having too much equity can mean the company does not have enough borrowing power.

This makes it harder for it to grow, because investing in new projects or opportunities to increase the total asset amount is more expensive. (The cost of debt financing is cheaper than the cost of equity financing.)

Now, in what situations is the DE ratio negative?

Debt-to-Equity Ratio Less than Zero

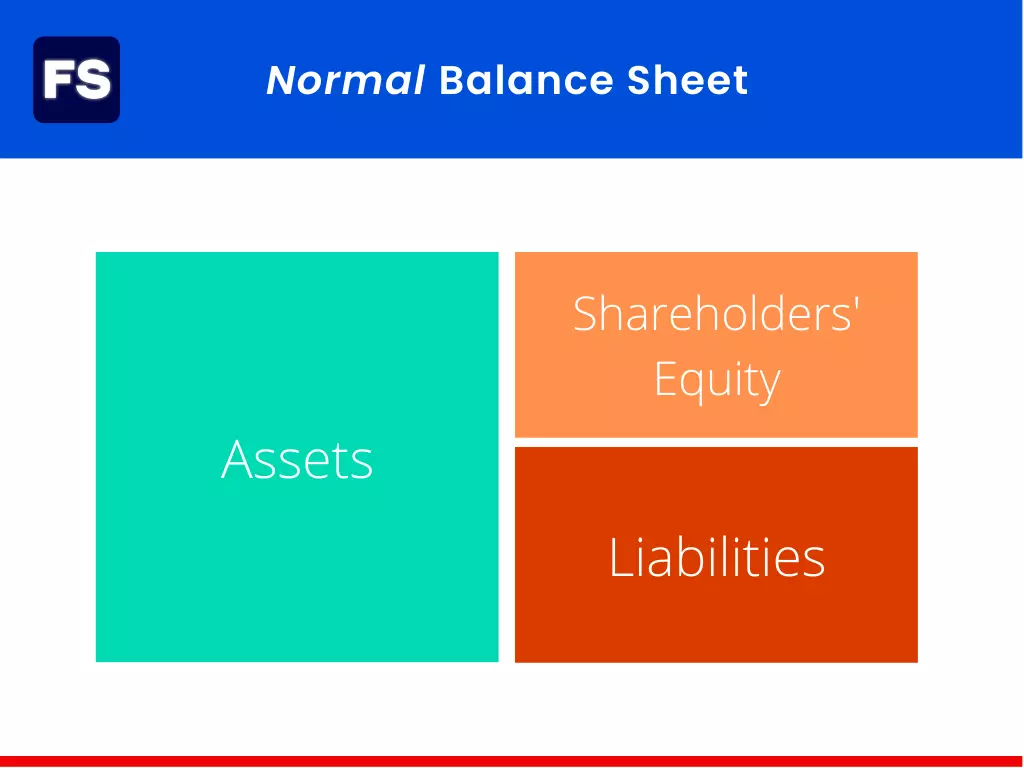

Let’s look at the fundamental balance sheet equation:

Assets must be equal to the sum of liabilities and shareholders’ equity.

Now, a company cannot have negative debt.

It may have credit balances recorded on the balance sheet with a negative sign. However, these usually refer to temporary situations regarding prepaid expenses, or expenses paid in excess due to accounting errors. Thus, they are corrected soon after the actual transactions are processed.

On top of that, these are usually small values and are highly unlikely to surpass all the other components of the liabilities category in the balance sheet, making it negative. This means the total liabilities will never be a number lower than zero.

So if debt can’t be negative, what does that mean when you look at a negative debt-to-equity ratio?

