In Europe, investment funds are typically structured under the UCITS directive (Undertakings for Collective Investment in Transferable Securities) or as an Alternative Investment Fund (AIF) under the Alternative Investment Fund Manager Directive (AIFMD).

Funds that follow the UCITS directive can be marketed all over Europe without additional authorization, and are typically targeted at retail investors for their strict diversification rules. The AIFMD regulates riskier funds, which have more freedom when picking investments and using leverage, and are therefore targeted at professional investors.

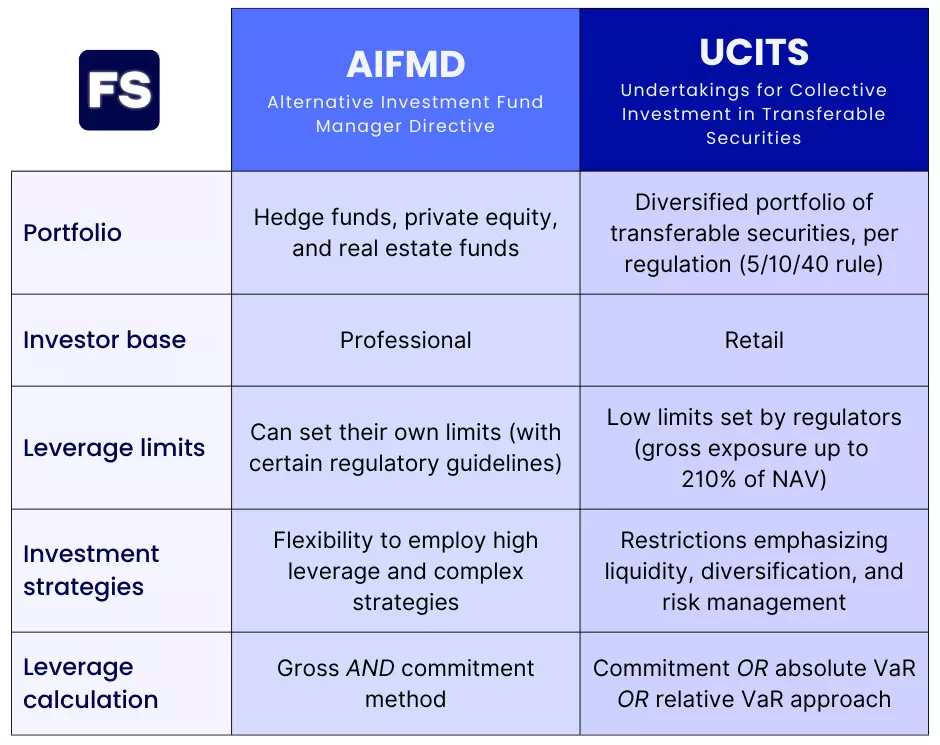

Here’s a summary of the key differences between the two directives:

The European Union developed the rules in the AIFMD to take into account the variety of AIFs it covers, while the UCITS directive covers a more uniform set of funds.

That’s the gist of it.

Still confused? Keep reading:

What Is AIFMD

The AIFMD (Alternative Investment Fund Managers Directive) is a European regulation that defines a set of rules fund managers must follow if they want to sell financial services across the EU market.

The primary goal of the AIFMD is to protect investors and control the systemic risk of AIFs.

An Alternative Investment Fund (AIF) is a collective investment undertaking. It raises capital from investors with the goal of investing it according to a pre-defined investment policy, and for the benefit of those investors.

Directive 2011/61/EU legislates AIFs.

Like all European directives, these are not laws per se. Each country does as it pleases when converting the directive into local law.

AIFMD Leverage Limits

In terms of risk management, the AIFM directive requires transparency when it comes to the leverage funds use.

Leverage is any method that increases a fund’s exposure, including borrowing cash/securities and using derivatives.

It increases the market and counterparty risk of the asset manager through non-fully funded exposure to securities. And it means the fund can lose more than what its investors pledged to it.

Under the AIFMD, asset managers must calculate their global exposure in two ways:

The gross leverage method, which says exposure is the sum of all the firm’s positions, even those with the goal of hedging and risk mitigation (hedging arrangements), or that can be netted against equivalent opposing positions with the same underlying and maturity (netting arrangements). Cash is not included though.

This is a more conservative approach than net leverage, the second way to calculate exposure:

Under the commitment method, the asset manager calculates net leverage.

This means exposure does not include positions in derivatives used for hedging (and that do not increase the market risk of the portfolio) and opposing positions in the same underlying are offset against each other. It includes cash and its equivalents.

The result of the calculation of the global exposure under both methods is then compared to the aggregated NAV (Net Asset Value) of the asset manager.

Under the AIFMD, each country sets leverage limits for each asset manager, based on the type of funds it manages (real estate, private equity, money markets, or hedge funds) and its peers (similar asset managers with similar risk profiles should have similar leverage limits).

Typically, the asset manager is limited to exposure up to 2x the NAV, whether the exposure is calculated under the gross leverage or commitment method.

The AIFMD covers a lot more types of funds than the UCITS directive. It essentially applies to all funds marketed in the EU that are not UCITS.

It covers open-ended as well as closed-ended funds, investing in a wider selection of asset classes, with a variety of risk and liquidity profiles, and more leveraged.

Hence the name “alternative” investment funds. Alternative to what? To UCITS funds.

Still, UCITS is the most common fund structure in Europe with over €11 trillion in assets (2020). Here’s what they are:

What Is The UCITS Directive

The UCITS (Undertakings for Collective Investment in Transferable Securities) directive is a framework that harmonizes investment funds targeted at retail investors throughout the European Union.

