The difference between the VIX and the VXX is that the VXX is an ETN (exchange-traded note) that tracks the performance of a basket of VIX futures contracts. On the other hand, the VIX index is a theoretical construct that reflects the market’s expectations of future volatility and cannot be bought or sold directly.

That’s the gist of it. For a more comprehensive explanation of the difference between the VIX and VXX, keep reading:

What is the VIX Index

The CBOE Volatility Index (VIX) is a measure of how much the stock market is expected to move up and down in the future. Market participants often call it the “fear index” because it goes up when investors are worried about the stock market.

As such, the index often moves in the opposite direction of stocks.

The Chicago Board Options Exchange (CBOE) is responsible for calculating the VIX. How do they do it?

They use a complex formula to analyze the price of options on the S&P 500 (SPX) and draw conclusions about the expectations of the stock market as a whole. The S&P 500 is a collection of 500 large, publicly traded companies.

Basically, if a lot of traders are buying far OTM options (calls or puts), the price of those options will rise because of the increased demand and trading activity. As a result, the VIX index increases as well.

Conversely, it can also be that those who are selling the options want to receive a high premium for the risk that the market could go there. They believe the market can make a big enough move up or down (volatility) in the near future. If the options they sell expire ITM, they take the loss. Thus, they charge higher premiums to accommodate the risk.

The VIX index is just a number. The higher the number, the higher levels of expected future volatility.

You can’t buy or sell the VIX index directly. Instead, you can use it to estimate how much the stock market will move, and to make decisions about your trading portfolio.

To add exposure to changes in market volatility to your portfolio you can use derivatives like VIX options, or futures:

VIX Futures

When people talk about going long or shorting the VIX, what they usually mean is they’re going long or short on VIX futures.

VIX futures are financial instruments you can use to hedge against, or speculate on, future changes in stock market volatility. The underlying asset they track is the VIX index, which we’ve discussed above.

These contracts are priced with complex mathematical models that analyze the prices of SPX options to estimate the market consensus for the VIX index at different future dates. This is what determines price fluctuations for these futures.

You can buy and sell VIX futures, just like any other financial instrument, on an exchange. Unlike the VIX index itself.

VIX futures contracts are cash-settled and have a multiplier of $1,000. This means with their minimum tick size of 0.05, every tick up or down on one contract is worth $50.

A futures contract can be expensive, especially for small investors. This is why a lot of people prefer trading the VXX:

What is the VXX

The iPath Series B S&P 500 VIX Short-Term Futures (VXX) is an exchange-traded note that tracks price fluctuations on the VIX index.

It is another way to access stock market volatility—an asset class that, as we’ve seen, is interesting (mainly for hedging purposes) because of its negative correlation to stocks. A VIX ETF is similar.

The VXX is not equivalent to a spot investment in the VIX. Instead, it is linked to a group of VIX futures. The result?

The performance of this ETN will often vary from a hypothetical investment in the VIX index (which isn’t possible to set up). But as of now, this is considered the closest financial engineers were able to get to.

You should never hold the VXX in your portfolio as a buy-and-hold long-term investment. Instead, this is intended for a day trader or investor making short-term bets, or as a hedging tool.

On a basic level, the VXX is comprised of a daily rolling long position in the first and second-month VIX futures contracts. However, owning this ETN does not mean you own the futures contracts that determine its price, nor any other security liked to its performance.

You can also trade VXX options. This further improves the choices you have when it comes to betting on changes in market sentiment and volatility. Option trading offers plenty of options, especially when using spreads.

Difference between VXX and VIX

If you’ve read through the whole article, by now the difference should be easy to understand. We can boil it down to a couple of bullet points:

- The VXX is an ETN that tracks short-term VIX futures prices. It allows you to bet on the future level of volatility in the stock market.

- The VIX is a measure of implied volatility in the stock market. The CBOE uses the prices of options on the S&P 500 index to calculate it.

- Consequently, the short-term VIX futures that price the VXX are calculated based on the VIX index.

- The VXX provides investors exposure to the VIX, but it is not a direct investment in the VIX itself.

- Instead, it tracks the performance of a basket of VIX future contracts, which are financial instruments that allow investors to speculate on the future direction of the VIX.

