This post contains affiliate links.

Not sure if becoming a certified Financial Modeling & Valuation Analyst is for you? You’ve come to the right place.

I went through over 2 hours of videos reviewing and ranking different certificates for business professionals, read through 20+ articles, and scrolled through countless forum discussions and comment sections where professional analysts, business owners, and students exchanged opinions on the FMVA certification.

This post aggregates everything I found.

That being said, I recommend you stick to the end to understand what the biggest limitation of the certification really is.

Ready? Let’s dive right in:

What is the FMVA Certification

The Financial Modeling and Valuation Analyst (FMVA) certification is an online training program that teaches you how to perform financial analysis.

It is composed of 33 courses that will help you master modeling skills, forecast more efficiently, and learn about accounting and finance.

The FMVA certification will arm you with the skills and tools you need to become a competent finance professional.

The program was created by the Corporate Finance Institute (CFI), a leading global provider of online financial modeling and valuation courses. 1,000,000+ people at top universities, investment banks, and financial firms worldwide have taken CFI’s programs since 2016.

The certification is divided into 4 essential steps, after which you become FMVA-certified:

#1) Preparational Courses

The first step is a review of the fundamentals of accounting, financial statements, corporate finance, risk management, Excel, and math.

It is composed of 9 courses taking on average around 2 hours to complete each.

This step is optional, but highly recommended—especially for beginners transitioning from other areas of study, or business grads needing a refresher in financial analysis.

#2) Core Courses

This is the main step of the certification.

14 courses that will teach you everything you need to know in order to do efficient financial modeling and valuation like the top finance professionals.

It should take you around 80 hours to complete and includes:

- A deep dive into DCF valuation modeling.

- Mastering the relationship between the income statement, cash flow statement, and balance sheet, without having to become a certified accountant.

- How to value a business without the DCF model.

- Common mistakes to avoid when budgeting and forecasting.

- How to incorporate the uncertainty of different scenarios when valuing a project.

- How to build impactful presentations, as unfortunately, a lot of times it’s not about what you know, but what you can show you know.

- And much more…

Overall, the lecturers are engaging and keep everything easy to understand.

These courses will push you from just knowing theory to mastering financial modeling and being able to work fast and efficiently.

#3) Elective Courses

In step 3 of the FMVA CFI certification, you’ll be invited to choose at least 3 electives (out of 9 available) to explore advanced modeling and financial analysis topics.

These topics include:

- How investment banking and private equity firms adapt their modeling to real-world mergers and acquisitions (M&A) deals.

- How to model for real estate (completely different than company valuation).

- How to value an e-commerce business.

- Mastering LBOs (leveraged buyouts, the most feared interview question).

- Little-known Excel and Power BI techniques that’ll minimize how long you take to build a model.

- And much more…

You can take as many electives as you would like—all the content is available to you in your CFI subscription.

#4) Case Study

Next, you have an optional case study to apply your newfound knowledge and skills to solving real-world problems.

#5) Final Exam

After completing the required courses, you take a final exam covering financial modeling and valuation to earn your certificate.

You will need to get at least 70% of the answers right.

After successfully completing the exam you can say you are FMVA certified. Congratulations!

You’ll have the option to order a physical copy of the certificate to your door.

Pros & Cons

Here are the advantages and disadvantages of enrolling in the FMVA program:

Benefits of the FMVA Certification

- Self-paced: You can pause, rewind, and review concepts as you need. Also, as we’ll see below, there is no option to buy the certification. Instead, you buy an annual CFI membership. This means the faster you complete the lessons, the less you pay.

- Recurring updates: The program is updated with new courses every month, so you stay up-to-date with the latest tools and skills in financial analysis.

- Real-world connection: Unlike other finance courses that focus on concepts that only exist in a vacuum of theoretical worlds, this certification challenges you with real-world problems that will teach you job-relevant skills and tools. It’s tangible project experience you can mention in a job interview, for example.

- 100% online: You can become a certified financial analyst from anywhere in the world.

- Shareable certificate: You can share your FPVM certificate in your LinkedIn profile, CV, or other documents. As everyone has a degree nowadays, this can make you stand out in a job interview. It shows that you’re proactive and work hard. And anyone can easily verify the validity of your certificate.

- All-access: Subscribing to CFI gives you access to all of their programs, including those with certifications. You can earn as many certifications as you want without having to pay a separate fee for each. And you can start with a free account that gives you a preview of all 200+ courses. For the full comparison of what the free account includes vs. the paid plans go here.

