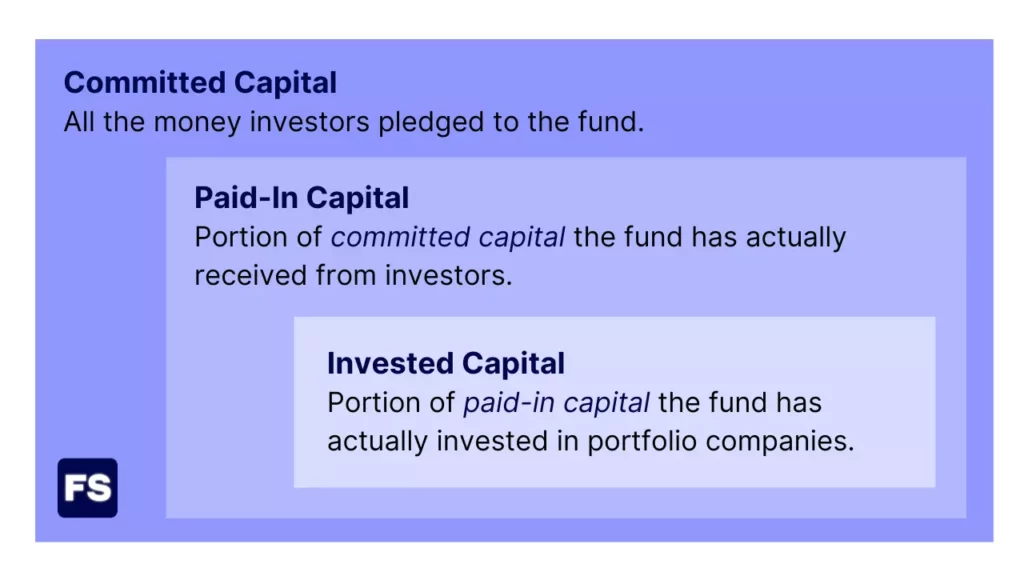

Both paid-in capital and invested capital are used in private equity. Paid-in capital is the cumulative amount of committed capital that has been drawn down. In other words, the money that limited partners have actually transferred to the fund. On the other hand, invested capital is the amount of paid-in capital that has actually been invested in the fund’s portfolio companies.

Knowing this difference is crucial to calculate the TVPI and the MOIC correctly.

Still confused? Keep reading.

We’ll look at the meaning of these terms within the context of alternative investments such as private equity (PE) funds and venture capital (VC).

But before you understand the difference between paid-in capital and invested capital in private equity, it’s important you know these 3 things that will be mentioned throughout the post:

- Committed capital: The total amount investors promise to invest in the fund. In other words, committed capital is a dollar agreement between a private equity fund and an investor. The investor pledges to contribute a certain amount of capital toward the fund. In turn, the PE firm uses the money to fund investments as well as take care of administrative costs.

- Limited partner (LP): In a private equity fund, limited partners are the investors who invest money in the fund and are not involved in its daily management operations. Thus, they have limited liability and generally cannot lose more than their contribution to the fund. LPs receive income, capital gains, and tax benefits. LPs are typically institutional investors, such as pension funds, endowments, insurance companies, or high-net-worth individuals.

- General partner (GP): The general partners manage the fund. They pick which companies the fund invests in, but are also responsible for the debts and obligations of the fund. GPs receive a management fee and a percentage of the profits (or carried interest). They’re the bridge between investors with capital (LPs) and businesses that need new capital to grow. Put simply, the GP is the fund manager and the LP is the capital source.

Paid-In Capital Definition

Paid-in capital is the cumulative amount of money that has been drawn down.

What does this mean exactly?

When limited partners commit capital to a private equity fund, they generally don’t transfer it immediately to the fund’s bank account.

The investor has the option of paying the committed capital in a lump sum or making contributions over time. Over weeks, months, or even years. Who decides upon this? The firm and its investors.

Pain-in capital is the amount of committed capital LPs have actually transferred to a venture fund. It is also called the cumulative takedown amount, or called capital, or drawn capital.

Note that paid-in capital is different than committed capital:

Imagine an LP agrees to invest $10M in a fund. When the GP needs money for a new capital investment or for everyday fund expenses, they ask for a portion of the LP’s commitment. Only then will the investor transfer the money to the fund.

Now, what is invested capital?

Invested Capital Definition

Invested capital is the cumulative amount of money that has actually been invested in target companies.

A private equity firm pools together capital from investors and acquires equity stakes in companies. Hopefully, those acquired companies grow in value and the firm can sell its stake for a profit—making investors happy.

As we’ve seen before, the money investors agree to give the PE fund is the committed capital. And the paid-in capital is the capital actually transferred to the fund’s bank account.

With that in mind, the invested capital is the portion of the paid-in capital that has actually been invested in the fund’s portfolio companies.

Now we’re ready to further clarify the difference between invested capital and paid-in capital:

Difference between Paid-In Capital and Invested Capital

Paid-in capital and invested capital are very similar as both metrics measure the money in a private equity or venture capital fund.

The difference?

Paid-in capital is capital investors have not only pledged to the fund but actually transferred to it after a capital call. The fund managers will use this money in the fund’s bank account to make investments (in other words, buy equity stakes in companies). The money that has been transferred from the fund’s bank account to a company in exchange for an equity stake is the invested capital.

Invested capital is always lower than the paid-in capital. Why?

Because there are administrative costs (not included in invested capital) and there may be a time gap between when the money hits the fund’s bank account and when it is actually used to acquire startups.

Understanding this difference is crucial to know how to calculate the MOIC and DPI correctly.

In practice, invested capital is equal to paid-in capital minus the money used to pay fees and general administrative costs, or which is waiting to be allocated to an investment.

Fund managers calculate their returns based on the invested capital, usually between 1% and 3%. This is the management fee.

Key Takeaways (FAQs)

What is paid-in capital in private equity?

When investors commit to funding a private equity fund, they do not immediately contribute the full amount of their capital commitment. Instead, they make contributions over time as the fund manager identifies investment opportunities. The paid-in capital is the total amount of money investors have actually transferred to the private equity fund’s bank account. It is the cash the fund manager has available for investment purposes.

What is invested capital in a private equity fund?

Invested capital is all the money the fund has invested in portfolio companies. It doesn’t include returns or distributions and cash flow received from portfolio companies. Only the original amount of capital the fund deployed into the investments.

What is the difference between paid-in and invested capital?

Pain-in capital is the portion of the committed capital that the fund has received from investors, whereas invested capital is the money the fund has already used to invest in target companies.

What is the difference between invested and committed capital?

Committed capital is the money investors promise to contribute to an investment fund over its life, whereas invested capital is the portion of the committed capital that has been actually not only transferred to the fund by investors (paid-in capital), but also transferred to portfolio companies.