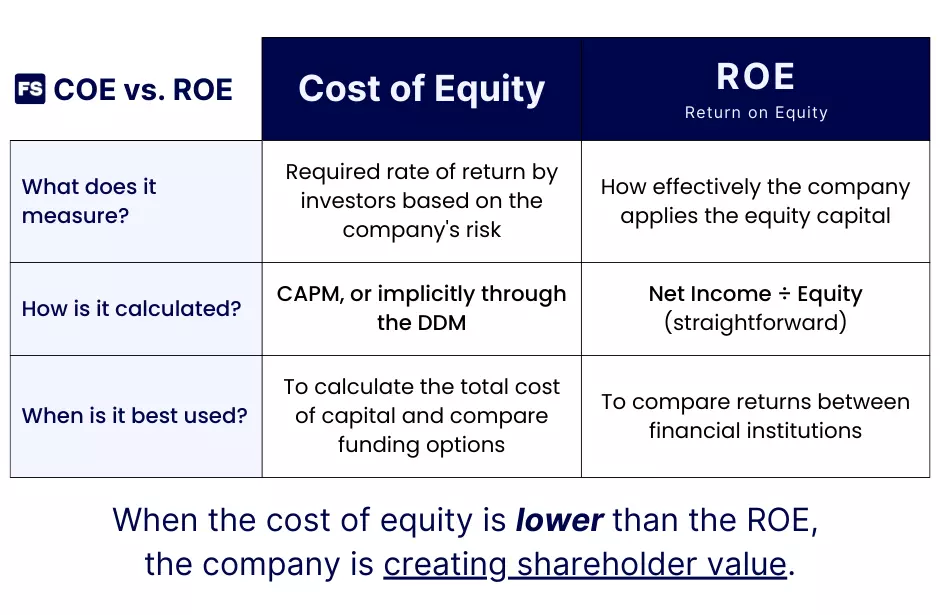

The cost of equity is the return equity investors demand in order to be willing to risk their money in the company. The Return on Equity is the profitability of that money. When the cost of equity is lower than the ROE, the company is creating shareholder value.

That’s the gist of it. For a more comprehensive answer on the difference between ROE and cost of equity, keep reading.

We’ll go through what each metric tells you, how to calculate each, how are they similar, and how are they different.

Ready? Let’s dive in:

What Is Cost of Equity

The cost of equity is the rate of return investors require in order to consider the investment in a company worth the risk.

When investors put their money into a company by buying its shares, they expect to be compensated for the risk of the investment with an attractive return.

If investors deem the return is not enough for the risk of the company due to better investment options in the market, they won’t invest in the company.

As such, this is why the cost of equity is also called the required rate of return.

The cost of equity is one component of a company’s overall cost of capital. What’s the other component? The cost of debt.

The cost of capital is the weighted sum of the cost of debt and the cost of equity (Weighted Average Cost of Capital, or WACC).

The cost of equity is typically higher than the cost of debt because it is riskier for investors.

See also: 4 Reasons Why Equity Is More Expensive Than Debt

Companies can raise funds through debt and equity, and will compare the costs of both when considering strategic maneuvers.

You can also look at the cost of equity from the perspective of the company.

When companies raise equity by selling new shares, they do so to invest in new growth opportunities most times.

Thus, the cost of equity of the newly raised capital is the minimum return the new project must generate to make it worthwhile. To justify executing the project in the first place.

Now, cost of equity is subjective. Different analysts may have different assumptions they find appropriate for a given company or project.

On top of that, there are two ways to calculate the cost of equity:

How to Calculate Cost of Equity Using Dividend Growth Model

The Dividend Discount Model estimates the fair value of a company’s stock based on its current dividend and its expected future dividend growth.

The fundamental idea behind the model is that any asset is worth the expected value of all the future cash flows it’ll generate.

Here’s the dividend model formula:

Where:

- P0 is the stock price today.

- D1 is the dividend the company will pay next year.

- rE is the cost of equity.

- g is the assumed perpetual growth rate for the dividend payments.

If the company you’re evaluating is publicly traded, you can use the current stock price as P0 and find the implied cost of equity:

You can only apply the dividend model to companies that pay dividends. And the more consistent the dividend policy, the better.

The calculation is based on future dividends. Those dividends are net income distributed to shareholders, and therefore the cost of equity.

A stable, well-performing company generally will have a lower cost of equity—and lower cost of capital in general—due to the less risk.

How to Calculate Cost of Equity Using CAPM

The Capital Asset Pricing Model (CAPM) estimates the return on an investment by establishing a linear relationship between return and risk.

The higher the risk, the higher the potential return.

Under the CAPM, the expected return on a stock is equal to the risk-free rate of return plus a risk premium:

Where:

- rf is the risk-free rate of return. This is the return an investment with zero risk has. In reality, it is the yield of bonds issued by the government of an established country such as Germany or the United States, arguably the safest investments you can make.

