You’re calculating the unlevered beta of a company and need the debt beta, but don’t know how to find it? Then this is for you.

You can extract the implied debt beta from the CAPM formula by equating the formula to the cost of debt, or you can estimate the debt beta based on the credit rating of the company and its industry.

That’s the gist of it. For a more comprehensive guide on how to find debt beta, keep reading:

We start from the beginning—by understanding what is beta, how analysts modify it to value companies, and how it affects the cost of equity.

After that, we clarify what is the debt beta and how to calculate it.

Ready? Let’s dive in:

What Is Beta

Beta is a volatility measure that compares how much an asset fluctuates relative to the overall market.

In other words, how a stock responds to swings in the market (usually S&P 500 when looking at American companies).

It is primarily used in the CAPM (Capital Asset Pricing Model), which calculates the expected rate of return for an asset or investment.

A beta of 1.0 means a stock is strongly correlated with the market benchmark. It moves in line with the market.

Stocks with a beta above 1 will tend to move with more momentum than the S&P 500. Those with a beta lower than 1 with less momentum.

Hence, you can use beta to determine the systemic risk of a security, analyze its volatility, and compute the cost of equity under the CAPM. More on this later.

There are two types—levered and unlevered beta. Here’s what that means:

Levered and Unlevered Beta

In corporate valuation and financial modeling, the concepts of levered and unlevered beta are essential.

Levered beta (also called equity beta) is the observed beta of the shares of the company. It encompasses the overall risk of the company.

Unlevered beta (also called asset beta) on the other hand, tells you the risk of the business without taking debt into account. In other words, the risk of the underlying core activities without considering how the firm finances those operations. The goal is to evaluate business risk only, and not financial risk.

Basically the main difference between levered and unlevered beta is whether or not you consider debt in the capital structure of the company.

Unlevered beta is usually lower than levered beta. Why?

Because more debt means higher risk of default, and a higher levered beta. On the other hand, unlevered beta stays the same for different levels of debt.

In essence, unlevered beta is a theoretical concept meant to help you value the core business of a company (how it generates cash flow) by assuming it is financed by equity only.

Here’s the formula for the unlevered beta (βU):

Where βL is the levered beta, βD is the beta of debt (more on this later), D/E is the debt-to-equity ratio, which measures how much debt the firm owes in relation to its equity capital, and t is the corporate tax rate, used to account for the tax shield of financial leverage.

And here’s how you calculate levered beta if you have the unlevered beta of a company:

This way you reverse the removal of the effect of debt from the unlevered beta.

Now let’s see how this comes into play when estimating a firm’s cost of equity.

Beta in CAPM and Cost of Equity

The cost of equity is the return shareholders expect to receive when investing in a business.

The higher the risk of the business, the higher the cost of equity.

The most common way to calculate it is by using the CAPM, which says the return rate equity investors require (rD) is the risk-free rate plus a market risk premium:

Where:

- rf is the theoretical return of an investment with zero risk. In real life, you use the yield of AAA-rated countries’ bonds because it’s probably the safest investment you can make.

- β is the beta of the stock, as we’ve seen before.

- (Erm – rf) is the market risk premium. This is the additional rate of return investors expect for holding a portfolio of risky securities instead of safe investments paying the risk-free rate. Erm is the expected return for the market as a whole.

Now, why does this matter if the subject of this post is debt beta?

Beta is easily observable for public stocks, making it easier to calculate the cost of equity. But what if the company you’re valuing isn’t publicly traded?

In that case you can estimate equity cost using the unlevered beta (which requires knowing the debt beta).

You calculate the unlevered beta from a sample of peer group competitors to focus on the risk of their business model (since their operations are likely similar to the company you’re valuing), assume that is the unlevered beta for the company you’re valuing, and then “re-lever” it taking into account the unique capital structure of that company to also reflect its financial risk.

I go into more detail about this whole process here:

How to Calculate the Cost of Equity of a Private Company

But may be wondering…

The beta of debt is in the unlevered beta formula that will determine the cost of equity. Does it make sense to include debt beta in the cost of equity calculation?

Yes, because the more debt the higher the risk of financial distress, and of equity holders getting left with nothing in case of default.

So, a higher debt beta translates into a higher cost of equity.

Now we’re ready to go into more detail on what exactly is the beta of debt:

What Is Debt Beta

Debt beta measures the risk of debt returns.

More specifically, the sensitivity of the returns on debt to changes in market returns.

It is usually an insignificant number. Why? Because debt holders have priority in getting paid when a company is liquidated after bankruptcy. This is what makes equity more expensive than debt.

This is especially true for big mature companies like Procter & Gamble and General Motors. Or in general solid companies from countries with top credit ratings.

In these cases you can assume debt beta is zero, as a zero-beta asset is one that yields the risk-free rate of return. And debt from these companies is close to what’s considered risk-free because it’s very unlikely they’ll default.

Still, keep in mind this is not 100% correct because why would you invest in corporate bonds (riskier than government bonds) if they only paid you the risk-free rate, right?

For companies with high debt-to-equity ratios, assuming beta of debt is zero is unrealistic because these firms have a higher probability of bankruptcy.

With that in mind, here’s how to compute debt beta:

How to Calculate Debt Beta

Computing the debt beta allows you to correctly derive the unlevered beta.

The problem is debt betas are difficult to estimate by observing the market because corporate bonds are traded infrequently.

But here are two ways you can do it:

#1) CAPM-like Approach

When you don’t assume debt beta is zero, this is the most common way to calculate it.

The CAPM is mostly used to get the cost of equity, but here you equate it to the cost of debt instead. Then, you extrapolate the implied beta of debt.

