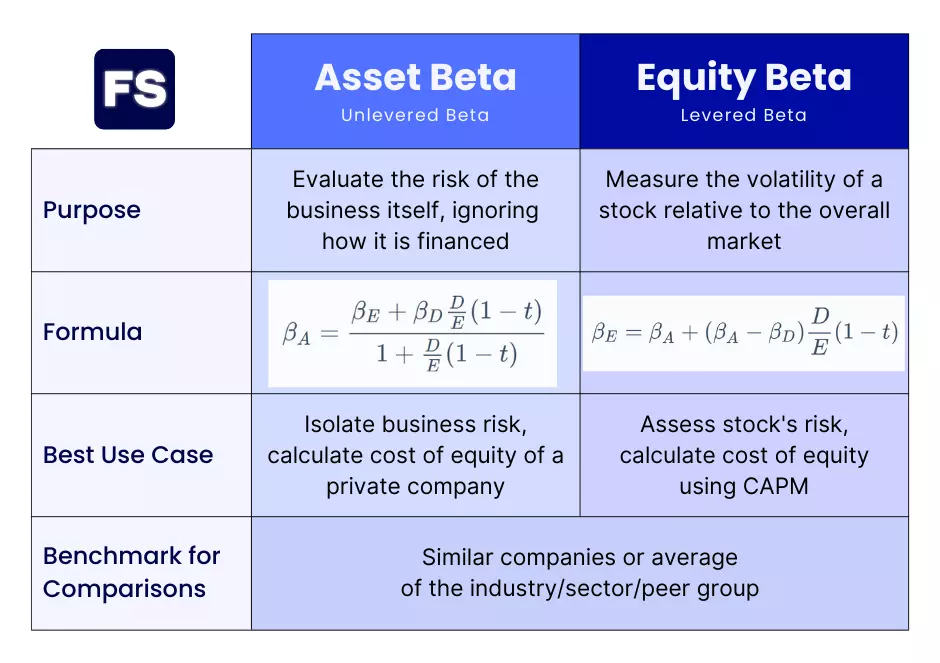

Equity beta is the overall business risk of the company, including both operational and financial risk. Asset beta on the other hand, excludes the effects of leverage on the capital structure, thus assuming the business is funded by equity only. The goal of this? To evaluate the risk of the company’s core underlying business.

At first glance, the two metrics appear similar. But a closer look reveals key differences:

That’s the gist of it.

For a more comprehensive answer, keep reading:

What is Beta

Beta tells you how much a stock fluctuates relative to the market. It helps you assess whether a stock has high volatility or not.

A stock with high beta (above 1.0) will rise faster than the broader market, but when the market falls it will fall faster as well. In other words, it is more volatile.

Stocks with a beta equal to one move in line with the market, while stocks with beta below 1.0 are safer because they are less likely to go through wild price fluctuations.

Beta is considered the risk you can’t diversify away (systematic risk) because it relates to the overall market, and all investments within it. Even well-diversified portfolios are impacted by economic crises.

For beta to be meaningful, the stock should be related to the market you consider. For example, if you’re evaluating an European stock it’s better to use the Euro Stoxx 50 as the market benchmark as opposed to the S&P 500, and vice versa for an American company.

Now, there is a difference between asset and equity beta:

What is Asset Beta

Asset beta is the beta of a company without the impact of debt. It measures how volatile the underlying business is without considering capital structure. As the name implies, the focus is on the assets only.

It is also called the unlevered beta. Why? Because you don’t consider the effects leverage has on the company.

Isolating business risk from financial risk is particularly useful in financial modeling when trying to estimate the fair value of a company.

You can always change how the business funds its operations (whether through debt or equity financing, or a mixture of both). What’s harder is to change the way the business generates cash flows. How it makes money.

Asset beta helps you identify companies whose core business model is solid but that are struggling with bad capital structure choices.

The asset beta formula is as follows:

Where:

- βA is the beta of assets, or unlevered beta.

- βE is the equity beta, which is the standard observable beta of a stock, as we’ll see below.

- βD is the beta of debt, the sensitivity of the returns on debt to changes in market returns. It is usually considered zero, especially for mature companies from developed countries.

- D/E means debt-to-equity, a ratio that compares the proportion of debt financing relative to equity financing.

- t is the corporate tax rate, used here to account for the tax shields leverage creates.

In essence, unlevered beta is a theoretical concept that assumes a company’s assets are financed by equity only.

Now, what is the equity beta?

What is Equity Beta

The equity beta is usually what people refer to when they just say beta. It’s the volatility of a stock’s price movements relative to the overall market fluctuations.