- Members-only online community: Like most online learning platforms, CFI also has a discussion forum where you can exchange ideas with other students pursuing the same programs. This empowers you to clarify any doubts you may have had while going through the courses. Also, as an FMVA certificate holder you can join the FMVA holder’s LinkedIn group with +44k members.

Drawbacks of the FMVA Certification

- Low recognition and status: All assessments are in multiple-choice format and you can retake them as many times as you need, making them pretty easy. The result? Even a person with very little knowledge of finance can take the final exam a lot of times, memorize the right answers through trial and error, and pass it with multiple retakes. While the quality of the material in the FMVA program is great, the online exam format will never render the same merit as a closed-book in-person exam like the CFA (Chartered Financial Analyst).

- No access to all reviews: Unlike Coursera for example, or a website like Amazon, you can’t see real reviews on the courses’ pages. CFI only shows you 5-star reviews. Still, if you go around forums or YouTube videos on the FMVA and scroll down to the comment section, you’ll see most people say good things about the program and that it just depends on what you want to get out of it (as I’ll explain below).

With these in mind…

Who is the FMVA Certification for

FMVA certification is appropriate for you if:

- You’re already in the financial services industry (working as an accountant, financial analyst, credit analyst, or consultant, etc.) and are angling for a promotion.

- You didn’t go to business school but are looking to transition to finance.

- You are studying finance, management, or accounting and want to enhance your skills, be at the top of your class, and boost your resume. (By the way, CFI offers university students a 50% discount.)

- You’re a business grad but you’re unsure of what path within the financial services industry you want to pursue.

Now, are there any requirements you need to meet before enrolling?

You don’t need a business degree (accounting, management, finance) to take the FMVA course.

You do need a good understanding of high school-level maths.

Completing this certification is not the easiest thing in the world. And of course, a degree in accounting or finance will help. A lot.

But so long as you put in the work, you’ll be successful—even if you never stepped foot in a business school.

CFI promises real-world applications and a hands-on curriculum that will prepare you for investment banking, private equity, M&A, business valuation, and corporate finance careers.

Interested in any of these areas?

Then the Financial Modeling and Valuation Analyst certification will only benefit you.

Who is the CFI FMVA not for

The FMVA certification is perfect for gaining actual financial analysis skills and training fast, but it does not hold anywhere near the same weight as the CFA. It does not signal the same status.

Some people even argue a CFA Level I passed exam (far from the full CFA designation) holds more weight than the entire FMVA designation.

The truth is everyone knows about the CFA. The failure rates are quite high (61% for May 2023’s Level I exam), but guess what?

That’s precisely what makes it so valuable. So prestigious. It is undeniable there is high rigor behind the CFA program and that only top candidates make it through. You really need to prove your worth.

So if you’re looking to enroll with the only goal of adding “FMVA” to your name on LinkedIn, think twice. Because the FMVA may not be what you’re looking for.

As of now, most people will not have a clue of what in the world you’re talking about when you mention it.

Don’t get me wrong:

Of course once you explain the curriculum, they’ll likely agree it’s a valuable program.

It’ll also show you’re ready to put in work to improve your skills on your own, all by yourself.

This is very good if you find yourself in a job interview for a high-earning position.

