If you, as a shareholder, choose to do nothing or not subscribe to a rights issue, the company sells them in the market, and you receive the net proceeds. Your existing shareholdings will be worth less money (at least in the immediate short term after the issue), and your equity ownership will be diluted due to the new shares the company sells.

In case shareholders overall don’t show enough interest in the rights issue, companies usually work with underwriters to secure the funding they need.

Still confused? Want a more comprehensive overview of how rights issues work? Keep reading:

What Is A Rights Issue

A rights issue is an invitation to existing shareholders to purchase additional new shares in the company at a discounted price for a set time period.

The number of shares each investor can purchase is in proportion to the amount of stock they already own.

Investors describe rights issues in reference to how many new shares can be bought for a number of existing shares owned.

For example, a 1-for-2 rights offering allows an existing shareholder with 10 shares to buy 5 additional shares in the company. And to do so at a discount from the current stock price.

A rights issue increases the number of shares circulating in the stock market, leading to a dilution of the value of each share.

The purpose of a rights issue is to raise additional share capital while giving existing shareholders the opportunity to maintain their level of ownership in the company.

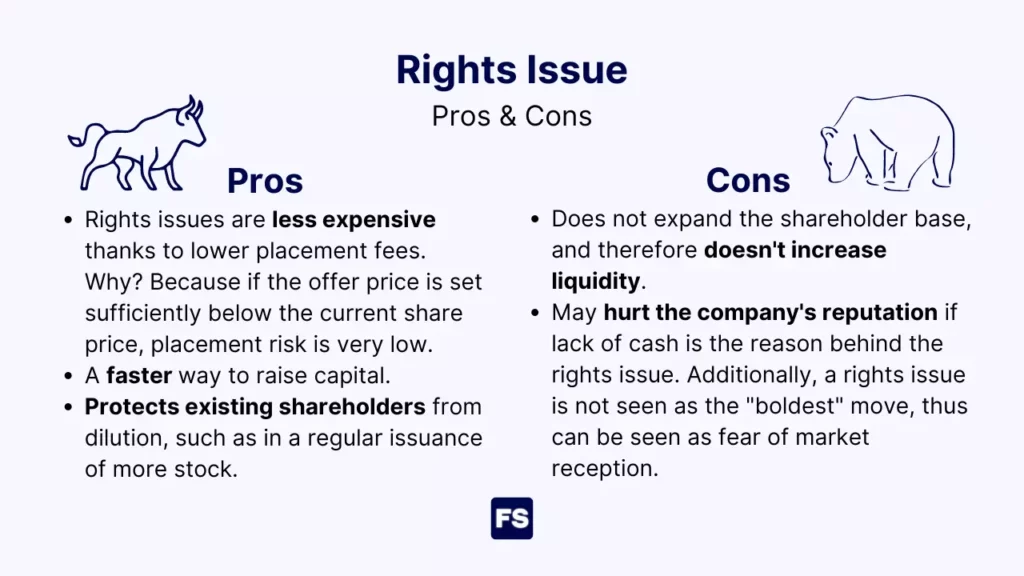

Here are the advantages and disadvantages of a rights issue:

You can find out about upcoming rights issues on stock exchange websites, through company announcements, on financial news websites, with your stockbroker, or through regulatory fillings.

Understanding Rights Issues

Firms typically finance their growth with the vast funds they receive in an IPO, and retained earnings from there on. But sometimes these funds are not enough for the firm.

Thus, companies will issue rights when they need to raise capital quickly or have limited access to other sources of funding.

It’s common for heavily leveraged businesses already trading in the secondary market to use a rights issue to pay down their debt obligations. They prefer this because raising money with existing shareholders can be easier than attracting outside investors.

Here’s why:

As a publicly quoted company already, they can raise equity by selling new shares to outside investors (a Secondary Public Offering, or SPO). The potential problems?

Firstly, it’s difficult to raise substantial amounts of funds at the current stock price. Why? Because the sudden increase in supply for any asset will drive its price down, even if only temporarily. So, the more money the company tries to raise, the bigger the impact on the stock price.

Secondly, companies can’t issue these new shares at a price higher than the existing share price, because a rational new investor will simply buy existing shares directly in the market for cheaper instead of the more expensive new ones from the company.

Thirdly, making the new issue at a price lower than the current market price would hurt existing shareholders.

The solution?

A rights issue.

