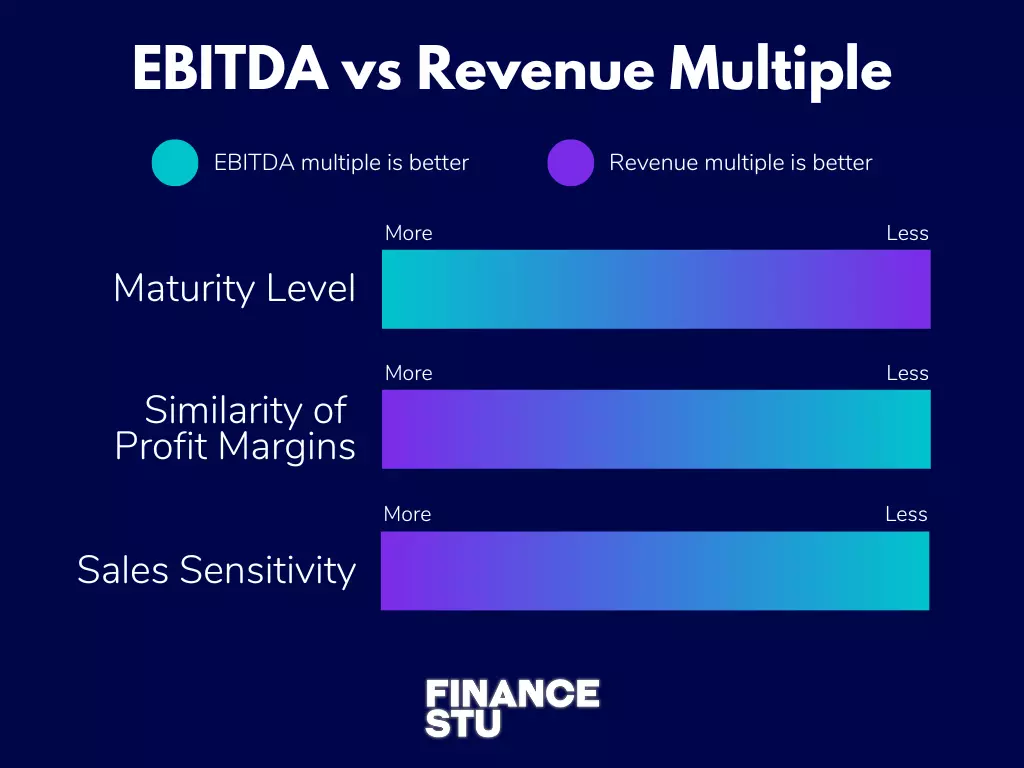

The revenue multiple is better when you’re dealing with young companies that are not profitable yet, companies that are sensitive to market cycles, or that are in industries with an established profit margin. The EBITDA multiple is better to capture the profitability and efficiency of a business, and in capital-intensive industries.

That’s the gist of it. For a more comprehensive explanation, read the whole article.

We’ll start by understanding enterprise value multiples for company valuation, both types of valuation multiple (definition, formula, and purpose), and finally 4 factors to help decide when should you use each.

Ready? Let’s dive in:

Market Multiples Valuation

Market multiple valuation is a form of relative valuation (also called comparables valuation) that uses a ratio between a pair of financial metrics. The goal? To compare similar companies or assets.

Relative valuation is used in conjunction with the DCF (discounted cash flow) model for company valuations. It adds robustness to equity research recommendations by confirming or not if a company is indeed undervalued, overvalued, or fairly valued.

There are also price multiples (such as the Price/Earnings and the Price-to-Book ratio). These focus on a company’s stock price and market valuation, but that’s not the focus of this post.

A multiple summarizes in a single number the relationship between the value of a company and some fundamental metric, such as earnings or operating cash flows.

It is calculated by dividing a specific item on the financial statements (generally revenue or EBITDA) by the enterprise value.

Enterprise value measures the total value of a company. It includes the entire market value of a business rather than just the value of its equity.

Multiples are simple to calculate, allow for quick and easy comparisons of relative values between companies, and are straightforward to communicate. This is why many private equity and investment banking analysts use them as valuation indicators.

The benchmark value to which you compare the multiple is usually a similar company or the median multiple for a peer group of companies in the same industry, sector, equity index, or country. You can also compare to the company’s own past values of the multiple.

The goal is to analyze if the entire enterprise value of a company is fair, overvalued, or undervalued.

For example, let’s say the companies in an industry have an enterprise value is 5x their EBITDA on average. If your company operates in the same industry and runs similar operations, it’s safe to say that with an EV/EBITDA of 4x it is undervalued.

Understanding EBITDA Multiples

EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

It measures the ability to generate cash and the operational performance of a company. This is because the expenses that come after it in the income statement are not operational, or actual cash flows leaving the company.

The EV/EBITDA (enterprise value to EBITDA) multiple helps investors focus on how the business is run because it excludes items influenced by accounting decisions and government policy. Instead, it is a measure of profit and potential.

The EBITDA multiple calculation is as follows:

Where: EV = Enterprise Value = Market Capitalization + Total Debt – Cash and Cash Equivalents

Companies with high and growing EBITDA are more valuable, as they generate more cash flow and are more financially stable.

This happens when there’s weak competition. Why? Because there’s less pressure to compete on price, allowing the business to maintain high profit margins.

What Is Revenue Multiple Valuation

The revenue multiple is more commonly called EV/Sales (enterprise value to sales) multiple.

Revenue (sales) is simply the total income generated by the sale of goods or services.

