A SICAV is an investment company, while an FCP is a fund. Both are common legal fund structures offered in Europe.

A SICAV has its own legal identity and is usually an umbrella structure, meaning it has many sub-funds under it, each one with its own investment strategy. An FCP does not have legal independence (they are dependent on the asset manager) but can also have sub-funds.

Both shares in a SICAV or units in an FCP are traded based on the fund’s net asset value.

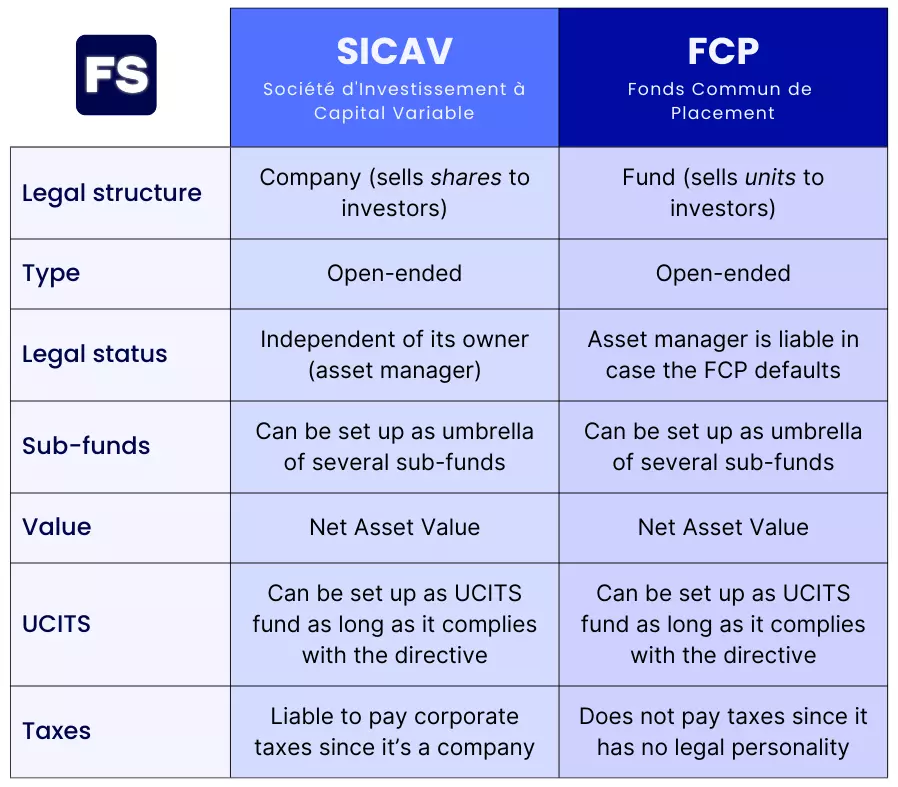

Here’s a comparison between the characteristics of both fund structures:

Still confused? Keep reading for a more comprehensive explanation:

SICAV Meaning

A SICAV is an open-ended investment company that is common in Europe.

SICAV is an acronym in French for Société d’Investissement à Capital Variable, which can be translated as investment company with variable capital (or open-ended investment company).

Open-ended means investors can buy or sell their shares of the SICAV at any time, as opposed to only upon the initial public offering.

The SICAV can create shares when new money is invested and redeem shares as requested by investors—it doesn’t need to hold a fixed amount of capital at all times (it has variable capital, unlike a SICAF).

Another difference is that SICAVs are not required to hold cash to cover the nominal value of their shares, while SICAFs have to do so.

A SICAV is not necessarily a fund. It is a legal entity that can act independently.

An asset manager can set it up as a single fund, yes. But also as an umbrella SICAV structure with many sub-funds, each with different investment policies.

How it works is the asset manager will create the SICAV vehicle, collect money from investors, and then constitute the sub-funds.

Then, it can delegate the management of the sub-funds to other asset managers, which will have the goal of generating the best possible return for investors while following the SICAV’s investment strategy (detailed in its prospectus).

When you invest in a SICAV by purchasing its shares, you become a shareholder—just as you become a shareholder of Apple if you buy Apple shares.

The value at which the shares of a sub-fund are exchanged is equal to its Net Asset Value (NAV), which is the value of the fund’s assets minus its liabilities. NAV is calculated at the end of each trading day.

SICAVs can sign legal documents independently without their owner—the asset manager. If a SICAV defaults, shareholders do not have the right to the assets of the asset manager.

For instance, if a financial institution sells derivatives to a particular sub-fund of the SICAV, it has counterparty risk on the SICAV, not the asset manager.

