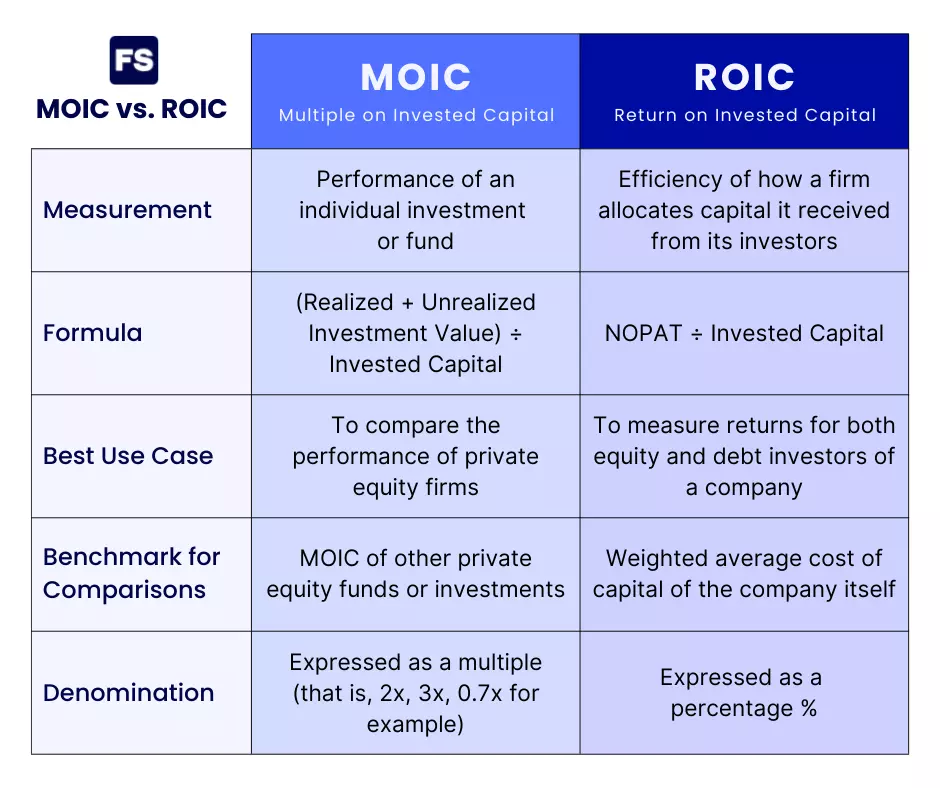

The key difference between MOIC and ROIC is in the purpose of each metric. MOIC is mostly used in private equity to assess fund performance. In contrast, analysts use ROIC to evaluate how well a company allocates money from its investors. Although both metrics include invested capital, it takes a different form for each.

At first glace, both metrics appear similar. But a closer look reveals key differences:

Still confused?

Keep reading for a more comprehensive answer. I divided this post into three steps to facilitate your understanding. We’ll go through:

- What is MOIC and how to calculate it.

- What is ROIC and how to calculate it.

- The fundamental difference between both metrics.

Ready? Let’s dive right in:

#1) MOIC Meaning

The Multiple on Invested Capital (MOIC) measures how much money an investment generates relative to the initial capital invested. As the name implies, it is expressed as a multiple.

The MOIC is the multiple of the initial investment that has been returned to the investor over the holding period. You can use it to evaluate the return on any investment.

But it is mostly used to evaluate the performance of private equity funds and venture capital.

Private equity funds pool together money from investors and acquire equity in small companies in hopes of selling that equity stake for more at a future date once the company has grown in value.

A MOIC over 1.00x means the portfolio company grew in value. Anything below 1 means the investment shrunk.

The MOIC measures performance from the beginning of the investment compared to the exit date, as opposed to expressing the return on an annual basis like the internal rate of return (IRR). It also doesn’t take into account the time value of money.

Now, here’s how to calculate MOIC:

