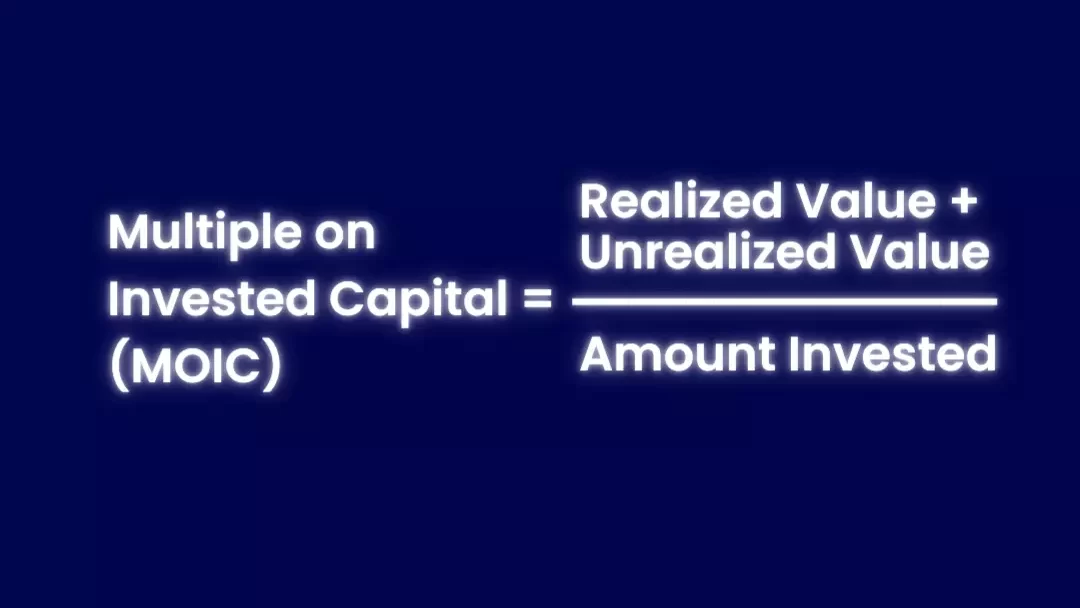

Multiple on Invested Capital (MOIC) is a return metric commonly used in private equity to track fund performance. It is calculated by dividing realized value and unrealized value by the amount invested.

Still confused? Keep reading.

We’ll start by diving deep into the MOIC meaning, and then how to calculate it.

MOIC Definition

After all, what is MOIC?

MOIC stands for Multiple on Invested Capital, and it is a way of measuring how much money you made from an investment relative to how much you initially put in.

It is mainly used by institutional investors in private equity and investment banking to follow funds’ investment performances and compare them across different firms.

A higher MOIC indicates a better return on investment.

Unlike the Internal Rate of Return (IRR), MOIC does not measure the profitability of an investment over time. It does not take into account the time value of money.

Instead, it is a measure of how much return an investment generates for every dollar invested, but does not consider the value of the investment at any point in time other than the specific valuation date.

Also, as an investor, you must know if you’re looking at a gross MOIC or net MOIC to make sure you’re making the proper comparisons, similar to how there’s a gross IRR and net IRR.

Net MOIC deducts fees, while gross MOIC doesn’t reflect the deduction of such fund expenses.

MOIC in Private Equity Investing

MOIC is straightforward in investments such as stocks. If you buy 10 shares of Apple for $1,500 and sell them 3 years later for $3,000, the MOIC for your investment is 2x.

In private equity investments and venture capital however, things get a little more complicated:

You need to recognize investments’ unrealized values (values of investments that are still active), as well as realized values (equity stakes and shares sold already).

This can be hard, as unrealized gains are just estimates and can fluctuate depending on market conditions. They aren’t guaranteed and can decrease in value or disappear if things change.

This can be applied, not only to single assets, but also to an entire portfolio of companies in a private fund (as is usual with the Total Value to Paid-In Capital).

MOIC Formula

Calculating the multiple on invested capital is fairly simple:

Where:

- Realized value: The total value of investments that are already sold, at the time of the exit transaction. In other words, how much did the firm sell its stake for?

- Unrealized value: How does the market currently value the investments the firm is yet to sell? This is an estimate and it can fluctuate depending on the market conditions.

- Amount invested: Total amount invested in the fund. Also called committed capital.

MOIC is typically expressed as a number with one decimal followed by x to indicate it is a multiple of the initial investment. A typical MOIC might be 1.8x or 2.5x.

