Both credit risk and counterparty credit risk refer to the same thing—that the firm on the other side of a transaction defaults and is no longer able to repay its obligations.

Credit risk usually refers to the potential loss that results from a borrower not paying back a loan. Meanwhile, counterparty credit risk tells you how difficult it is to recover the value of a derivatives trade in case the counterparty defaults before its maturity. It is a subset of credit risk.

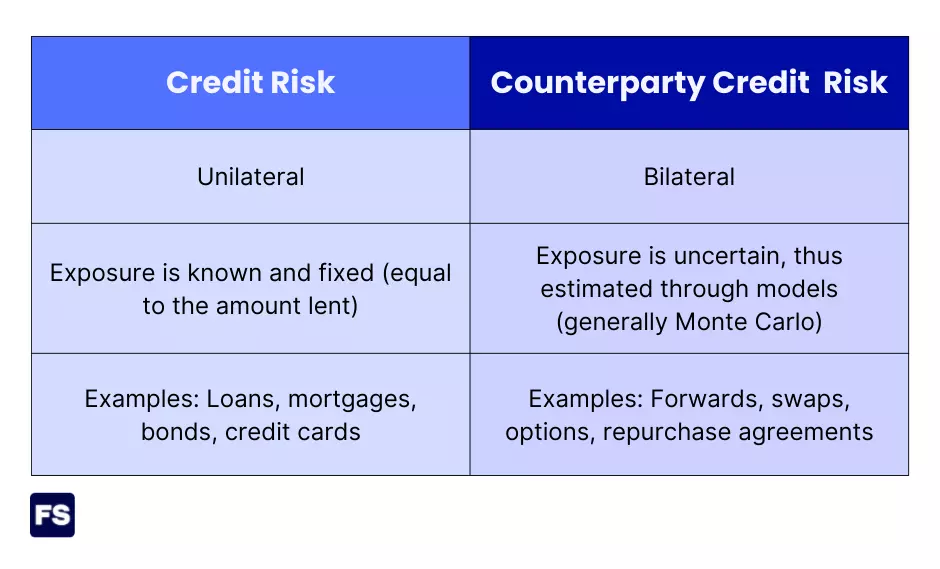

They are similar concepts but generally used to refer to different things:

Still confused? Keep reading.

In this post we’ll go over the difference between credit risk and counterparty credit risk within the context of OTC derivatives trading.

Let’s start from the beginning:

Understanding Derivatives Contracts

A derivatives contract is an agreement to buy or sell a specific amount of a given underlying asset (it can be a stock, a bond, an index, an interest rate, or any other asset) at a future date.

The amount paid/received at the beginning of the contract is a fraction of the price of the underlying asset. And the value of the contract fluctuates with the price of the underlying asset.

As with all contracts, there are two parties involved. Every time you trade a derivative there is someone on the other side, taking the opposite position of you.

The most common derivatives are swaps, forwards, and options. There are also futures, for which the risk is lower because they are standardized contracts traded on an exchange.

OTC (Over-the-Counter) derivatives are riskier than exchange-traded derivatives because only two parties are involved and the contracts are tailor-made, making them illiquid.

Corporations usually trade derivatives as a hedge against risk. For instance, to cover losses caused by currency fluctuations.

Now we’re ready to tackle the difference between counterparty and credit risk:

What Is Credit Risk

Credit risk measures a borrower’s inability to repay a loan or pay interest to the lender.

Here the exposure (amount the lender risks losing) is simply the amount lent.

Examples of products that have credit risk include loans, mortgages, bonds, and credit cards.

All the bank can lose is the amount it gave upfront to the borrower.

You can also think of credit risk as a broader category of risk, while counterparty is a subset of credit risk. Other components of credit risk include market risk, liquidity risk, and country risk.

Let’s see what exactly is counterparty risk:

What Is Counterparty Credit Risk

Counterparty credit risk (CCR) is the possibility that the counterparty to a derivatives transaction may default before its final settlement.