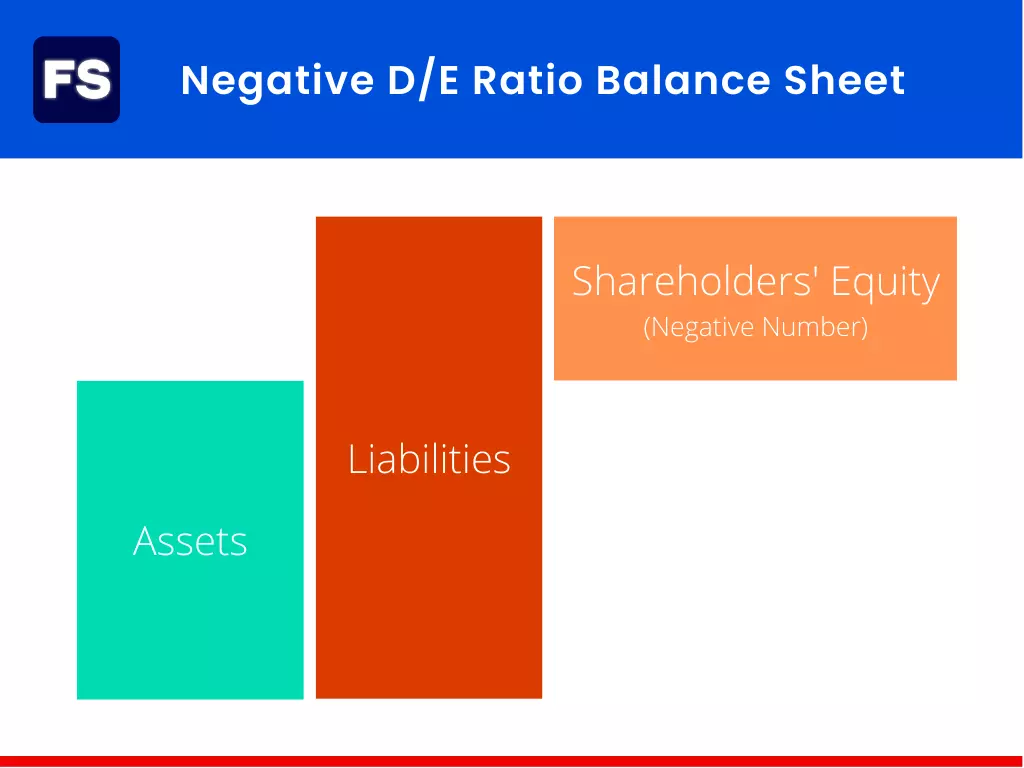

It means shareholders’ equity is a negative value.

And negative equity means liabilities exceed assets.

How do you interpret that? What does it mean for you as an analyst or investor? What does it tell you about the company?

Negative Debt-to-Equity Ratio Interpretation

High risk of bankruptcy.

A negative debt-to-equity ratio indicates the company is highly leveraged. It has a lot of debt relative to its equity.

This means the company relies too much on debt to finance its operations. The problem?

In the case of financial turmoil, it doesn’t have enough assets to cover its debts. Thus, the company is vulnerable.

If a business is unable to pay its debts, it could face bankruptcy.

Shareholders’ equity is the amount shareholders would receive if all the company’s assets were sold and its debts were paid off. It’s a measure of the company’s net worth.

If this value is negative, it means shareholders get nothing.

Negative owner’s equity is easy to spot in the company’s balance sheet.

Now, a negative debt-to-equity ratio does not equal bankruptcy. The company can continue operating if its cash inflows are higher than the required debt payments. Many do.

However, it is definitely a warning sign of excessive leverage, and vulnerability to financial distress.

It’s important to consider other financial metrics and factors, such as cash flow, profitability, and industry conditions, when evaluating the risk of bankruptcy.

What Causes a Negative D/E Ratio

Negative shareholders’ equity and the resulting negative D/E ratio are a result of:

- Accumulated losses: Negative net income reduces equity (more specifically, it erodes retained earnings). If a firm continually loses money over time, shareholder equity may turn negative.

- Big dividend payments: Dividends are payments made directly to shareholders. What funds these payments? The company’s profits. It’s a chunk of cash that effectively leaves the retained earnings and disappears from the balance sheet. As a result, large dividend payments reduce the amount of money available to fund operations and investments.

- Excessive debt: Sometimes companies take on high debt in an effort to cover accumulated losses. As a result, liability increases, along with risk. Equity stays the same (likely negative).

Firms must carefully decide on dividend policy, manage equity, and maintain a healthy balance between debt and equity to remain financially stable and avoid the risk of financial distress.

How to Improve Negative D/E

When equity is negative, shareholders will likely step in and provide additional funding to help the company meet its financial obligations and improve its financial position.

They have two options to improve its leverage ratio:

- Invest more money: Shareholders have the option of investing more money in the business through a direct cash investment or by purchasing more shares. They can also be willing to take a dividend cut. As a result, the company’s equity will become positive again, as well as its debt-to-equity ratio.

- Debt forgiveness: It is common for the same investors who own shares to also be creditors of the company. In this case, shareholders can write off a portion of the company’s debt, reducing the amount of money owed to them. As a result, the company’s liabilities decline, and its debt-to-equity ratio improves.

These options have different results on the balance sheet.

A direct cash investment will result in an increase in the assets (cash), and an increase of the same proportion in shareholders’ equity.

Debt forgiveness, however, causes the total liabilities to reduce, while equity increases. This increase in equity is typically retained by the company and does not belong to any specific shareholder.

Negative Debt-to-Equity Ratio FAQs

Is a negative debt-to-equity ratio good?

No. A negative debt-to-equity ratio means shareholders’ equity is also negative. This indicates that if all the company’s assets were sold, it would not be enough to cover its debts. In other words, the company has a negative net worth.

Is a debt-to-equity ratio below 1 good?

A debt-to-equity ratio below 1 means debt is lower than equity. This is a healthy capital structure for most companies. However, it’s important to consider other factors, such as profitability and industry conditions, when evaluating financial stability.

What does the debt-to-equity ratio tell you?

Debt-to-equity is a financial ratio that tells you how a company finances its operations. It looks at how much of its assets are funded by bank loans and bonds—debt, and how much is financed by earnings from previous years and cash injections from shareholders—equity.