Let’s look at an example:

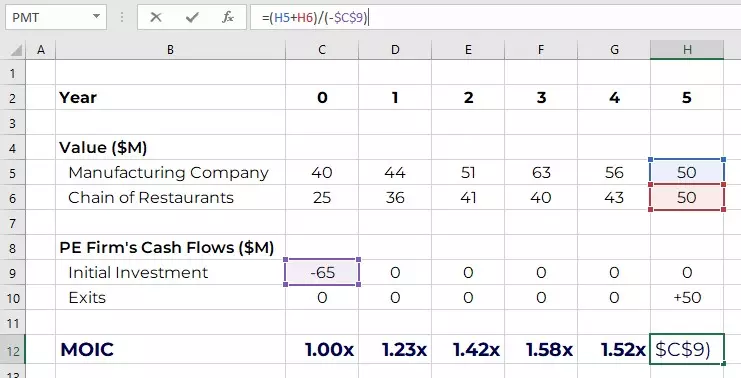

Imagine a private equity firm invested $40 million in an upcoming manufacturing company, and another $25 million in a chain of restaurants. 5 years later, the firm’s stakes are worth $50 million each. The PE fund decides it will exit from the manufacturing company and keep its stake in the chain of restaurants.

What is the MOIC?

It will have a realized value of $50M in the manufacturing company, and an unrealized value of $50M in the restaurants, totaling $100 million.

The amount invested originally was $40M + $25M = $65M.

Therefore the Multiple on Invested Capital is $100M/$65M = 1.54x. This means that for every dollar invested, the firm got roughly a dollar and fifty cents back. Or a 54% return.

MOIC Calculation in Excel

There is no special formula in Excel to compute MOIC, as the calculation is simple (example from above):

The initial investment is a negative cash flow, but we add a minus sign to the MOIC formula to ignore that.

Notice how the value of the companies varies every year, going both up and down. This is due to market conditions and investor sentiment. If the firm decided to sell the businesses at that time, that’s what he would receive for them.

As a result, the MOIC also varies every year throughout the investment horizon.

We can also say it is the unrealized value at the time. Once the firm decides to exit, it locks it in as the realized value, and a cash inflow is recorded.

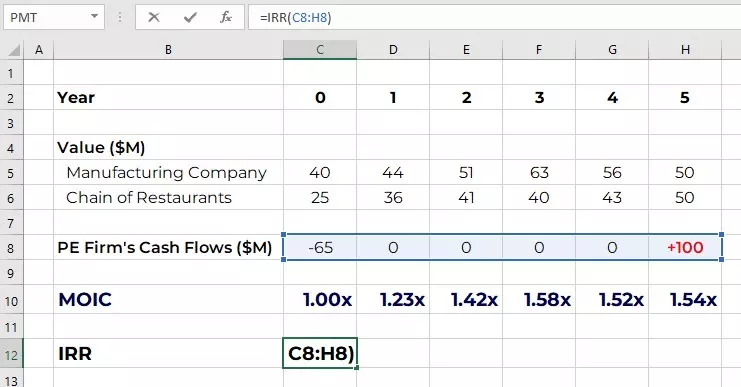

How to Calculate MOIC From IRR

Now, how do you calculate MOIC off of IRR?

You can’t. The MOIC and the IRR are calculated differently and provide different information.

The Internal Rate of Return only looks at actual cash flows and realized value. This means you can only calculate it when there’s an exit that generates a cash inflow.

The MOIC on the other hand, accounts for unrealized value as well.

The example above has an IRR of 9.0%:

You need to make an adjustment for this to make sense though—assume the firm is exiting both businesses. That’s why there’s a cash inflow of +100 in year 5 in the image above, even though only the manufacturing was sold.

Also, don’t forget the zero in years where there’s no cash flow. Otherwise, the IRR formula will give you a wrong result.

Notice how the MOIC stays exactly the same. Why does this happen? Because it accounts for both unrealized and realized value. It doesn’t account for cash flows only (realized value), as opposed to the IRR.

If you want to avoid misleading results, it’s important to use both these metrics to measure investment performance.

Frequently Asked Questions (FAQs)

How do you calculate MOIC in Excel?

Like you would with a calculator, as there’s no formula specifically for the Multiple on Invested Capital (MOIC). Simply divide the realized and unrealized value of an investment by the initial dollar amount invested.

Is MOIC the same as equity multiple?

Yes. MOIC (Multiple on Invested Capital) and Equity Multiple are used interchangeably in the private equity industry. They measure the same thing—the total value of all investments in the fund (both realized and unrealized) divided by the initial investment.

What is the difference between IRR and MOIC?

They’re both return metrics, but give you different information. Multiple on Invested Capital (MOIC) is when you take the amount of money your investments are worth and divide it by the amount of money you originally invested. Internal Rate of Return (IRR) on the other hand, is the discount rate (%) that makes the Net Present Value (NPV) of an investment equal to zero. Thus, it takes into account the time value of money. MOIC doesn’t.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.