MOIC Calculation

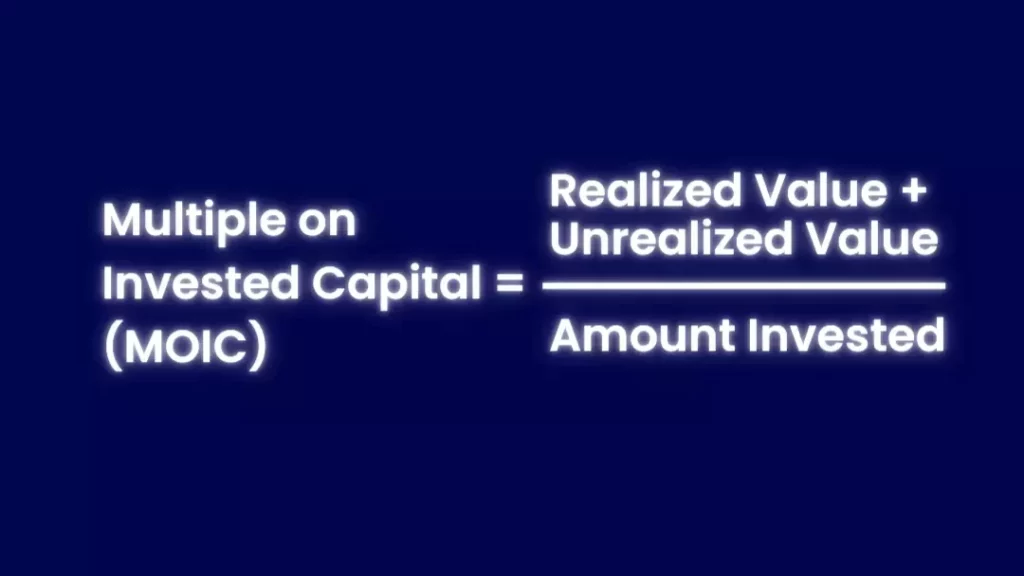

The MOIC formula is as follows:

Where:

- The realized value is the sum of the value of all the exits the PE fund has had.

- The unrealized value is the value of the portfolio companies the fund hasn’t exited yet. It’s how much money the PE firm estimates it can get for its investments that are still active. This estimate fluctuates depending on forecasts.

- The amount invested (or invested capital) is the total amount of capital invested in the fund’s portfolio companies.

Now, let’s move on to the ROIC:

#2) ROIC Meaning

Return on invested capital (ROIC) measures how efficiently a company uses its investors’ capital to generate a return. It is expressed as a percentage.

A company funds its assets either through equity capital or debt capital. Equity investors buy shares in exchange for a piece of the company. Meanwhile, debt investors lend money to the company in exchange for a steady interest payment.

What does the company do with the money it receives from investors?

Invest in assets. Invest in new projects. Capitalize on growth opportunities. All with the goal of growing, developing the business, and (most importantly) generating a return for the investors that funded the company.

Thus, the ROIC evaluates how well the company is investing its investors’ capital (from both souces—equity and debt).

The higher the ROIC the better, as it means the business is making good capital allocation decisions that are generating returns for investors. There’s a benchmark you can compare the ROIC to though:

The weighted average cost of capital (WACC). Why? Because the WACC is the minimum return rate required by both shareholders and lenders on average.

As a rule of thumb, when the ROIC is greater than the WACC, the company is creating value for its investors.

Now here’s how to calculate ROIC:

ROIC Calculation

The ROIC formula is as follows:

Where:

- NOPAT stands for Net Operating Profit After Tax. It measures operating profitability without the influence of leverage. You calculate it by multiplying EBIT • (1 – Tax Rate). Why not use the net income (money available to distribute to shareholders)? Because the goal of ROIC is to compute the return for all investors of the company, not just shareholders. That means including the income available to bondholders as well.

- Invested capital is the equity and debt capital that funds the assets needed to generate the NOPAT. You can also think of it as the money investors have put into the company and get a return for it. How do you calculate it? By summing equity book value to financial debt and subtracting non-operating assets.

The ROIC focuses on operational performance. That’s why non-operational assets are excluded from invested capital. Notice NOPAT also focuses solely on the performance of the core business (capital structure is not taken into account). Thus, the numerator and denominator are in alignment in that sense.

Now we’re ready to clarify the difference between ROIC and MOIC:

#3) Difference between MOIC and ROIC

Although the title is similar, MOIC and ROIC are different in their purposes and how analysts employ them.

The key difference between ROIC and MOIC is their scope.

MOIC is mostly used in private equity and venture capital to evaluate the overall success of a fund. You can also use it to evaluate the success of a particular individual investment.

On the other hand, ROIC is used to assess the overall profitability and efficiency of a company’s operations by analyzing its return on all invested capital.

Also, although the denominator is invested capital for both metrics, they’re not exactly the same:

Invested capital in MOIC is the money that has been invested in portfolio companies. It contrasts with money investors have pledged to the fund but not transferred to the fund’s bank account yet. This is why the MOIC differs from the TVPI.

Invested capital in ROIC on the other hand, relates to an individual company’s capital allocation efficiency. An alternative formula to the one we saw previously is to subtract non-interest-bearing current liabilities from all the assets the company uses in its operations to generate profits. You can think of it as the value of the assets the company needs in order to generate the operational income.

In summary, ROIC measures a company’s overall return on its investors’ money, while MOIC is the return multiple on a specific investment.