Yes, you can short the VIX. There are a couple of ways to do it, namely: You can short VIX futures, you can buy put options on these futures, or you can short VIX ETFs (or buy VIX inverse ETFs). However, keep in mind that the VIX is a highly volatile index, so shorting it is a risky bet. It’s important to carefully research and understand the risks of your investment decisions.

Start your research with this article. We’ll go over the 4 things you need to know before shorting the VIX:

- What is the VIX and how it impacts your investments.

- Three ways to short it.

- Risks of betting against market volatility.

- How the VIX typically moves.

Ready? Let’s dive in:

Understanding the VIX Index

The CBOE Volatility Index (VIX) is a key index that tells you the expectation for the volatility of the stock market (S&P 500) in the next 30 days.

The VIX is calculated using a variety of factors, including prices of options on the S&P 500 index (SPX). It is expressed as an annualized percentage.

Those options measure implied volatility. By aggregating weighted prices of SPX options (both calls and puts) over a wide range of strike prices, we get a measure of the expected volatility for the future.

The VIX has an inverse relationship with the overall stock market. This means that as stocks go up, everyone is chilling, and analysts are bullish, the VIX goes down and stays stable.

But when the expected volatility increases due to market turbulence, the VIX goes up.

Shorting the VIX means you believe nothing major will happen in the market. Nothing that will bring a lot of uncertainty. Everything will remain stable. To place that bet, you have 3 options.

The VIX index, or any other form of gauge for market volatility are not things you can trade. Therefore, you can’t short them directly. If you’re interested in volatility trading, you must use derivatives:

Shorting the VIX with Futures

A futures contract written on the VIX index is a contract celebrated between two counterparties that meet through an exchange, whereby:

- The long position agrees to pay the fixed price in the futures contract at expiration.

- The short position agrees to pay the price of the VIX at the time the contract expires.

- There is no initial cash flow today, so the value of the futures contract is zero at the beginning of the contract.

VIX futures reflect the expectations the market has for the value of the VIX Index on various expiration dates in the future. They allow you to implement a variety of strategies, such as hedging a market downfall and overall diversification.

Since volatility is not something you can buy in itself, like a stock or bond, VIX futures are cash-settled. This means that, at expiration, the winning position receives a cash flow from the losing position. How much will that cash flow be?

It is the difference between the agreed-upon (fixed) price and the current market quote of the VIX index.

This is different than, for example, futures on oil, where if you hold the contract through expiration you have to deliver/receive actual barrels of oil. And deal with the costs and logistics of physical delivery.

Contract expirations include every month of the year, along with weekly contracts for the front month. But the most traded are the monthly contracts.

Lastly, VIX futures contracts have a multiplier of $1,000. This means the value of one contract is calculated by multiplying the quote of the future you’re looking to trade by 1000. The futures trade in increments of 0.05 or ($50 per tick).

Shorting the VIX with Options

Along with VIX futures, VIX options allow you to trade volatility independent of the direction of stock prices.

Whether you think the market will shoot up, tank, or chill somewhere in the middle, these derivatives give you the ability to diversify a portfolio as well as hedge, mitigate or capitalize on broad market volatility to increase your total return.

VIX options are some of the most traded options contracts in the market.

So, how to short the VIX with options? You can implement a number of bearish strategies with options contracts. The most simple is going long on a put. But you can also do a variety of spreads with different option prices.

VIX options contracts are also cash-settled. The multiplier is $100, and contract expirations range from weekly to monthly.

Shorting the VIX with ETFs & ETNs

Trading volatility is an interesting idea, but the current exchange-traded funds (ETFs) available do a poor job of being proxies for the spot price of the VIX. Nonetheless, volatility ETFs and ETNs (exchange-traded notes) are another way to get exposure to movements in market volatility.

The most active volatility product of this type as of 2022 is the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX). A lot of people confuse the VXX with the VIX itself.

If you believe market volatility will fall, you can short this ETN. Although many argue you should never do this due to the risks.

Inverse VIX ETFs are another way to bet on a contraction of future volatility.