- Another important difference between the VXX and the VIX is that the VXX is a marketable security that you can buy and sell on an exchange, while the VIX is a theoretical construct you cannot trade directly.

- The VXX is exposed to futures market risks, mainly the risk of loss from fluctuations in the value of the underlying short term futures contracts. On the other hand, the VIX does not face any risks because it is not tradeable—it only indicates market predictions for future volatility.

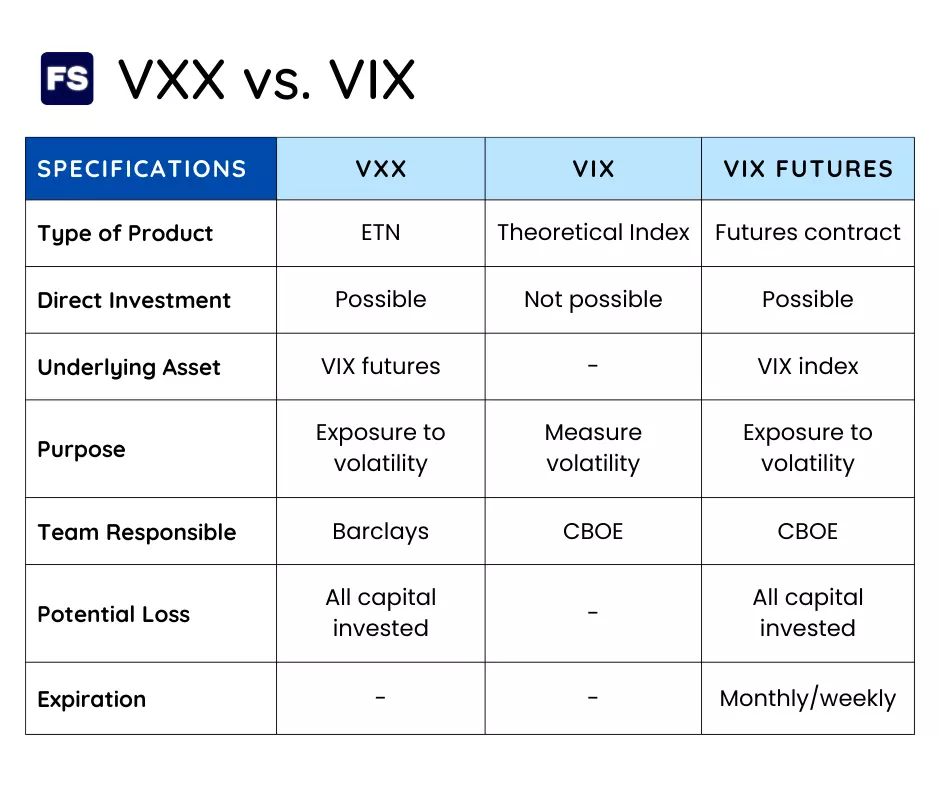

This table should help too:

VXX vs VIX Frequently Asked Questions (FAQs)

Is VXX the same as VIX?

No. The CBOE Volatility Index (VIX) is a measure of the expected market volatility for the near future. You cannot long or short the VIX itself. To do that, you can use the VXX, which is an exchange-traded note that follows the price of the VIX index (although it is not a perfect proxy).

What is the relationship between VIX and VXX?

VIX futures use the VIX index as the underlying asset of the contracts. In turn, the VXX uses short-term VIX futures to offer investors exposure to market volatility. The VXX ETN depends on the VIX, while the VIX does not depend on the VXX.

Why is VXX lower than VIX?

VXX’s goal is to follow fluctuations in the VIX as closely as possible, but it is not a perfect tracker and deviates from the VIX because it tracks VIX futures, not the index itself. Also, the VXX is an ETN. These are unsecured debt obligations for which the issuer doesn’t need to hold any assets as collateral. Lastly, ETNs are often structured with fees that reduce their value over time.

Does VXX go up with volatility?

Yes. When there’s a spike in market volatility, the VIX index, and consequently, the short-term VIX futures contracts, will also see an increase in their value. These future contracts are the underlying asset for the VXX. As a result, the VXX will also go up.