In other words, credit risk in derivatives trades is called counterparty risk.

CCR arises when firms trade derivatives. But also upon repurchase agreements (Repo), where securities are used as collateral to quickly borrow or lend cash.

You can also think of counterparty risk as the replacement cost of a derivative in case the counterparty defaults. That is, the present value of the derivative—which varies with market conditions, who is winning the trade, and the chosen discount factor.

Here exposure is subjective, more uncertain, and more complex to estimate. Each institution has its own model.

But in general it involves a Monte Carlo simulation taking into account:

- Credit information on the counterparty: Credit rating and how much the firm expects to recover if the counterparty defaults.

- Details of the transaction: Type of derivatives contract, direction of the trade the firm takes, underlying asset, nominal amount.

- Legal documents: Is there an ISDA/CSA master agreement in place? If so what is the minimum transfer amount for variation margin, and how frequently is collateral exchanged?

- Environment: Overall economic environment, forecasts, market sentiment, and regulatory requirements at the time.

The Monte Carlo simulation will create thousands of potential future scenarios where each one of these elements has a random (but reasonable) value. Then look at how the overall portfolio value behaves in each scenario.

In some scenarios the firm will be winning the trade. In others the market will move unfavorably, resulting in a loss for the firm.

But with CCR, you only have credit exposure if you are winning the trade. Otherwise, the counterparty has exposure on you. On the risk of you defaulting.

In other words, for an options trade for example, counterparty exposure exists only for the winning (in-the-money) position in the derivative contract, not for the out-of-the-money position.

Only a gain exposes a firm to counterparty default.

This means at the beginning of the derivatives contract, as the market value is zero for both sides of the trade, neither counterparty has credit exposure to the other.

If one counterparty immediately defaults, the other loses nothing. The market hasn’t fluctuated enough yet to determine a winner and loser in the trade.

Here’s how to estimate counterparty credit risk:

Counterparty Credit Risk Calculation

Since counterparty credit risk is not as straightforward as credit risk (because the exposure is uncertain), how do you determine it?

You’ll want to model the Potential Future Exposure (PFE), which is a similar metric to the VaR (Value-at-Risk). Again, the most common way to do this is using a Monte Carlo simulation.

The PFE assumes the counterparty defaults and aims to compute the loss for the surviving firm.

The process goes roughly like this:

- Run thousands of simulations of the price path underlying asset and/or other market parameters that influence the value of the derivative contract, as we’ve seen above. The simulation uses historical performance to anticipate future behavior.

- Based on each of those scenarios, price the derivative and compute the value of the transaction for your side. You will be winning (transaction value is positive) in some paths and losing in others.

- Delete the negative values. PFE is always positive. You don’t care about negative values because they represent how much you owe the counterparty, thus they do not expose you to credit risk. You only care about how much the counterparty owes you in case of default.

- Determine the VaR for a given confidence level (usually 95%). That is, at every future date what are the 5% worst scenarios? Take the average of those values. There’s a 5% probability of losing that value until the expiration date of the derivative.

The PFE is pretty similar to the VaR. The difference?

While VaR is an exposure due to a market loss, PFE is a credit exposure due to a gain. And while the VaR typically considers a short period like one or ten days, the PFE is the VaR at each date until the maturity of the trade.

Why not just use the notional amount of the contract as an indicator of exposure?

You may be confusing notional with the principal amount.

Notional (also called face value) is just a reference value with the sole purpose of calculating payments on a derivatives contract based on the underlying asset or rate. It is not actually traded between the counterparties.

In contrast, for bank loans (credit risk), the principal amount is the initial amount borrowed by the borrower. The actual cash the borrower receives from the lender. And that the lender risks losing.

How to Reduce CRR

The main ways to mitigate CCR are:

#1) Demand Collateral

A bank can reduce the risk it faces in a derivatives trade by demanding collateral for the trade. Collateral is typically cash or securities that can be used to cover potential losses in the case of default.

