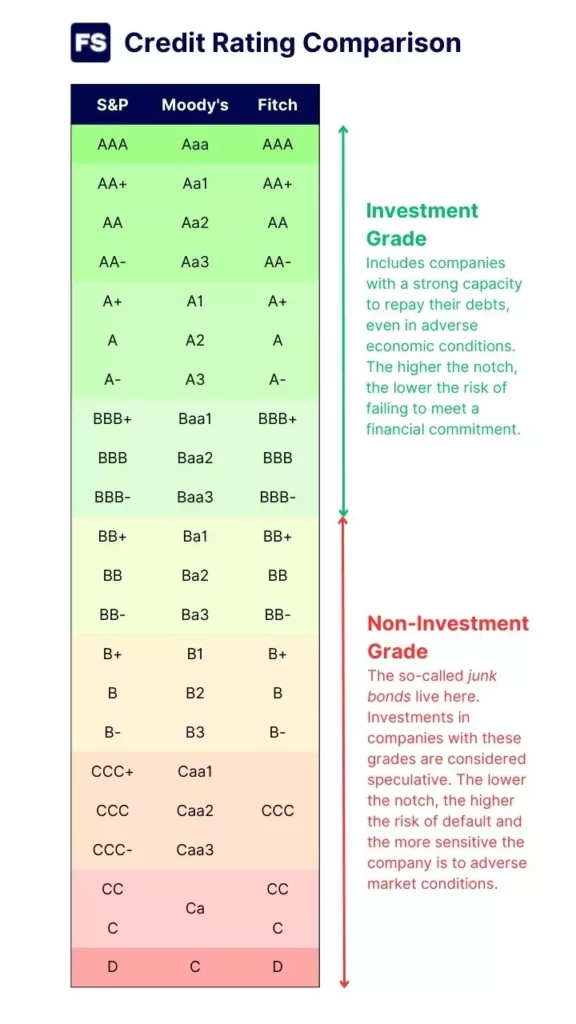

Here’s a table showing you the equivalent ratings between the big three credit rating agencies:

| S&P | Moody’s | Fitch |

| AAA | Aaa | AAA |

| AA+ | Aa1 | AA+ |

| AA | Aa2 | AA |

| AA- | Aa3 | AA- |

| A+ | A1 | A+ |

| A | A2 | A |

| A- | A3 | A- |

| BBB+ | Baa1 | BBB+ |

| BBB | Baa2 | BBB |

| BBB- | Baa3 | BBB- |

| BB+ | Ba1 | BB+ |

| BB | Ba2 | BB |

| BB- | Ba3 | BB- |

| B+ | B1 | B+ |

| B | B2 | B |

| B- | B3 | B- |

Here’s a more complete chart:

As you can see, S&P and Fitch are pretty similar. Moody’s however, uses a slightly different scale with numbers.

Credit Ratings FAQs

Some frequently asked questions and their answers to help you understand credit ratings:

What does a credit rating tell you?

A credit rating tells you the creditworthiness of a borrower, which is their ability to repay debt in time. These ratings estimate the risk of lending money to a company, but they don’t tell you about its profitability. Credit ratings also exist for individuals and governments.

Credit ratings have a significant impact on the company’s ability to access credit and the interest rates lenders offer it.

The higher the rating, the lower the risk of the borrower defaulting. As a result, companies with high credit ratings have an easier time getting approved for loans and are charged lower interest rates.

The lower the rating the more sensitive the company is to adverse market conditions, which hinder its ability to meet its financial obligations.

How do credit ratings work?

Credit ratings are expressed as a letter grade which ranges from AAA (best rating possible) to D (weakest rating, junk status).

Each grade is called a notch. For example, if a company goes from AA to AA+, investors say it increased a notch.

Notches equal to or above BBB- (Baa3 for Moody’s) are considered investment grade. These are attributed to companies or countries with low risk of financial distress.

Notches below BBB- are considered junk. These are more speculative investments in companies that may be near defaulting on their debts.

Many investment funds won’t buy junk bonds and keep them in their portfolio, so it’s important for companies to stay above the BBB- notch.

Each notch may have an outlook. What’s that? The probability of the rating changing in the next 12 to 24 months.

Outlooks can be positive, stable, or negative. For example, a stable outlook means the credit rating agency is saying “In the next 12-24 months we consider it unlikely for the rating to change.”

All rates are public. The big three make their ratings available to the public on their websites and with market data providers.

Who assigns credit ratings?

A credit ratings agency. They analyze the creditworthiness of companies based on factors such as borrowing history, repayment behavior, and financial stability. Investors and lenders look for companies with higher credit scores, as this indicates a lower credit (more ability to honor financial commitments).

The big three (most significant) credit rating agencies are Standards & Poor’s Global Ratings (S&P), Moody’s, and Fitch Ratings.

All agencies assess the creditworthiness of countries and enterprises based on business risk, financial risk, and management and governance.

What countries have the best ratings?

European countries dominate the small list of countries with the best credit rating (AAA), although a lot of them don’t have the Euro as their official currency.

More specifically, Norway, Switzerland, Liechtenstein, and Sweden are some of the few AAA-rated countries. They are located in Europe, but didn’t adopt the Euro. Interesting, right?

Furthermore, a company cannot have a credit rating above the rating of its country, unless most of its activity is abroad (generally only up to 3 notches above though).

Is it possible to have rating of Royal Bank (Canada)?

You can find their credit ratings through their investor relations page here.