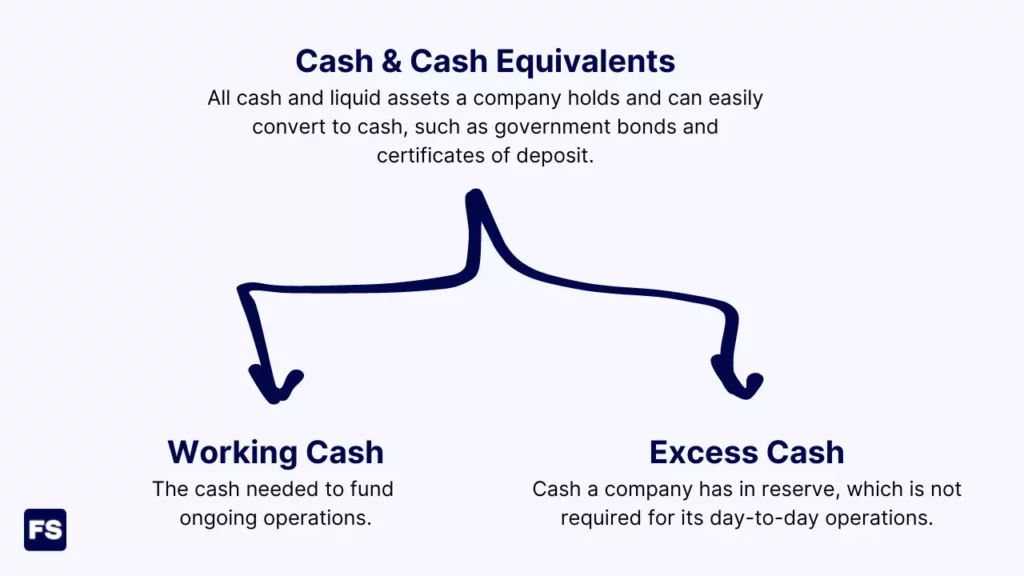

Working cash is the cash balance a company has on hand to cover its day-to-day expenses and cash needs. In contrast, excess cash and marketable securities are non-operating assets the company does not employ in its business (having or not having these assets won’t impact the future performance of the company). Working cash is how much cash is essential to run the business—hence, it is considered a current operating asset.

That’s the gist of it.

For a more comprehensive explanation of what is working cash and how it impacts business valuation, keep reading.

By the end of this post, you’ll be able to make more informed assumptions about how to treat the cash balance of a firm when estimating its value and performance.

Ready? Let’s dive in:

Working Cash Definition

Working cash is the amount of cash a business has on hand to spend on its day-to-day operations, such as paying bills, purchasing inventory, and meeting payroll obligations.

This cash is usually kept in the company’s bank account, and is separate from cash that is set aside for long-term investments or other cash outflow purposes.

Having sufficient working cash is essential for the smooth functioning of a business, as it allows the company to meet its short-term obligations and take advantage of opportunities as they arise.

Some businesses take a while to convert cash into inventory into revenue and back into cash again. For them, a higher percentage of cash on hand is appropriate.

On the other hand, companies that turn cash into inventory into revenue back into cash quicker need less working cash to operate.

In these cases, if you’re trying to evaluate the operations of the business, you should exclude any cash beyond a small percentage of revenue, as it is a non-operating asset.

How much should that percentage be though?

How Much Cash Is Working Cash

In order to assess how much cash is necessary you need to first understand why businesses hold cash.

All businesses need some liquidity in the form of cash to conduct their daily operations. This number is generally a small percentage of revenues. And it varies from industry to industry.

For example, restaurants keep a small amount of cash on hand (compared to their total revenue) because they operate in a cash business.

They turn their inventory into cash immediately when the customer makes their purchase. On the flip side, they can negotiate with the suppliers of the inventory to pay later. The result? A negative cash conversion cycle.

Large manufacturing companies on the other hand, take much longer to turn a pile of aluminum or a bunch of electronic equipment into an actual cash inflow. Why? Because it’s common to give out credit to customers.

As a result, these types of companies need to keep a significant amount of cash on hand to cover the necessary expenses in the normal course of a business cycle.

The maturity of the business also plays an important role in determining what is working cash:

A startup or small business requires more cash on hand to cover operating expense and buy equipment—as it is still building its customer base, refining revenue streams, and developing the business overall.