Most SICAVs are incorporated in Luxembourg under the UCITS directive (Undertakings for the Collective Investment of Transferable Securities).

This directive enables asset managers to market a fund across Europe—as opposed to only in its domicile country—as long as it complies with the UCITS leverage calculation and diversification rules.

Why Luxembourg?

Luxembourg has become the European hub for funds and firms, with trillions of assets under management (second only to the United States).

This expansion can be attributed to the stability of the political and social system, favorable regulation, and high internationalization.

What Is Fonds Commun de Placement (FCP)

An FCP (French acronym for Fonds Commun de Placement, which translates as investment funds or mutual funds) is an open-ended fund.

As an investor in an FCP, you (alongside other investors) buy units of a fund.

By buying these units the fund issues, you do not become a shareholder of the fund. Instead you become a co-owner of its assets.

Thus, FCPs are not investment companies, but more like open partnerships.

They have no independent legal status.

The asset manager is the entity responsible for signing legal documents regarding the FCP and is liable in the event the FCP defaults.

If a financial institution sells derivatives to the FCP, it has counterparty risk on the asset manager.

An FCP can also have sub-funds, although most times it is a single sub-fund.

While a traditional fund has a single portfolio of assets, a sub-fund belongs to an umbrella fund.

The umbrella fund acts as a single legal structure, under which a number of sub-funds or compartments are created.

The sub-funds are distinct from each other and operate like a traditional fund, each with its own investment process and investors.

As an investor in a conventional fund, if you want to switch strategies, you’ll need to sell your units and allocate the money somewhere else.

Meanwhile, switching from one sub-fund within the same umbrella structure (whether FCP or SICAV) is usually faster and cheaper.

All open-ended retail funds (whether SICAV or FCP) must have a custodian holding their assets.

Difference between SICAV and FCP

Both the FCP and the SICAV are open-ended collective investment instruments similar to each other.

They collect money from investors and allocate it to transferable securities (stocks, bonds, and derivatives).

The main difference is the FCP is a fund, so it sells units to investors as opposed to shares. There are no “shareholders” to a fund.

With SICAVs, the fund itself is a company and thus a legal entity. Investors buy and sell shares of a SICAV based on the value of the fund’s assets (NAV, or net asset value).

Just like in a corporation, each shareholder receives voting rights and has the right to attend the annual meetings. SICAVs also have a board of directors to oversee operations. They are essentially a company.

FCPs on the other hand are set up as a contract between the fund manager and the investors, having no independent legal status in its own right. The legal entity is the management company setting up the fund.

An investor who buys units of an FCP has shared ownership of the securities but does not have voting rights and is not a shareholder.

As an investor, you hold units in the FCP, which are also based on the NAV.

Both a SICAV and an FCP may be set up as a single fund or as an umbrella fund with multiple sub-funds.

The fund and its respective sub-funds may have different share/unit classes, depending on the needs of the investors.

Asset managers use FCPs more often for direct investment, while SICAVs is a more complex structure requiring more administration—but it is also more marketable in more places.

SICAVs tend to suit more liquid investment strategies.

On the flip side, running a SICAV is more expensive than running an FCP. Why?

Because FCPs have simpler legal structures, resulting in lower administrative and compliance costs. SICAVs require more regulatory reporting.

These regulatory requirements in a SICAV include the need for a board of directors, which can conflict with the investment advisor when it comes to investment policy.

Also, as an FCP does not have a legal personality, it does not have to pay corporate income tax. SICAVs are liable for taxes, but benefit from exemptions and deductions most times. Investors will pay personal taxes when either distributes income.

FCP vs. SICAV Fund Structure FAQs

Are SICAV and UCITS the same?

No. SICAV, FCP, Trust, or any other sort of legal structure are not by nature regulated or unregulated, UCITS-compliant or not. These are merely legal frameworks that impact governance and taxation, not investment. UCITS funds can all use these structures if they comply with the regulation.

Can a SICAV be closed-ended?

No, but a SICAF is. A SICAV company is open-ended, meaning shareholders can buy or sell the shares of the fund at any time. SICAF on the other hand, is a closed fund—it can only be bought when the fund is created and can only be sold when the fund is closed.

What is the difference between UCITS and FCP?

UCITS is a regulation allowing funds to be marketed across Europe without the need for additional approvals necessary, as long as they follow a set of diversification, legal, and leverage rules. An FCP is a legal structure for an investment fund. It is a joint ownership (between the fund and its investors) of liquid financial assets and securities. FCPs can be considered UCITS funds if they comply with the rules.

This is some great content, got very clear understanding of the investment structures.

Thanks