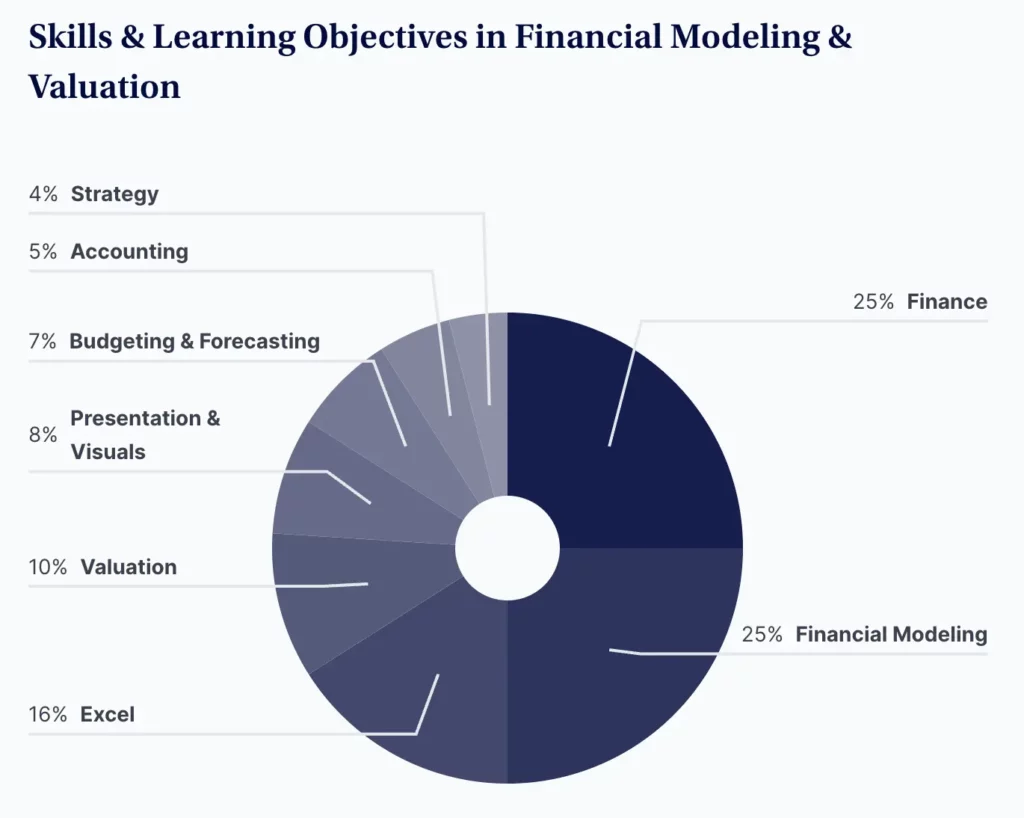

This part of the course page explains each of the skills you learn with the FMVA certification. These alone won’t land you any raises or promotions, but they may do so indirectly by showing you better modeling approaches. In a job interview for example, this section will help you explain how valuable the experience was.

And on top of that, the FMVA certification has been getting more and more recognized over the last few years.

Keep this in mind about programs like this (whether it’s the FMVA or even the CFA):

A resume filled with certifications is not what’s going to get you a job in high-paced careers such as management consulting or investment banking.

It can certainly make you stand out, but none of these certifications are needed.

What has the most impact is a high GPA, a top university, relevant internships, and soft skills.

Now that we’ve got that out of the way, here’s how to access the FMVA program:

How to Enroll in the FMVA Program

You cannot purchase access to the FMVA certification by itself.

Instead, you can only buy a CFI membership plan. And the FMVA certification cost is included in this membership.

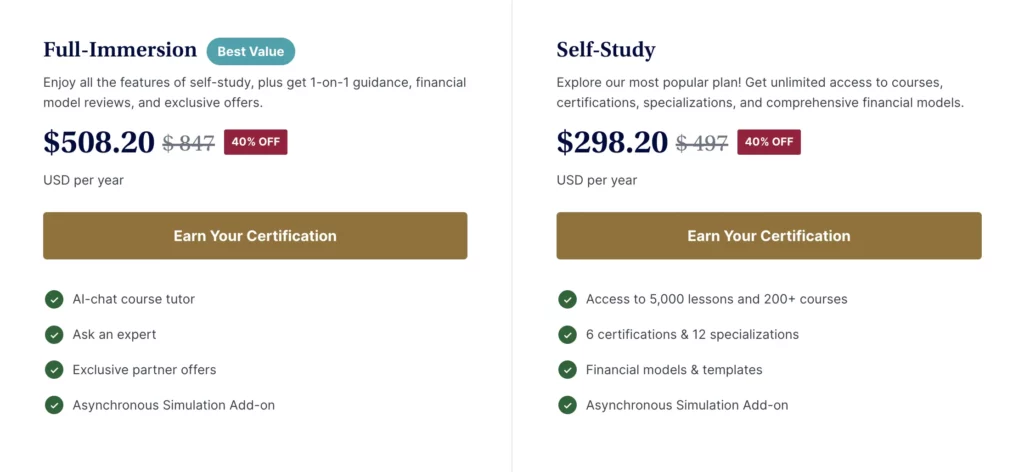

The Self-study plan costs $497/year and gives you unlimited access to:

- 200+ online finance courses and certification programs, including the FMVA program.

- 5,000+ lessons, models, and case studies.

- Downloadable models, templates, and guides.

CFI may sometimes show the $497 as $41 per month but there’s no option to subscribe monthly. You can only purchase the annual subscription.

This gives you the flexibility to complete all the courses you wish to take for an entire year.

You can also opt for the Full-Immersion version for an extra 350 bucks ($847/year). What’s this?

It gives you everything in Self-Study, plus access to CFI’s AI Chatbot integrated into the FMVA course experience and discounts on advanced financial tools.