It’s also crucial to have cash available, especially in the early stage, in order to tackle new investment opportunities as soon as possible, and to adapt to changing market conditions.

As the business grows and becomes more established, the percentage of cash that is crucial to day-to-day needs decreases. Why? Because the business generates more consistent revenue thanks to a stable customer base and it also likely built up reserves or access to credit.

Nonetheless, the company will still invest in ongoing operations, such as hiring and training employees, upgrading equipment, and maintaining their facilities.

Overall, what’s considered working cash depends on a variety of factors, including revenues, expenses, cash conversion cycle, maturity level, growth trajectory, and access to credit.

With that said:

According to Morgan Stanley, once a company reaches a mature state, a rule of thumb suggests you should consider about 2% of revenue as the necessary (working) cash.

For younger and less predictable companies with greater growth prospects but more risk (such as small tech startups), a ratio of cash to revenue up to 5% may be appropriate.

Now, why is it important to differentiate between working cash and excess cash?

Impact of Working Cash on Corporate Valuation

Let’s look at how the way you treat the cash balance of a company affects its valuation and financial metrics:

The ROIC (Return on Invested Capital) is calculated by dividing NOPLAT by the Invested Capital. What’s the Invested Capital? The Book value of equity + Financial debt – Non-operating assets.

If you include cash in non-operating assets, it should be only excess cash.

Another way to calculate the Invested Capital is to subtract Non-interest-bearing current liabilities from Current operating assets. Thus, the percentage of revenue you pick as the working cash (a current operating asset) will impact the ROIC.

Overall, depending on the speed at which the company can turn inventory into a cash receipt (its cash conversion cycle), the Invested Capital should include only the cash balance the business needs to cover day-to-day cash flow needs.

Similarly, the EVA (Economic Value Added) also uses Invested Capital to measure a company’s financial performance and its true economic profit—and thus your working cash assumptions will impact it.

Considering the entire cash and cash equivalents balance as either a non-operating or operating asset is a mistake:

- If you consider all cash a non-operating asset, the Invested Capital value is smaller than it should be. And the ROIC will erroneously tell you the company is being able to generate more returns with less money invested.

- If you consider all cash an operating asset, the Invested Capital is likely bigger than its true value.

Take Walmart as an example.

If you assume the company needs working cash of 2% of the 2022 $573B revenue, or $11 billion—as opposed to considering the entire balance sheet cash and cash equivalents value of $15 billion as an operating asset—you’ll see significant differences in ROIC and Invested Capital.

Another valuation metric impacted by working cash is the Enterprise Value (EV), which is calculated like this: Market Capitalization + Total Debt – Cash and cash equivalents.

You can look at EV as the effective cost of buying a company. Cash is added back because it reduces the acquisition cost of the target company.

But do you think it’s a good idea to drain the cash reserves to zero and leave nothing for day-to-day operations? Probably not.

Hence, keeping the working cash and removing only the excess cash is ideal.

Lastly, working capital.

Some analysts calculate it using the bottom line current assets and current liabilities. Others prefer to focus solely on operating items (accounts receivable, accounts payable, and inventory), so they exclude non-operating assets—such as excess cash, and non-operating liabilities—such as bank debt.

Usually, when you evaluate a company, you’ll want to focus on its operational activities. As such, because not all cash and cash equivalents are essential to business operations, you should make adjustments to improve accuracy.

Key Takeaways (FAQs)

What is working cash?

Working cash is the money a business needs in order to run its daily operations. For most companies, the cash and cash equivalents value presented in the financial statements includes excess cash—money and securities that have nothing to do with how the business generates positive cash flow. It’s underlying activity. Working cash on the other hand, is the minimum amount the business needs to function smoothly.

How do you calculate working cash?

If you’re evaluating a company as an analyst or outside investor, you’ll likely need to make an assumption on the percentage of revenue the company needs to run its daily operations. You can use 2% of revenues as rule of thumb for the working cash, but may adjust it according to the maturity of the company, its cash conversion cycle, and the industry it operates in.

What is the difference between working capital and working cash?

Working cash is the portion of the total cash a company has that it needs so that it can cover its short-term expenses. Net working capital on the other hand, is the difference between a company’s current assets and current liabilities, and it measures, not only its ability to face short-term obligations, but also its negotiating power in terms of payment terms with clients and suppliers.