The debt beta formula is as follows:

Where:

- rD is de cost of debt. In general this is simply the effective interest rate a company pays its debt holders. That is, all of its interest expenses divided by its financial debt. You can also use the yield on the company’s bonds, although low-rated bonds will imply an unreasonably high debt beta.

- rf is the risk-free rate.

- βD is our beta of debt. What we want to find and will solve the equation for.

- (Erm – rf) is the market risk premium.

So how this works is you will plug everything into the formula except for what you’re trying to find, the beta.

You then extrapolate the beta from the resulting equation. Confused? Don’t worry, we’ll go through an example to make this clear below.

Using the CAPM has the advantage of allowing you to use a consistent methodology for both equity and debt beta. That is, the same return interval and estimation period.

Still, this is an approximation, and more specific information about the firm and its default risk improves it.

#2) Based on Credit Rating

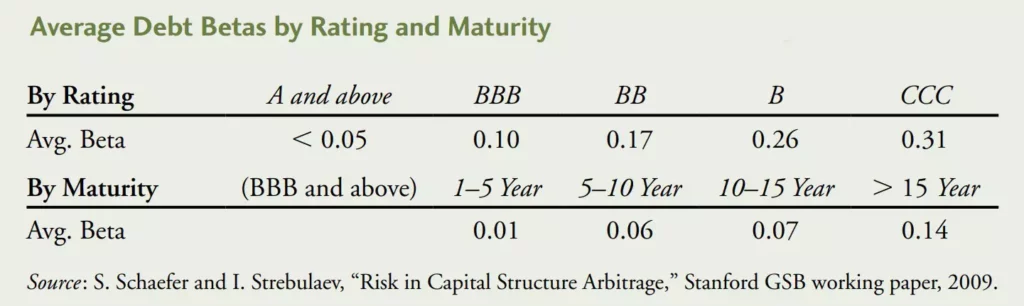

You can also approximate debt beta using estimates of betas of bonds by rating category, as shown in the table below:

Of course this is only applicable to entities significant enough to receive a rating from credit agencies. It doesn’t really apply if you want to evaluate a small private company with limited public information.

Note that these are averages across all industries.

Debt betas are likely higher or lower from industry to industry, according to how much it is exposed to market risk.

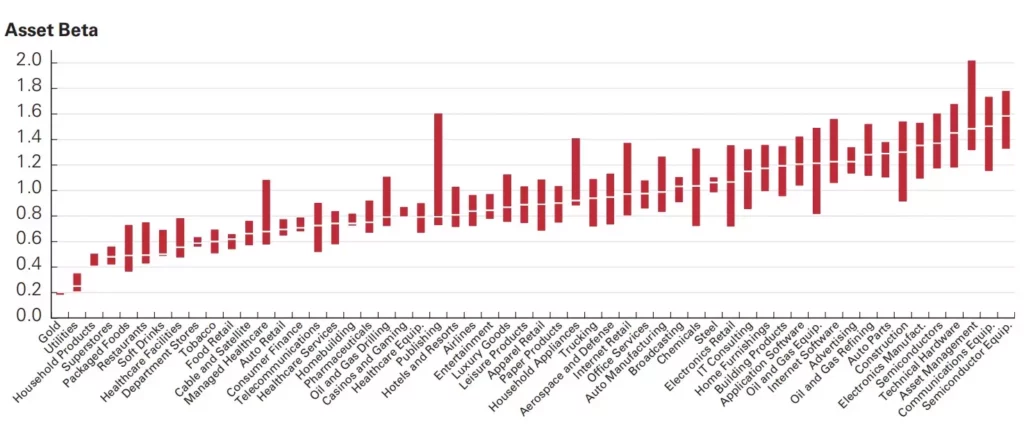

You can consider this difference in your analysis by scaling the debt betas by the relative asset beta for the industry, per this table:

Now, let’s go through a quick example to put these concepts in motion:

Debt Beta Calculation Example

Imagine a private company for which you want to calculate the cost of capital to use as a discount rate for its projected cash flows.

You don’t have a lot of data about the business, but you find the following information about a comparable firm in the same industry with similar operations and that is traded publicly:

| Levered Beta | 1.2 |

| D/E Ratio | 90% |

| Cost of Debt | 3% |

The risk-free rate is 1%, the market risk premium is 5%, and the corporate tax rate is 20%.

Your goal is to compute the unlevered beta in order to isolate business risk. How do you go about it?

To unlever the beta, you need the beta of debt. Using the CAPM, you have:

And now the unlevered beta:

You can then re-lever this βU using the private company’s own debt-to-equity and cost of debt to get a good approximation of its cost of capital.

Frequently Asked Questions (FAQs)

How to calculate implied debt beta?

You calculate the implied debt beta using the Capital Asset Pricing Model. The CAPM states the return of an asset is equal to the risk-free rate plus a market risk premium multiplied by the beta. To compute the implied debt beta you need the cost of debt. You plug it on the left side of the equation and then extrapolate the beta.

How does debt affect beta?

The beta of debt is the risk associated with the company’s debt obligations. The more total debt capital a company has, the higher the chance it struggles to pay its obligations, and eventually it may default. Hence, companies with higher credit risk have higher betas. In general, the higher the debt/equity ratio of a company, the higher its levered beta.

How to calculate cost of debt with debt beta?

You can calculate it using the CAPM just like you would for the cost of equity using the risk-free rate and the market risk premium. Instead of using the beta of equity, you use the debt beta.

THANK YOU FOR EXPLAINING KEY FINANCE TERMS IN SIMPLE WAYS.