The opposite of risk aversion is risk-seeking behavior. Risk-seeking investors are willing to put up with higher risk for a higher chance of better returns. Risk averse investors on the other hand, prefer a lower risk investment such as government bonds and a savings account.

After reading this post, you’ll understand the different levels of risk aversion, including the type of investor that makes up each level. We’ll also look at an example to connect these concepts to the real world.

Ready? Let’s dive in:

#1) What Is Risk Aversion

Risk aversion is how much a person is willing to put up with uncertain outcomes relative to investing returns.

Why is it important? It helps you quantify the demand for assets, therefore better estimating their price. This is essential for asset pricing and valuing future cash flows that are uncertain.

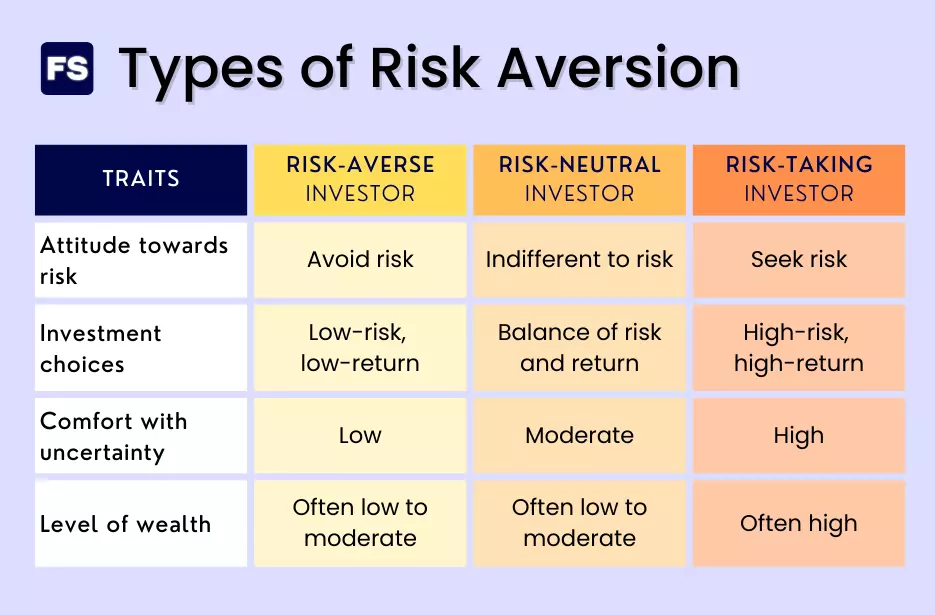

There are different levels of risk aversion. We can distinguish 3 types of investors’ risk aversion:

- Risk-averse: Investors who will avoid a fair bet.

- Risk neutral: Investors who are indifferent to fair bets.

- Risk-tolerant: Investors willing to take fair bets.

What is a fair bet?

It’s a bet (or lottery) for which the expected return is zero. For example, would you pay $1,000 dollars for a 50% chance of winning $2,000? (If you lose you get nothing, so a 50% chance of winning $0 and being $1,000 short in your bank account.)

The expected return is $2,000×50% + 0x50% = $1,000 (which is equal to the initial payment, thus an expected value of $0).

Even though it is a fair game, most people won’t play it due to their loss aversion. The pain of losing $1,000 is higher than the joy of winning $1,000 (prospect theory). Therefore, they won’t take the risk.

A risk-averse investor prefers lower returns with known risks to higher returns with unknown risks. They look for short-term investments with known returns and usually put their money in savings accounts, government bonds, and index funds.

Now, is there a way to quantify risk aversion?

Yes, with utility theory. It studies how different people choose between uncertain options based on the value they expect to get from their choices.

Every person has a different utility function that captures their risk aversion.

Another reason why understanding risk aversion is important is—it helps fund managers design investment portfolios suited for their clientele. Individuals and firms benefit from knowing their own risk tolerance for better risk management.

Many regulators also require the products sold to match the needs of their clients. To comply with this, brokers and financial advisors access investors’ risk profiles (their willingness and ability to take risks).

Investors with an appetite for risk put their money in portfolios with a higher percentage of assets allocated to riskier investments, such as speculating in venture capital, Initial Public Offerings, real estate, and private equity. This is the opposite of risk averse:

#2) Risk-Loving: The Opposite of Risk Aversion

Risk-seeking, risk-loving, risk-taking, thrill-seeking, risk-prone, risk-taker.