A revenue multiple values a business based on how much it sells. Similarly to EV/EBITDA, it is not heavily influenced by accounting rules. It focuses on measuring a company’s ability to meet revenue targets.

Multiple of sales valuation measures the market value of a company to its sales. Here’s the revenue multiple formula:

A high EV-to-sales multiple indicates recurring revenue and high demand for the products or services of the company.

Revenue Multiple vs EBITDA Multiple: When To Use Each

Both the EBITDA multiple and revenue multiple are used in business valuation to estimate the value of a company. And they share similarities. As we’ve seen, you calculate both metrics by dividing enterprise value by EBITDA or revenue respectively.

In both cases, firms carrying a lot of debt and interest payments will have higher ratios than companies that don’t. Why? Because of the enterprise value calculation.

They also both lack in reflecting a couple of fundamental components of corporate valuation: changes in working capital, and capital expenditures.

So, which valuation method should you use?

There are situations where one multiple is more appropriate than the other. You can decide based on the following four observations:

#1) Level of Maturity

For growing companies revenue multiples are better than EBITDA multiples.

Early-stage startups spend a lot of money on product development, acquiring assets, and researching the industry they’re in, which can lead to negative profit margins. The problem?

If you calculate an EBITDA multiple with a very low or negative number, the information loses its meaning. It’s useless.

As an alternative, you can use revenue or expected revenue, which is always a positive number. It will measure the ability to meet sales targets.

On the flip side, revenue multiples aren’t appropriate as a stand-alone metric for mature companies with predictable cash flows because it ignores the profitability aspect that EBITDA captures.

EBITDA multiples on the other hand, consider all the operational costs (variable and fixed), giving the business owner a clearer view of the expense structure his company has.

#2) Similarity of Profit Margins

You should use EV-to-sales to compare companies within an industry that has similar profit margins. Why?

Because it doesn’t take the costs of running the business into account.

Margins can vary a lot between peers in industries where companies primarily gain their competitive advantage by reducing costs. A revenue multiple won’t capture this, as opposed to the EBITDA.

For example, in the electronics industry, companies compete on price, features, and innovation. They focus on reducing production costs to boost profitability.

Industries with no room for disruptive innovation to reduce expenses past a certain point of business maturity will have profit margins within a tight range. Here, it makes sense to use a revenue multiple. Why?

The only way a firm can increase profits and stand out from its peers is through increasing revenue, since they all share a similar profit margin. Thus, the revenue multiple is superior to the EBITDA multiple.

A similar EBITDA margin may also be seen in industries where suppliers have tremendous negotiation power.

Two examples:

- The pharmaceutical industry, where companies develop and sell prescription drugs. Due to strict regulations and high research and development costs, profit margins tend to be within a tight range across the industry.

- The utility industry, such as electric, gas, and water utilities. These are essential services, which face regulations on pricing and profits. Profit margins also live within a tight range across all peers.

#3) Sales Sensitivity to Economic Downturns

The revenue multiple is useful for companies that are sensitive to business cycles. Where the impact of economic downturns is more noticeable in the number of goods and services sold than in other financial metrics.

Companies not as sensitive to business cycles have stable earnings even during economic downturns. For these companies, the EBITDA multiple is more appropriate, as it reflects more accurately operating performance and financial stability.

An example of this is the defense and security industry. Governments prioritize spending on military equipment and security services in times of uncertainty.

#4) Depreciations and Amortizations

As we’ve seen, the EBITDA multiple estimates the value of a firm based on its operating performance, as it captures profits before deducting financing costs and taxes. This is useful to value companies in capital-intensive industries where depreciations and amortizations have a significant impact on earnings.

Depreciation and amortization are not actual cash outflows leaving the company. Although they are important to account for, as an analyst valuing a company, your focus should be on cash flows. Why?

Because cash flows reflect the ability to generate income. This is what determines long-term viability at the end of the day. Also, they are not influenced by accounting policies, as opposed to net income.

Now, what are capital-intensive industries?

Manufacturing, construction, and energy production. These require large amounts of capital investments in equipment, machinery, and other assets. Transportation, utilities, and real estate development also require large investments in fixed assets such as buildings, equipment, and other structures. The result? Lots of depreciation expenses.

Another example:

The tech sector, including software, hardware, and telecommunications, requires investments in research and development, as well as in the production of complex products and services. The result? Lots of amortization expenses on intangible assets such as patents, copyrights, and trademarks.

EBITDA vs Revenue Multiple FAQs

When should you value a company using a revenue multiple vs. EBITDA?

If a company has no profits, value it using the revenue multiple. Early-stage startups are an example. The revenue multiple is also optimal in industries where revenue growth is a key driver of value, such as industries with a lot of regulation, or where suppliers have more negotiating power. The EBITDA multiple is appropriate for mature companies because it measures the ability to generate and preserve cash.

What is a good revenue multiple?

A revenue multiple above the industry average or median. There’s no universal absolute number to answer this question because the goal of multiples is to compare companies with similar operations. A company with a lower multiple than its industry may be considered undervalued, while a company with a higher multiple may be considered overvalued. Any investor can use publicly available industry multiples for comparisons.

What is the best metric for valuing a company?

It depends mostly on the industry of the company you want to value. Still, the enterprise value to revenue (EV/R) multiple and the enterprise value to EBITDA (EV/EBITDA) multiple are the most common valuation multiples. To calculate them, you must add market capitalization (equity value) and debt, then subtract cash to get the enterprise value. Then, divide that total by revenue or EBITDA accordingly. These multiples give you a snapshot of how the market values a company based on its financial performance.