Again, there are a number of options to choose from, but the most active nowadays is the ProShares Short VIX Short-Term Futures ETF (SVXY).

In this case, if you believe stock market volatility will decrease, you go long on this VIX ETF, because it tracks the inverse performance of the index.

Now, it’s important that you know the risks of shorting volatility:

Risks of Shorting the VIX

Holding a short position in the VIX is disastrous in the event of a market crash or decline, especially with leveraged exposure.

For example, in March 2020, the VIX spiked to its highest level in history due to the Covid-19 pandemic and the resulting market volatility. Everyone was anxious about the economic impact of the pandemic, and that was reflected in the fear index.

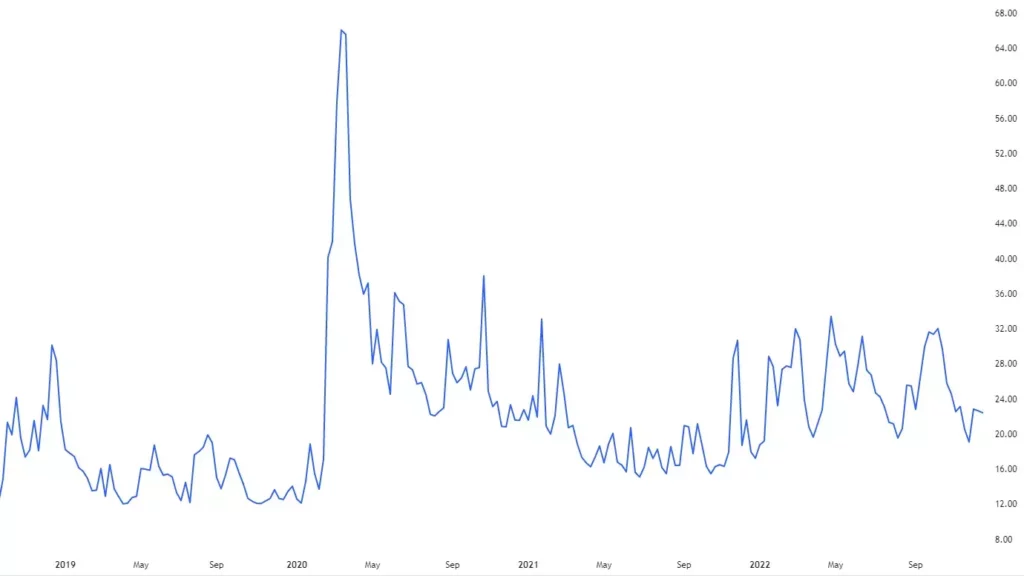

Look at this spike:

Market participants who were short volatility were caught. Badly. The VIX shot up due to the increased uncertainty and fear in the market.

The potential losses for short selling, as with every financial instrument, are in theory unlimited.

This is because when you’re long, the worst-case scenario is the asset goes to zero. You lose everything you invested. But with short selling? There’s no limit to how high the price of an asset can go, so you can easily lose more than what you invested.

With that in mind, the VIX Index moves in a distinct way from regular old stocks and bonds:

How the VIX Index Moves

The VIX is mean reverting.

This means over time, it will return to its historical average. Volatility cannot move higher in perpetuity. It also cannot drop to zero. This is different from stocks, as these tend to rise over the long term, and can go to zero.

If the VIX is low, it’s because nothing is happening, and nothing can continue to happen for a very long time.

However, if the VIX spikes, something dramatic happened, and you can normally bet that something dramatic isn’t going to continue happening. So, it’s a decent bet that it’s going to go back down again.

Shorting volatility when it is high sounds like a good idea, right? Well, not quite:

How do you time it? In financial markets, the wrong timing (even if you guess the direction correctly) is the same or worse than betting in the wrong direction. The best traders and investors know this.

Picking the peaks accurately is difficult. This is why shorting the VIX is so risky.

The VIX can continue to go up indefinitely.