After taking into account the risk of the collateral losing value in the time needed to sell it (slippage risk), you subtract it from the PFE to get the actual exposure the bank faces.

This way the PFE captures not only the exposure mitigation thanks to collateral, but also the risk of not being able to sell the collateral quickly.

Initial margin is the collateral both parties pay each other upfront when entering into a derivatives contract.

There’s also variation margin, which are collateral exchanges triggered by changes in exposure caused by market fluctuations. The goal of this?

Instead of waiting for the expiration date to move a big sum of money from one institution to another, they pay each other every day along the way, mitigating settlement risk.

See also: Initial Margin vs. Variation Margin for OTC Derivatives

#2) Clear Trades Through Central Counterparty

A Central Counterparty Clearing House (CCP) is a market infrastructure acting as an intermediary between two parties in a transaction to reduce the counterparty risk.

It is composed of a group of big financial institutions, whereas if one fails, the others cover it.

Using a clearing house in derivatives and securities lending transactions mitigates the counterparty risk, as the CCP lies in the middle of the OTC market and keeps track of all transactions, matching buyers to sellers, fixed leg to floating leg.

Thus, the CCP (intermediary) absorbs the counterparty risk and reduces the max PFE/VaR.

Difference between Credit and Counterparty Risk

Counterparty risk is a type of credit risk.

Counterparty credit risk is the risk that the counterparty to a transaction could default before the final settlement of the transaction’s cash flows.

In the context of OTC derivatives trading for instance, if at the time of default the transaction had a positive economic value for you (in other words, you were winning the trade), you will lose money if the entity on the other side of the trade defaults.

The same applies to the firm you’re trading with. If you fail to meet your financial obligations, they risk losing money on the trade.

Thus, with counterparty credit risk there is bilateral risk of loss.

The market value of the transaction can be positive or negative to either counterparty to the trade. It fluctuates over time according to the underlying asset, and there’s no initial cash flow from the bank to the borrower to fund it. Only a promise that at the time of expiration, they will exchange cash flows.

As a result, either party can have trouble paying the other at the settlement date.

On the other hand, credit risk through a loan or bond is unilateral and only the bank (or any other lender) is exposed. Exposed to what?

To the amount it gave the borrower upfront. That’s the risk of loss for the bank. Simple as that.

Credit and counterparty risk are essentially the same thing—the risk of default—but for different credit products.

And the fact they relate to different products completely changes how they’re measured. There are also some differences in terms of regulation.

In essence, credit risk is how likely the counterparty is to default and how likely are you to recover the loan.

And counterparty credit risk is how likely is the counterparty to default and how likely are you to recover the value of the derivative.

In a derivatives trade (counterparty risk) we don’t know what may happen in the future. The exposure fluctuates every day and therefore needs to be simulated. It can become either an asset or a liability for either counterparty.

Meanwhile, in a bank loan (credit risk) the exposure is fixed and known. It is simply the amount agreed upon in the past. And it is an asset for the lender, while a liability for the borrower.

Both loans and derivatives are contractual promises that might be broken, thus exposing the parties involved to a potential loss.

Let’s go through a super quick example to put these concepts in motion:

Credit Risk vs. Counterparty Credit Risk Example

You’re a big asset manager.

You buy a Portuguese government bond, and at the same time you buy a credit default swap from Credit Suisse against the default of Portugal.

You have credit risk on Portugal.

You have counterparty credit risk on Credit Suisse.

Counterparty Risk vs. Credit Risk FAQs

What is the difference between credit risk and counterparty credit risk?

While a loan has credit risk, a derivative has counterparty risk. Counterparty risk is a type of credit risk and is the potential loss resulting from the possibility the counterparty defaults on a derivatives contract. With credit risk, only the lender is exposed to the borrower defaulting, while with counterparty credit risk both counterparties are exposed to each other throughout the life of the trade.

Does credit risk include counterparty risk?

Yes. Credit risk is any type of risk of loss resulting from the default of a party you deal with. Counterparty risk is usually used to refer to the credit risk in derivatives contracts.