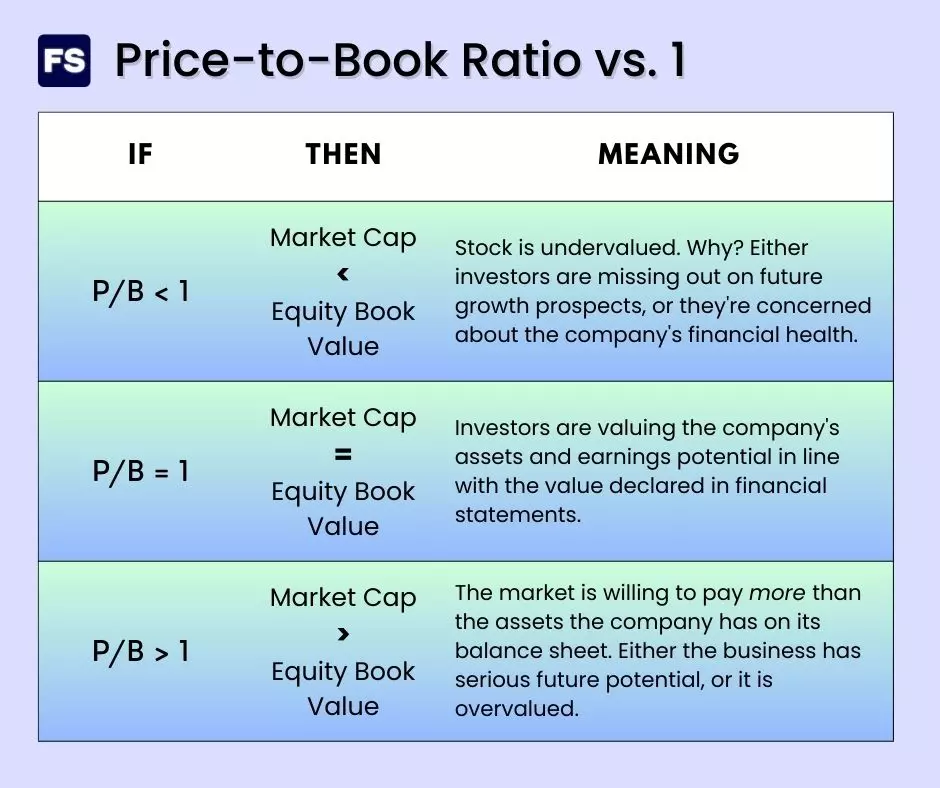

A price to book below 1 indicates the stock is undervalued. It means the market values the company below its accounting net worth. This could be an investment opportunity, or a sign the business lacks future growth opportunities.

Here’s a summary table of how you can interpret the price-to-book ratio in relation to 1:

Still confused? Keep reading for a more comprehensive answer:

What is the Price to Book Ratio

The price-to-book (P/B) ratio is a financial metric that measures how market participants value a company compared to its book value.

As an investor, you can use the P/B ratio to identify potential investment opportunities and make informed decisions. How so?

The price-to-book ratio helps you understand whether a company’s market capitalization is reasonable compared to its balance sheet.

A high P/B ratio indicates a high valuation, which may be justified due to the company’s ability to generate future profits and growth.

In fact:

The market value of a business is typically higher than its book value, as investors are betting on the future potential of the company. Here’s why:

The book value from accounting does not consider the expected future growth opportunities, the skills of the workers, and the human capital.

On the other hand, the market value is what similar businesses (or assets) are trading for. It is influenced by supply and demand, and includes the expected value of growth for the assets.

It’s rare the book value and the market value are equal.

Financial analysts often use the P/B ratio as a multiple to compare a company’s valuation to its peers in the same industry.

How to Calculate Price to Book

To calculate the P/B ratio, you need the current share price, the value of total assets, total liabilities, and the number of outstanding shares.

You’ll want to divide the current market price at which the company’s stock trades by its book value per share. The price-to-book ratio formula is:

Now, what is the book value? It’s the company’s total assets minus its total liabilities.

It’s also called net worth, or equity book value. Some analysts don’t include intangible assets in the calculation. Why? Because intangibles aren’t easily valued.