Even though it doesn’t move in one direction over long periods of time, like the stock market over the last decades, it moves faster. Meaning, you can lose a lot, quick. Wiping out any small gains you might’ve made shorting the VIX in tranquil times.

When the VIX rises, it’s hard to tell if it’s a short-lived spike in volatility, or a long-term shift in investor sentiment toward fear.

It’s also important to understand the term structure of VIX futures:

Term Structure

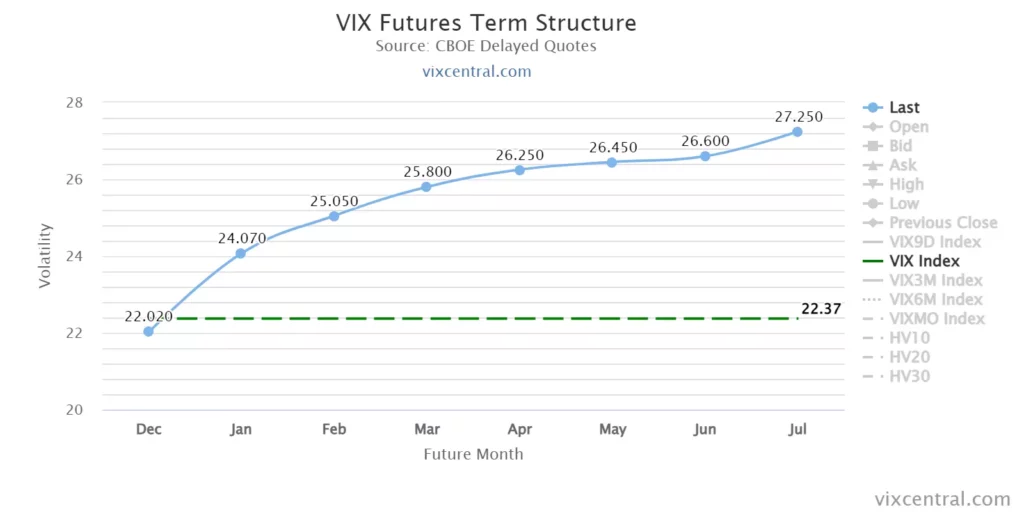

The VIX term structure is the relationship between the prices of monthly VIX futures contracts with different expiration dates.

When the prices of the further-expiration futures are higher than those of the nearer expiration, the VIX term structure is in what’s called contango.

When the prices of the further-expiration futures are lower than those of the near-term expiration that’s called backwardation. Backwardation is rare.

What does this mean for you?

If you short a contract and hold it, its value will decline in comparison to contracts with a later expiration date. Thus, shorting a VIX futures contract results in a profit as long as it doesn’t spike, but instead stays the same or declines.

Back in late 2008, when the VIX spiked higher as well, VIX futures were in backwardation. This means market participants believed there was going to be less volatility in the coming months.

Contango is the norm in times of market tranquility, when nothing is happening.

Backwardation means volatility is high, causing a disparity between VIX futures and the spot VIX index price. Either the VIX starts to settle down, or, if market fear stays high, the price of the futures has to rise to meet it. If the jump in volatility is expected to be short-lived, VIX futures won’t go up that much.

VIX Frequently Asked Questions (FAQs)

What is the best way to short the VIX?

It depends on your personal preferences, appetite for risk, what you’re most comfortable using, and what financial instruments are available to you. Most people have 3 choices: Short VIX futures, open a long put or bearish spread position on VIX options, or use regular/inverse ETFs/ETNs that track the VIX index.

Is shorting the VIX a good strategy?

It can be, but most times no. Although the VIX has a tendency to revert back to low levels after a spike, it is difficult to get the timing right when it comes to entering the short position. The way the VIX moves is very different from stocks, so extra research is needed before implementing trading strategies.

Can I hedge with VIX?

Yes. You can do so using VIX futures, options, or ETFs. For example, if you’re concerned about increased volatility in the stock market for the coming months, you can go long on VIX futures contracts to hedge your portfolio. You’re betting that the value of the VIX will rise, which will offset any losses from a decline in the value of your stock portfolio due to increased volatility.