You also get 1-on-1 support from professional analysts who will review models you’ve built once per week, and give you resume and cover letter feedback every month.

You can see a side-by-side comparison of both plans on CFI’s pricing page.

If there’s no promotion available when you’re enrolling, try using the affiliate referral code Welcome10 for a 10% discount. How?

After choosing your subscription plan, on the checkout page you’ll be asked to create an account with your details. You’ll also have the chance to insert coupon codes (this article explains how).

Also, you can always upgrade and downgrade plans including starting with a free account.

Remember:

Unless you cancel automatic renewals, this is a recurring annual payment. So in case you don’t find the program valuable, make sure you cancel your subscription.

Now, you may be wondering…

How long does it take to complete the FMVA designation?

CFI programs take an average of 4-6 months to complete. However, you have the freedom to complete them at your own pace.

You will always have access to the required courses, resources, and assessments to obtain the certifications as long as your membership is active.

We’re now ready to wrap up this CFI FMVA review:

FMVA Certification: The Verdict

If you’re looking for a glamorous and prestigious acronym to put next to your name in hopes of impressing people, forget about it.

The FMVA is not for you, as it has low brand value.

Don’t expect it to get you a job on its own (no certification can do this for you anyway, not even the CFA).

But it will probably increase your confidence in technical interviews. Why?

Because the FMVA certification is the best way to improve your understanding of financial modeling.

It’s a cleaner, modernized, deeper, and better-structured version of other modeling programs.

The program will boost your analytical skills, make you good in Excel, good at modeling, good at data analysis, and business and investment valuation.

No one really cares if you have it, but you will learn something new. Your on-the-job skills will improve.

It takes around 6 months to finish, but working through just a couple of courses will help you tremendously. Plus, CFI offers thousands of templates (literally) and several case studies.

Now the question is…

Is the FMVA worth it?

To put it simply:

If you’re looking to improve your modeling skills, the FMVA is for you and the answer is yes. It is worth the few hundred you pay because the course is well-built.

More knowledge will always increase your chances of success. Especially practical knowledge, which is the focus of CFI.

If you put in hard work and take the time to soak up the contents of the FMVA program, you can reach your career goals faster.

Why?

Because having the power to build financial models—not only accurately but also fast—is a +$100,000/year skill.

To join, you need to purchase a CFI membership.

This gives you access to the entire CFI training library—including all programs, courses, templates, case studies, and models—for one single price per year.

If you want to join the +1,800,000 other CFI members, make sure to first check their pricing page and look for discounts.

They run promotions regularly.

Also, as they explain on this page, CFI offers university students a 50% discount on the Self-study plan.

If there are no special promotions at the time you’re reading this and you’re not a university student, you can use the discount code Welcome10 at checkout for 10% off.

If you need help applying a coupon code, this article may help.

Financial Modeling & Valuation Analyst Certification

The Financestu team dives deep into CFI’s FMVA Certification curating opinions and sharing actual experience from within the program in this in-depth 2025 review.

Product Brand: Corporate Finance Institute

Product Currency: USD

Product Price: 497

Product In-Stock: InStock

4.5

Frequently Asked Questions (FAQs)

Here are some common questions and answers about the FMVA certification:

Is the FMVA recognized in the USA?

Corporate Finance Institute is an approved provider of continuing professional education (CPE) for CPAs in the United States and a member of the National Association of State Boards of Accountancy (NASBA). This means CFI courses are in line with USA accountancy standards.

Will the FMVA help me get a job?

It can help, especially if you want to work in investment banking, corporate finance, equity research, or related careers that rely on financial modeling and valuation. Certifications are a great way to stand out, since everyone has a degree nowadays. Additionally, companies love proactive people who don’t need to be handheld. However, certifications like the FMVA are not a requirement for working in the financial industry.

Is the FMVA exam difficult?

Not really. The course has great content, great structure, and great instructors. And you get access to thousands of modeling templates. Not to mention you can repeat course exams as many times as you need until you get them right.

How long does it take to complete the FMVA certification?

It takes an average of 4-6 months to complete the entire program. But you have the freedom to complete the courses at your own pace.

What is the salary of a certified FMVA?

According to CFI, the average salary of people who have enrolled in or completed the FVMA certification is $121,000/year. The FMVA cost is included with a CFI membership.

Hope you enjoyed this 2024 FMVA certification review.

Have you enrolled? If so, what did you think of the courses? Leave your comments below.

Have any further questions I didn’t answer? Let me know and I’ll get back to you in less than 24h.

do you think cfi fmva is better than wallstreet prep?

Your product design is excellent.