It’s also called levered beta because it takes into account the capital structure of the firm. This means if a company has a lot of debt, the beta will reflect the fact it is riskier than a comparable company with less debt.

If you have only the unlevered beta, the levered beta formula is as follows:

This way you reverse the removal of the effect of debt from the unlevered beta.

Now that you know both the levered and unlevered beta formula, we’re ready to clarify the difference between the two measures:

Difference between Asset Beta and Equity Beta

Both the asset and equity beta tell you about the riskiness of investing in a particular company. The difference?

They represent different aspects of a company’s risk profile.

Asset beta considers only the underlying business and ignores how it is funded. As we’ve seen, you calculate it by stripping out the capital structure that impacts the equity beta.

Equity beta on the other hand considers both the underlying business and how it is financed.

Asset beta is very useful when you want to value a private company whose stock doesn’t trade on an exchange. In these cases, you can’t observe the price fluctuations and compare them to the overall market.

Instead, you can find the beta of a couple of similar companies that are publicly traded and strip the effects of leverage from them in order to assess their business risk. Your target company should have a similar business risk.

Then you can reconsider the capital structure in the beta with the debt-to-equity ratio of the private company to get an approximation of its equity beta.

Related: How to Calculate the Cost of Equity of Private Companies

In essence, asset beta is better than equity beta when you want to compare the risk of the operations of a business only, regardless of its financial decisions. It allows a more accurate comparison between firms with different debt levels and capital structures.

Equity beta is better to have a sense of the risk equity holders incur when they invest in a company. You can also use it to compare the risk of firms with similar capital structures.

When calculating the cost of equity under the CAPM (Capital Asset Pricing Model), you always use the equity beta.

Even though you may associate leverage (debt) to debt holders only, shareholders’ returns are also impacted when a company contracts more and more debt.

Related: What Happens to the Cost of Capital as Debt Increases?

One exception is when using the Adjusted Present Value (APV) method to value a company, where you calculate the unlevered cost of capital (using unlevered beta), discount cash flows using that rate, and then add tax shields gained from debt.

Equity beta is usually higher than asset beta, as considering leverage means the risk beta captures is higher. Using debt amplifies the returns for shareholders when the company performs well, but it also magnifies the losses when it underperforms.

Because asset beta doesn’t consider leverage, it is lower, reflecting the lower risk and volatility of avoiding debt.

Let’s go through a quick example to put these concepts in motion:

Asset Beta vs. Equity Beta Example

Consider Amazon (AMZN), a well-established publicly traded company.

According to Yahoo Finance it has a beta (equity beta) of 1.26 (5Y Monthly, meaning the stock price changes and the market benchmark are observed in monthly intervals over the previous five years).

This means if the S&P 500 rises 1%, Amazon stock tends to rise 1.26%. If the S&P 500 falls 1%, Amazon stock tends to fall 1.26%.

Following the “unlevering” formula, we have that asset beta is:

Note that I consider the debt beta is zero as it is very unlikely for Amazon to default on its obligations. Hence, the numerator becomes simply the equity beta.

From the Statistics page of the AMZN stock in Yahoo Finance, I got that the debt-to-equity ratio was around 115% as of the most recent quarter. You can also calculate it from the balance sheet.

As to the corporate tax rate, I looked at the company’s income statement to find that from 2019-2021 the effective tax rate (simply taxes divided by earnings before taxes) was around 14%.

So, 0.63 is the asset beta of Amazon’s underlying business.

This is a substantial difference from the equity beta of 1.26, and it happens because of the high D/E ratio. It means Amazon uses significant leverage to amplify its business.

The asset beta tells you the volatility of the company’s business model of e-commerce, fulfillment, streaming, advertising, and cloud services.

Meanwhile, the equity beta tells you the volatility of the overall stock.

Keep in mind comparing Amazon to other companies is difficult due to the variety of its business units.

Frequently Asked Questions (FAQs)

Is equity beta higher than asset beta?

Yes, equity beta is usually higher than asset beta. This happens because most companies have debt in their capital structure, as opposed to being financed by equity holders only (what asset beta assumes). As such, financial leverage amplifies the volatility of returns (beta).

Does CAPM use asset beta or equity beta?

Equity beta. When using the CAPM to estimate a company’s cost of equity, you use its equity beta (levered beta) because as leverage increases, the risk of the company going bankrupt increases as well—leaving shareholders with nothing in case that happens. Thus, investors will require a higher return for taking the risk, and levered beta captures that.

How do you calculate asset beta?

Asset beta tells you how volatile the underlying business is, irrespective of capital structure. To calculate it you divide equity beta by one plus the product of debt-to-equity and the difference between 1 and the company’s effective tax rate.