These are all synonyms and mean one thing—the opposite of risk averse. A person with a higher tolerance for risk.

This category includes investors willing to go through short-term losses because they believe long-term gains will outweigh those losses.

The biggest predictor of someone’s risk aversion level is initial wealth. Is the investor in question rich?

Rich people are more risk-seeking.

Take the example above for a person who has $2 million dollars in the bank. $1,000 is nothing, so they don’t care. They’ll play the game. This happens due to the decreasing marginal utility of money—as you become richer, the satisfaction you get from getting more money decreases.

But if you ask a person with $5,000 in the bank to gamble $1,000 at a 50% chance of losing and the answer will always be no.

Now, even though people with high net worth have more resources to invest, (allowing them to take higher risks without substantial financial harm), this is not a rule. Most millionaires who started from the bottom are risk-takers.

Rich people can still be risk averse. This is especially true when bets are proportional to initial wealth.

With proportional bets, risk tolerance is similar for everyone, no matter the level of wealth.

For example, instead of $1,000, let’s say the bet is to win 20% of all the money you have or lose 10%. Both scenarios have a 50% chance of materializing.

It’s still a fair lottery, as the expected return is zero.

This is a bet worth $1,000 for the person with $5k, but a $400,000 bet for the person with $2M. Both will likely say no, as they have a Constant Relative Risk Aversion utility function.

#3) Understanding Risk-Neutral Investors

A risk-neutral investor doesn’t have a preference for taking on more or less risk. They’re indifferent to risk.

This type of investor is willing to accept any level of risk, as long as it makes sense.

It’s all about the expected return and the risk-free interest rate, regardless of the risk involved. This means he’s willing to invest in a high-risk high-reward opportunity, as long as it has a bigger expected return than a low-risk opportunity. He’s also willing to invest in a low-risk opportunity if the expected return is higher.

What he’s not willing to do is invest in a high-risk opportunity with a potential return lower than the risk-free rate. No one is.

A risk attitude of neutrality is a theoretical concept. In the real world, it’s difficult to find truly risk-neutral investors, as most people have some level of risk preference across different things. In finance and economics, it’s a useful concept that serves as a benchmark between conservative investors and risk seeking individuals.

#4) Real-Life Example of Different Attitudes Toward Risk

Imagine three friends, Hugo, Sarah, and Michael, who are considering investing in a new technology startup. The startup has the potential to generate high returns, but also has a significant risk of failing completely.

Hugo, who is a risk seeking investor, is excited about the opportunity. He believes the potential returns outweigh the risks and is willing to invest half of his savings into the venture. Hugo is attracted to the high-risk, high-return potential of the startup and is comfortable with the possibility of losing his investment.

Sarah, on the other hand, is a risk averse investor. She won’t invest because of the high potential loss. Sarah prefers to put her money in a safer, lower-return low risk investment, such as a savings account or treasury bonds (as opposed to the stock market). She’s not comfortable with the risk.

Michael, who is a risk-neutral investor, is indifferent to the risk involved. He focuses on maximizing his expected return and is willing to invest in the startup if the expected return is higher than the risk-free rate. After analyzing the startup’s financials and the overall market conditions, he decides to invest a moderate amount of money in the startup.

In summary, Hugo is a risk taker, Sarah is a risk-averse investor, and Michael is a risk-neutral investor. Each of them has a different attitude towards risk and they make their investment decisions accordingly.

Frequently Asked Questions (FAQs)

What are the types of risk-takers?

There are 3 types of risk taking: risk seeking, risk-neutral, and a risk averse person. These determine the willingness to invest in projects with the potential for a higher return, but that also have high uncertainty or potential loss. In general, a risk tolerant investor will carry on challenges and pursue opportunities with high potential gains, even in the face of failure.

What are the disadvantages of being risk averse?

Excessive risk aversion leads to stagnation. Risk averse investors avoid opportunities for growth because of their unwillingness to take risks. The problem? No risk, no reward. They limit their portfolios, resulting in fewer options for advancement and financial gain. With that said, risk aversion is a natural human tendency and it is not always bad. As moderate risk investors will tell you, balance is everything.

How to determine risk tolerance?

Financial advisors examine the investment goals, time horizon, and risk appetite of their clients through interviews and questionnaires, reviews of investment history, and assessments. All the factors affecting risk tolerance will determine the right investment strategy for a person.

I needs to spend some time learning much more or understanding more.