Funds that comply with the requirements set in the directive are granted a European passport—meaning, a fund authorized and domiciled in one member state can be marketed in another member state without additional authorization.

Directive 2009/65/EC legislates UCITS. So any time you see this mentioned in a fund, it is a UCITS fund.

To be UCITS-compliant, a fund must invest mostly in transferable securities (liquid assets traded in public markets and therefore easy to price), and follow the 5/10/40 diversification rule:

It can’t invest more than 5% in securities from the same entity. But those 5% can go up to 10% if the total investment in that entity doesn’t surpass 40% of all the assets of the fund.

UCITS Leverage Limits

Another requirement is the fund must calculate its global exposure every day. And it can do so using one of three ways:

- Commitment approach (net leverage): Just like under the AIFMD, the fund only looks at exposure from derivatives positions, and ignores stocks and bonds (market risk). It calculates all derivatives exposures as if they were direct investments in the underlying positions, which means it includes the risk mitigation effect of hedging and offsetting positions. The exposure from derivatives cannot exceed 100% of the fund’s NAV. Additionally, the exposure from temporary borrowings cannot exceed 10%. This means the maximum overall risk exposure of a UCITS fund is 210%.

- Absolute VaR approach: With the Value-at-Risk (VaR) approach, the fund estimates the maximum loss it could experience in a month (20 trading days) with a 1% chance of happening. How so? By running thousands of simulations of the price path of variables that impact the fund’s portfolio. The top 1% estimated losses resulting from unfavorable potential scenarios cannot be higher than 20% of the fund’s NAV. Note that the VaR approach focuses on losses due to market risk, rather than leverage like the commitment approach.

- Relative VaR approach: Instead of using the 20% hard limit, the relative VaR approach compares the VaR of the fund’s portfolio to that of a benchmark (typically an unleveraged market index with a similar risk profile). The absolute VaR of the fund cannot be 2x bigger than that of the benchmark.

See also: Commitment vs. VaR approach (UCITS Leverage Calculation)

Funds using the VaR approach (whether absolute or relative) must also calculate and report expected gross leverage.

Here, gross leverage is a measure of total derivative usage and is calculated as the sum of the notional exposure of the derivatives used, without netting opposite positions that cancel each other out.

Unlike in the AIFM directive, this gross exposure does not include direct investments such as stocks and bonds. It only considers derivatives positions. Hence why it is also called the sum of notionals calculation method.

Following this method, derivative instruments are converted—using the conversion methodologies set out in the regulations—into the equivalent position in their underlying assets.

And the sum of all those converted derivatives positions is the gross leverage.

Difference Between AIFMD And UCITS

Both the UCITS and the AIFMD are European Union legislative frameworks that offer risk management and reporting requirements that benefit regulators, fund managers, and investors.

They make up the two main pieces of European legislation when it comes to fund management.

According to a publication from the European Court of Auditors, Europe is the second largest market for investment funds—with €19 trillion in assets as of 2020, only behind the US.

And 60% of those assets (€11.6 trillion) are in UCITS funds, which are mostly targeted at retail investors.

The remaining is in AIFs, which are mostly aimed at professional investors.

Both directives aim to increase transparency and protect investors through a common framework for the regulation and supervision of funds. And for both, each country has to convert the directive into local law.

Also, both directives require funds to calculate their global exposure every day. How so?

Under the AIFM directive, funds must calculate their exposure in two ways:

- Gross leverage: The sum of all positions (not only derivatives) in the fund’s portfolio that potentially have market risk. This is then compared to its NAV.

- Commitment method: The sum of the notional amount of all derivatives contracts in the fund’s portfolio (all other securities are ignored) and compared to the fund’s NAV. Also called net leverage, as it does not consider derivatives used for hedging nor opposing positions in the same underlying.

Again, alternative investment funds must provide authorities and investors the use of their leverage both on a gross and commitment method.

In contrast, under the UCITS directive, managers choose one of two ways to calculate leverage:

Equal to the AIFMD, there’s the commitment approach, which takes into account only derivatives and securities lending transactions. It ignores the market risk of stocks and bonds in the portfolio.

It’s called the commitment approach because it aims to measure the true commitment of a firm (by offsetting netting and hedging arrangements). Under this method of calculating global exposure, a fully invested portfolio without derivatives has a leverage of 0%.

In alternative, UCITS funds can calculate leverage using the VaR approach. Under this approach, the fund estimates the maximum potential loss the portfolio could suffer within a certain time horizon with a given level of confidence.

Exposure calculation under the commitment approach is equal under both directives, but the leverage limits determined based on that calculation are different.

The asset management company must disclose the method it uses to calculate global exposure both in the fund’s prospectus and its annual report, whether it is a UCITS or AIFMD fund.

In terms of leverage limits, the AIFMD allows more flexibility.

Each asset manager determines its own leverage limits (as long as its country’s regulatory entity approves) and discloses them to investors.

In contrast, the UCITS directive imposes strict limits on leverage:

- Up to 100% of NAV for derivatives positions calculated under the commitment approach, and up to 10% of NAV for borrowings.

- Up to 20% maximum loss calculated under the absolute VaR approach, or up to 2x the VaR of a reference benchmark portfolio (relative VaR).

In essence, UCITS funds typically have lower leverage limits to ensure investors are protected and to create a harmonized set of products.

In contrast, the AIFMD applies to a broader range of funds around the EU, which employ riskier strategies.

Hope this helps. Questions? Doubts? Feedback? Leave them in the comments below.