- β is the (levered) Beta of the company’s stock, a measure of volatility that compares the sensitivity of the stock in relation to the overall market fluctuations.

- E(Rm) is the expected market return.

Thus, the stock’s volatility and level of risk compared to the general market determine the cost of equity.

Unlike the dividend model, you can use the CAPM to estimate investors’ required rate of return for any company, even for private companies.

What Is Return on Equity (ROE)

The Return on Equity (ROE) is a profitability ratio that measures the company’s ability to generate a return for its shareholder’s money.

Here’s how to calculate return on equity:

Where:

- Net Income is revenue left after all the expenses are deducted. So after paying all operating expenses, accounting for depreciation, interest on debt, and taxes to the government.

- Equity Book Value (or shareholder’s equity) is the portion of a company’s assets that shareholders own. It’s the difference between total assets and total liabilities. It’s composed of two major items: paid-in capital—the money shareholders invested in the company, and retained earnings—the profits the company earned and retained over time.

You can easily find the net income and equity value in the balance sheet of the firm you’re analyzing.

Now, how to interpret return on equity?

ROE indicates how effectively a company uses its equity capital to generate profits.

Net income is the money available to distribute to shareholders. (Debt investors receive interest payments only.)

By dividing net income by the investments of stockholders in the company, you get a direct measure of the return on their investment—excluding lenders and debtholders.

Thus, the ROE is a measure of profitability relative to the money from shareholders only, unlike the Return on Invested Capital for example (that considers both equity and debt investors).

The higher the ROE, the more cash the company generates per each dollar of equity. A low ROE on the flip side, may indicate an ineffective use of equity to generate profits, and a need for a change in strategy.

A company can improve its return on equity by reducing its interest costs or allocating capital to projects that will raise profit margins, both of which will improve net income and consequently the ROE metric.

Difference between Return on Equity and Cost of Equity

The difference between the cost of equity and the ROE is that the cost of equity is the minimum required return for shareholders, while the return on equity is the actual return the company generates for them.

The two metrics serve completely different purposes:

ROE evaluates performance, while the cost of equity reflects the risk of investing in a company.

But you can use them in conjunction:

If a firm generates a return on equity higher than its cost of equity, it means the profits it generates exceed the expectations of its shareholders. This is good. It indicates the company is creating value for its investors.

On the flip side, ROE lower than the cost of equity suggests the firm isn’t generating enough returns to meet shareholders’ demands. Why does this happen?

It depends. But it could indicate the company doesn’t use its equity capital efficiently on new opportunities, or is operating in a challenging market and saw a drop in net income.

In this case, investors may find it more attractive to put their money in other opportunities that offer higher returns or that have lower risk, or both.

When Return on Equity Equals Cost of Equity

When a company distributes all of its net income to shareholders in the form of dividends (100% payout), it implicitly signals it has no growth opportunities to invest in.

Going back to the dividend model, this means g is equal to zero and that the implicit cost of equity is:

But no growth opportunities and a 100% payout ratio imply more than that:

It means the net income per share is equal to the dividends per share.

In this case, the company does not retain any earnings to reinvest back into the business or allocate for other purposes. Therefore, the net income of the company is equal to the dividends paid out.

Use the book value per share instead of the market price of the stock, and you have that the cost of equity is exactly the same as the return on equity:

Let’s go through a quick example to put these concepts in motion:

ROE vs. Cost of Equity Example

Consider the following data of a company and the market it operates in:

| Assets | $90M |

| Liabilities | $50M |

| Net Income | $6M |

| Beta | 1.4 |

| Risk-free Rate | 2% |

| Expected Market Return | 8% |

Can you calculate the ROE and the cost of equity?

It should be straightforward:

As you can see, ROE and cost of equity use completely different things in their formulas. However, the value is in comparing both.

In this case, the ROE (15%) being higher than the required rate of return by shareholders (10.4%) indicates the company generates cash flow sufficient enough to compensate for the risk of equity investments.

Return on Equity vs. Cost of Equity FAQs

Is return on equity the same as cost of equity?

No. The return on equity measures the profitability of a company’s equity investments, while the cost of equity is how much those equity investors demand as a return. Comparing both metrics is useful to assess if a company is creating or destroying shareholder value. A ROE higher than the cost of equity suggests the business generates returns sufficient enough to compensate for the risk equity investors undertake.

How do you calculate return on equity from cost of equity?

Return on equity and cost of equity use completely different components in their calculations. You calculate the ROE by dividing the company’s net income by its shareholders’ equity. For the cost of equity, using the CAPM you sum the risk-free rate to the product of the company’s Beta and the market risk premium.

What does cost of equity tell you?

The cost of equity is the required rate of return shareholders expect to receive as compensation for risking their money and investing in a company.