No. Stock prices and dividend payments are not connected directly. However, if the dividend stays the same and the stock price goes down, the dividend yield goes up. This does not mean the company changed its dividend policy.

That’s the gist of it. For a comprehensive guide on the relationship between stock price fluctuations and your dividend payments, keep reading:

How Stock Price Fluctuations Impact Dividends

Spoiler alert: They don’t directly.

A stock’s price can go up or down for a lot of reasons, such as the financial performance of the business, market conditions, and investor sentiment.

Dividend payments are payments that companies (both public and private companies alike) make to their shareholders in the form of cash or additional shares.

Who determines these payments? The company’s management team. This means dividends are not directly connected to the price of a stock.

Now, the decline in the price of a stock may be a result of poor performance, operational issues in the underlying business, or unfavorable market conditions. These problems can lead to a cut in dividend payments to save money and strengthen the financial position.

You may be wondering:

What about the other way around? Do dividend payments affect stock prices?

Yes. Differences in dividend payments can have:

- Direct impact on (theoretical) stock price, as analysts use them in many financial models and calculations.

- Indirect impact on the stock price, due to market reactions.

Let’s start with the first point—direct impact in indicators and formulas:

The Impact of Changes to Dividend Payments

How do dividends affect stock price?

So, when the stock falls, the dividend doesn’t necessarily change. The dividend payout ratio and dividends per share stay the same as well.

Now, what does change as the stock price fluctuates is the dividend yield.

The dividend yield is the ratio of the cash dividend to the stock price.

For example, if a company pays a $1 dividend per share and the stock price is worth $100, the dividend yield is 1%. If the stock price falls to $50, the dividend yield increases to 2%.

Does this mean dividends increased? Or that the company reduced its dividend payments?

No. It simply means the dividend yield increased because of the fall in the stock price.

Additionally, here’s a list of financial models, instruments, and ratios that change when a company makes changes (it can be an increase or decrease) to its dividend payments:

- Dividend discount model (DDM): The value of an asset is the present value of all its future cash flows. For stocks, these cash flows are dividends. Investors use the DDM to estimate the intrinsic value of a stock based on the present value of future dividends. A change in the dividend payment will impact the calculations.

- Option pricing models: Market makers use models to determine the theoretical price (or fair value) of an option contract, such as the Black-Scholes model or the binomial model. A change in the dividend payment affects the assumptions used in these models and, as a result, the calculated option price.

- Options’ greeks: These measure the sensitivity of the price of an option to different factors, like changes in the underlying stock price, and time to expiration. A change in the dividend payment or yield affects the greeks of options.

- Stock index futures: The models used to determine the theoretical price of futures contracts on stock indexes also take dividend yield into account. Thus, a change in dividends of a company that makes up that index affects futures contract prices.

- ETF’s Dividend Yield: An ETF is a basket of stocks. If a stock in that basket changes its dividend policy, the whole calculation for the total dividend yield changes. This is especially true for ETFs for which the goal is to offer investors additional passive cash flow from dividend stocks, such as the S&P 500 Dividend Aristocrats.

The management team determines the dividend policy. And they can decide to pay dividends even if the stock price falls. At the same time, even though most pay a quarterly dividend, companies are not required to pay dividends.

Market Reaction to Dividend Announcements

Stock market participants can have different reactions to dividend announcements, and make the stock rise or fall. Everyone has a different investment objective and priority, especially when it comes to dividend investing.

Many different scenarios can result in many different outcomes, so it’s hard to predict what will happen after a dividend announcement.

