The advantages of a stock split are:

- Lower share price makes the stock more affordable for smaller investors.

- More liquidity as a bigger pool of investors can trade the stock after the split.

- Easier to achieve the desired portfolio composition.

The disadvantages of a stock split:

- No intrinsic value change, as they do not change the underlying fundamentals or financial performance of the company.

- Potential short-term volatility, because investors may have different reactions to a stock split announcement.

Wanna know more? In this post I explain stock split and its pros and cons:

What is Stock Split

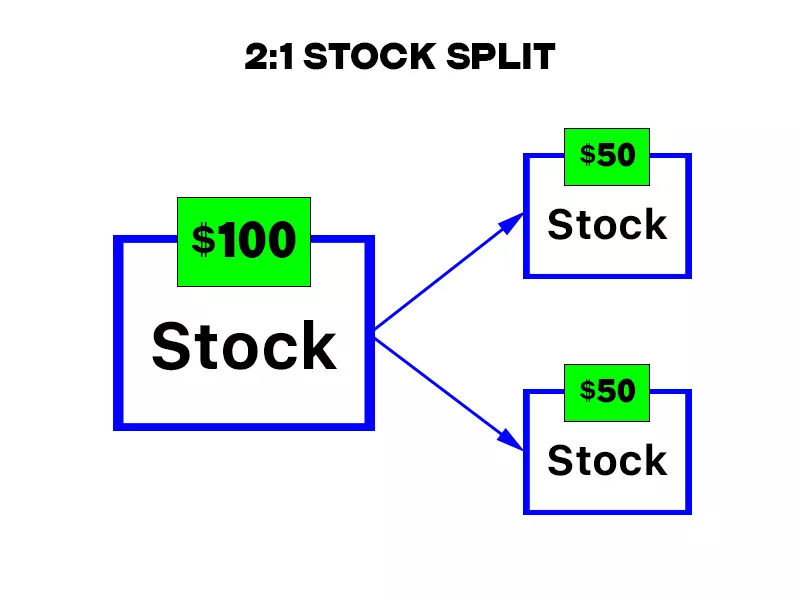

A stock split happens when a company issues new stock. As a result, every shareholder who owns the stock receives additional shares of the company. The market capitalization of the company stays the same, but the number of shares outstanding increases and the price of each share decreases.

For example, a 2:1 stock split means every investor that owns 1 share will end up owning a total of 2 shares, a move that cuts the share price in half.

On the other hand, a reverse split occurs when the price of a company’s stock falls too low and the company reduces the number of outstanding shares. A stock price that is too low increases transaction costs for investors in percentage terms.

For example, a 2:3 reverse split means you if you owned 3 shares, you now own 2 shares. In other words, every 3 shares are replaced with 2. If you owned 3,000 shares, you now have 2,000. This doesn’t mean you lose money though, as the stock price increases proportionally.

Advantages of a Stock Split

Is a split stock good? Here are some of the advantages of stock splits include:

Because each share is worth less than before, they become more affordable for small retail investors, who may not have been able to afford the higher-priced shares before the split.

Stock splits can also increase a company’s visibility, as they often receive media coverage. This attracts new investors, increasing the company’s stock price, as more investors are interested in buying the shares.

More Liquidity

Stock splits can make a company’s shares more liquid, as the lower share prices make them more attractive to a wider range of investors. With more shares trading hands, the stock becomes more liquid due to the increase in trading volume. As a result, it is easier for all investors to buy and sell shares quickly.

If just a limited number of shares are trading hands, a shareholder who wants to sell may have trouble finding a buyer near the market price. They may have to significantly lower their asking price to find a willing buyer.

No Taxes

Another advantage of stock splits is it is not a taxable event for shareholders. This means shareholders don’t have to pay taxes on the additional shares they receive as a result of the stock split.

In contrast, shareholders must pay personal taxes on the value of cash dividends they receive. This reduces the overall value of dividends for shareholders, compared to receiving additional shares from a stock split.

Seems like stock splits are free money, right? Not quite:

Although, from both the firm’s and shareholders’ perspectives, there is no real consequence to a stock split. The number of shares is proportionally increased and the price per share is proportionally reduced so that there is no change in value.

An additional advantage of stock splits over dividends is that they don’t affect cash reserves, as they do not involve the distribution of cash to shareholders. This is beneficial when a company wants to retain its cash for future growth or investment opportunities. Dividends, on the other hand, require companies to distribute a portion of their profits to shareholders, which reduces their cash reserves.

Portfolio Composition

Stock splits make it easier for investors to reach their desired portfolio composition.

For example, if an investor has a target allocation for a particular sector, but the shares of the companies in that sector are too expensive for the investor to buy enough of them to reach the target allocation, a stock split will make it possible for the investor to buy the desired number of shares at the lower price.

A high-priced stock means the investor is forced to have that stock make up a percentage of his portfolio that is either too high or too low.

Additionally, the increased liquidity makes it easier to buy and sell the shares quickly in order to maintain the desired portfolio composition. This is especially useful for investors who rebalance their portfolios on a regular basis.

Now, what are the disadvantages of a stock split?

Disadvantages of a Stock Split

Stock split disadvantages include:

No Intrinsic Value

Unlike dividends, stock splits do not create any new value for a company or its shareholders. They simply divide the existing number of shares into smaller units, lowering the price of each share. This does not change the underlying value of the company or its assets.

Short-Term Volatility

Stock splits can result in short-term volatility in a company’s stock, as investors react to the news of the split in different ways. This creates uncertainty and potentially negative impacts on the stock price in the short term. For example, some investors may sell their shares in anticipation of the split, while others may buy shares in anticipation of the split.

Stock Split FAQs

What are the pros and cons of splitting a stock?

Share split pros include a lower share price, which benefits investors who can’t afford expensive stocks, increases liquidity, and makes it easier to recompose a portfolio. Share split cons include the fact that no intrinsic value changes, as the number of shares increases in the same proportion the price of the share decreases. A stock split may also cause some short-term volatility.

What happens when you own a stock and it splits?

The value of the stock on your portfolio will stay the same, as you now own more shares, but those shares are worth less. With a stock split, a firm does not pay out any cash to shareholders. As a result, the total market value of the firm’s assets and liabilities, and therefore of its equity, is unchanged. The only thing that is different is the number of shares outstanding. The stock price will therefore fall because the same total equity value is now divided over a larger number of shares.

Do stocks usually go up after a split?

It is not guaranteed that a stock will go up after a split. Stock splits do not create any new value for a company or its shareholders, and do not change the underlying fundamentals or financial performance of the company.

However, stock splits can lead to an increase in the stock price because they can make the shares more affordable for individual investors. This can attract more investors and lead to increased demand for the shares, which drives up the stock price.

Additionally, stock splits are often viewed as a positive sign of a company’s growth and success, which can improve shareholder sentiment and also lead to an increase in the stock price.

Overall, the impact of a stock split on a company’s stock price will depend on a variety of factors, including the company’s fundamentals, market conditions, and investor sentiment.

i believe when stock splits lower the overall price of a stock, they become more “affordable” , so most investors believe. this creates a mini frenzy in buying of said stock. Thus improving the performance of that stock for a period time.