This gives existing shareholders rights to buy new discounted shares in proportion to their existing shareholdings. No new shareholders participate.

The share price immediately after the rights issue will fall.

This is because the price reflects the weighted average of the original share price and the rights offer subscription price, meaning the discount in the rights offer is spread over all the shares.

After that initial period, the market as a whole will price their long-term expectations for the business based on what the company intends to do with the newly raised equity:

- If investors believe the new money will fund projects that will increase the cash flows of the company, the share price will likely increase.

- If the proposed investment looks financially unattractive to investors, the share price may fall to reflect this.

Basically, the information from the announcement will be incorporated into the share price based on market sentiment.

Now, a rights issue is optional (unless it’s a non-renounceable rights issue). Stockholders have the right but not the obligation to subscribe.

What happens if the rights issue is not subscribed?

What Happens If Rights Issue Is Not Subscribed

Existing shareholders are never hurt in a rights issue, at least in the short term.

As an investor, if you decide to subscribe to the issue, each of your shares will be worth less, but you’ll have more shares.

If you decide not to participate, the rights entitlement has intrinsic value and will be sold. You receive the money from the sale.

Both decisions leave you economically in the same position (in theory).

It makes no difference how big the discount on a rights issue is either. A bigger discount means the shares will be worth less, but at the same time the right is worth more.

However, a narrow discount increases the risk of the company not receiving its desired new funding. Why?

Because the rights issue is available for a specified period of time, so that eligible shareholders decide what to do (usually around three weeks). During this subscription period, the share price will fluctuate:

If the share price rises, the value of the rights offer increases and the rights become more attractive to investors. However, if the share price falls the opposite is true.

If the share price goes below the subscription price, no one will want to buy the new shares. The right is worthless, just like an option expiring out-of-the-money.

Overall, before deciding to trade or exercise a right, investors should research how the company will use the new capital and consider if their added investment will grow over the long run.

An unexpected fall in the share price could mean a failed rights issue—and the firm not receiving its desired injection of new equity funding, right?

What happens to the company if existing shareholders have no interest in its rights issue?

This could leave the company unable to implement its new strategy. So, it needs an insurance policy—underwriting.

The company can remove the risk of funding failure by underwriting the rights issue through an investment bank, which agrees to take up—at the issue price—any of the new shares investors don’t buy.

This transfers the risk of any stock price drop to the underwriters. They will likely only have to buy the shares if the stock price sits above the exercise price at the end of the rights offer period.

The company pays an underwriting premium for what is effectively a put option, exercisable at the rights offer price.

Let’s go through a quick example to put these concepts in motion:

Rights Issue Example

Imagine a company that wants to raise new equity funding to repay some of its existing debt.

You own 10 shares—which currently trade at $100 each.

The company’s financial advisors suggested a 1-for-2 rights issue at $70 per share which would raise the money the firm needs, excluding costs.

This means you get the right but not the obligation to 5 additional newly issued shares at $70 each.

You decide to exercise your subscription right.

How much is each of your shares worth after?

Just $90 (as opposed to $100). This is the ex-rights price, a theoretical price. But as you can see, you shouldn’t think of a rights issue as getting 5 additional shares at the current price.

What if you don’t subscribe to the rights issue?

You can let them expire, or sell them to other shareholders before the expiration date. This way you’ll be compensated for the decrease in stock price after the issue.

More specifically, if you don’t which to invest an additional 70×5=$350 in the company, you can sell the rights for (90-70)x5=$100, which corresponds to exactly how much your existing shareholdings lose in value: 10×100-10×90=$100.

Thus, on paper, the impact is always balanced—no matter how large the original shareholding and irrespective of whether the rights are subscribed or sold.

Now, there’s no guarantee the stock price will move to $90 after the issue.

What happens to the market sentiment regarding the business after the rights issue and overall how investors react is hard to predict.

Frequently Asked Questions (FAQs)

What if I don’t apply for rights issue?

In a rights issue, firms offer shares to qualified investors at a discounted subscription price. As a result, the total number of shares of the firm increases after the rights issue. If you choose to do nothing, your equity share will be diluted thanks to the extra shares issued by the company. However, your rights issue will likely be sold to interested investors and you’ll receive the money from that sale.

Is it mandatory to apply for rights issue?

No. A company cannot force its existing shareholders to buy more shares. Hence, it gives them an option to buy new shares at a lower price than the current market price of the existing shares. This option has value and can be sold if a current shareholder does not want to take it up.