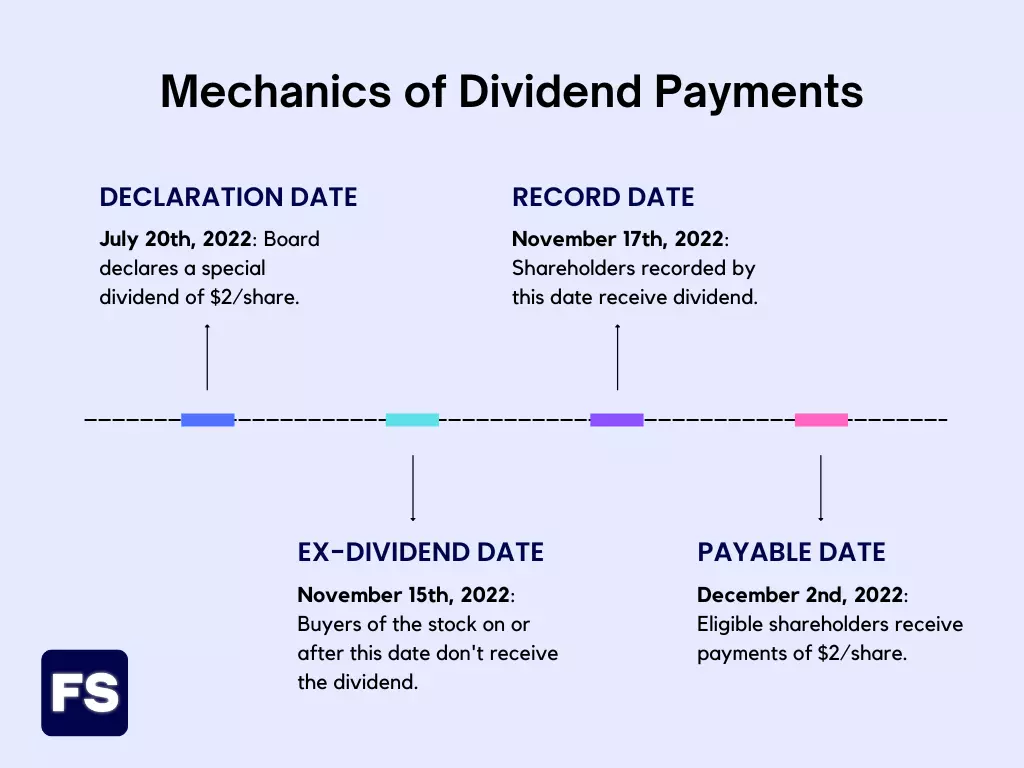

The announcement date is also called the declaration date. It’s the first stage of a dividend payment:

So, even though market sentiment is not implied, and reactions do not follow a predictable set of rules, here’s how they can be justified:

It has everything to do with the underlying signaling the dividend announcement makes…

#1) Positive Reaction to Dividend Increase

When the share price of a company increases after it announces a larger dividend payment to shareholders, the reason why is pretty straightforward:

An increase in dividends signals that management is confident in the company’s ability to maintain or even increase dividend payments in the future. This implies confidence in the capacity to produce increasing future earnings and cash flow.

Also, the declaration of a dividend encourages investors to purchase stock and be eligible to receive the payment.

This is especially true for investors interested in receiving regular income from a dividend aristocrat (a company that did dividend increases consistently for the last 25 years). They see dividend growth as positive news.

Since they know they’ll receive a dividend if they buy before the ex-dividend date, they’re willing to pay more. The result?

The price of the stock increases in the days leading up to the ex-dividend date.

In theory, the increase is equal to the amount of the dividend. However, the stock market is unpredictable. There’s no entity or predetermined formula that dictates the actual price change.

The stock price may even drop after what seems like a positive dividend announcement:

#2) Negative Reaction to Dividend Increase

This is not so straightforward.

Here are a couple of reasons why market participants may react negatively to an increase in dividend payments:

- Signals lack of investment opportunities: Investors interpret a dividend increase as a lack of growth opportunities, and sell the stock as a result. The company is essentially saying “Take this money because we don’t know what to do with it. We couldn’t find projects that will grow our revenue.” When dividends take away from reinvesting in the business, it’s not a good signal.

- More taxes: For investors in high tax brackets, personal taxes are a big concern. The bigger the dividend received, the more taxes Uncle Sam collects. This is why they prefer companies that don’t pay dividends, or that do share repurchases instead.

A dividend is typically taxed at a higher rate than a capital gain. In fact, long-term investors can defer the capital gains tax forever by not selling.

#3) Negative Reaction to Dividend Decrease

Straightforward.

Many investors see dividends as a sign of financial strength.

If a company is in financial distress (or market conditions are tough), it will likely reduce its dividend payments to shareholders. It needs the cash to recover.

It also indicates the company doesn’t see its future earnings increasing enough to be able to afford to pay an increasing dividend every year. So it needs a dividend cut to save cash.

In this case, a company’s announcement of reduced or suspended cash dividends is negative news that causes the stock price to fall.

It’s also worth noting that stock market participants are influenced by broader market conditions and the overall economic environment.

For example, investors are more willing to invest in a dividend stock in a bear market. Why? Because dividend stocks generate returns even when their prices are falling.

#4) Positive Reaction to Dividend Decrease

Why would investors buy more shares when a company announces it will reduce its annual dividend payments? They’ll get less dividend income. This is not so straightforward, right?

Here are a couple of reasons why this may happen:

- Reinvesting in the business: The management team found growth opportunities to invest in. Instead of giving cash away to shareholders so they go out there and make a return for themselves in the market, the company is signaling it is confident it can give shareholders a better return on their money.

- By cutting the dividend to zero, or doing a share repurchase instead, investors will pay less personal tax. This attracts rich investors, as they’re taxed at a high rate.

Basically, management believes the company is better off retaining its profits and reinvesting in the business.

The Bottom Line

Do dividends decrease with stock price?

Not automatically or immediately. While the dividend yield changes (because the stock price changes), the actual dollar value of the dividend does not, unless the company decides to change its dividend policy.

Does dividend yield go down as stock price goes up?

The dividend yield is a financial ratio calculated by dividing a stock’s dividend payment by the stock’s price. If the stock price goes up and the dividend amount stays the same, the dividend yield will go down.

What causes dividends to decrease?

A company decides to decrease its dividend payments because it needs to save cash to improve its financial position, to invest in new growth opportunities, or because it is not confident in its future earnings growth. The management team may also decide to change its dividend policy to better match the expectations of its clientele of investors.

Any questions? Comment below!

Google finds and displays your first paragraph. I believe your first paragraph is wrong. It says “if the dividend stays the same and the stock price goes down, the dividend yield goes down.”

I think it should say that “yield goes up.” instead of “yield goes down.”. You state this later in your article.

Yes that’s a mistake on my part, thank you for letting me know!