In this modification, you subtract intangible assets and total liabilities from the total assets to get the book value.

You can also calculate P/B by dividing the market capitalization (which is the product of the number of outstanding shares and the market price of one share) by the book value:

The price-to-book ratio varies a lot by industry. A few examples:

- The tech sector is known for high P/B ratios due to high growth potential and few tangible assets.

- The retail industry can extend debt with suppliers for a long time, reducing their book value and resulting in a high P/B ratio.

- Real estate companies on the other hand, have large asset bases due to their property holdings, increasing their tangible book value and lowering their P/B ratio.

A high P/B ratio indicates the market has high expectations for the future growth prospects of the business. It could also mean the company’s balance sheet has a lot of intangible assets, such as goodwill, patents, trademarks, and intellectual property—which are not reflected in the book value. Microsoft is an example of this.

However, a high P/B ratio could also indicate that the stock is overvalued, and it’s time to hit the sell button. Why?

Because a price-to-book ratio greater than 1 indicates the stock is trading at a premium to the book value. Meaning you could be overpaying.

What about P/B below 1?

Price to Book Below 1 Meaning

A P/B ratio of less than 1 indicates an undervalued stock.

It means the accounting net worth is higher than the value market participants attribute to the company.

Does this mean the stock is worth buying? It depends.

It either means most investors in the market have not yet caught onto the future earning potential of the company. Thus, there’s an opportunity for a solid investment.

But it can also mean investors don’t believe in the future of the business, and thus are pricing it below the value of its assets.

To help you determine which is the case you can look at the company’s financial trends. Are numbers going down?

Is the company generating enough operational cash flow? Is there a decline in the company’s financial health, growth opportunities, or the industry as a whole?

Ultimately, a low P/B ratio alone doesn’t guarantee a profitable investment. Thus, you should use it in conjunction with other metrics to make informed investment decisions.

Price to Book Below 1 Example

Let’s go through a quick example to put these concepts in motion.

Imagine a company with the following balance sheet (in millions of dollars):

| Non-current assets | 70 | Equity | 40 |

| Current assets | 50 | Non-current liabilities | 50 |

| Current liabilities | 30 |

The company’s stock trades publicly for $30 at the moment. And the number of outstanding shares is 1,000,000.

What is the P/B ratio of this firm?

As you know, the assets (on the left) are everything that has current or future monetary value to the business. The liabilities are all the money the company owes to creditors, whether it is a bank, a supplier, or the government.

The difference between these two? It’s the net worth of the company. Or its equity book value.

The price-to-book financial ratio compares this equity value to the value market participants agree upon for the company—the market cap.

In this example, the company’s market capitalization is 30×1,000,000 = $30 million.

Thus, the price-to-book value ratio is:

Or if you prefer, you can get the equity book value per share ($40M divided by a million outstanding shares) and compare it to the share price:

This value means that for every dollar of the company’s book value per share, the market is willing to pay 75 cents.

In other words, the market is valuing the company’s assets and earnings potential lower than its book value. The conclusion? Either the company is undervalued, or investors have concerns about putting their money in this stock.

Ultimately, all the P/B ratio does is reveal the market’s perception of a stock’s value. It is one of several valuation multiples investors use to evaluate companies. For instance, EBITDA and revenue multiples are also common.

Price to Book FAQs

There you have it! Now you know how to interpret the price-to-book ratio. Let’s finish this post with some frequently asked questions:

What does a price to book value of 1 mean?

The price-to-book ratio is a financial valuation metric used to compare a company’s market value to its book value. When it is equal to 1, it means the stock’s market price is in line with the company’s book value.

Is a low price to book value good?

The price to book compares the current stock price of a company to its equity book value. A low price-to-book value indicates the market is currently undervaluing the company in question. This can be good and present an untapped investment opportunity, or it can mean that the company’s future growth prospects are not good enough for it to trade at a premium to its accounting value.

How to find companies with a P/B ratio below 1?

To find companies with a P/B ratio below 1, you can use a stock screener tool or a financial website that allows you to filter stocks based on their financial metrics. Alternatively, you can manually search for companies by looking at their financial statements.