If a SPAC fails to merge with a target company within the specified time frame (typically 2 years), it is liquidated and the funds raised in its IPO are returned. This means investors get their money back—minus any fees or expenses the SPAC had.

Still confused? Keep reading:

What Is a SPAC

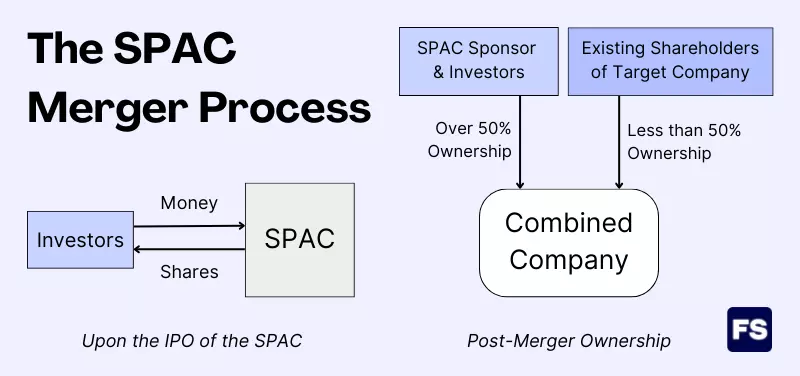

A SPAC (or Special Purpose Acquisition Company) is an investment vehicle that raises capital through an Initial Public Offering (IPO) with the intention of using those funds to acquire another company.

The firm is formed solely for the purpose of acquiring other companies. It does not have any operations or assets other than the funds raised in its IPO.

Once a target company is identified, the SPAC uses its funds to purchase a controlling stake in that company. The result?

The two companies form one sole entity, a combined company. Meaning, the target company becomes publicly traded as well.

Hence, the SPAC (sometimes called the poor man’s private equity) works as an alternative to the IPO.

In essence, a SPAC is a shell company that goes public without assets, with the goal of acquiring a company in the private equity markets. Shareholders in the acquired company sell control and receive liquidity in return.

Pros and Cons of a SPAC

The SPAC transaction is a way to fast-track the process of going public, and it provides more certainty regarding the valuation and the equity raised.

However, although they reduce valuation uncertainty, SPACs are more expensive due to the promote and refunding of the redemptions.

What’s the promote?

The compensation the SPAC’s sponsors receive for their role in identifying and acquiring a target company. It’s usually in the form of warrants or shares issued at a discounted price, that the SPAC sponsor can then sell for a profit once the merger with a target company occurs. How is the size of the promote determined? It is negotiated between the sponsors and the investors during the IPO process, along with other proposed rules.

Now, going back to the process of a SPAC merger:

As we’ve seen, a SPAC investor typically purchases shares in the SPAC on its IPO. These funds are held in a trust account until the SPAC identifies and merges with a target private company.

The time to completion of this is usually 18 months to 2 years.

Now, what happens if the SPAC fails to complete a merger in that timeframe?

What Happens When a SPAC Fails

When a SPAC does not merge within the specified timeframe the funds in the trust account are returned to the investors.

However, the amount returned may not be equal to the initial investment due to fees and expenses incurred by the SPAC during its lifespan.

Therefore, investors can lose money in the event of a failed SPAC deal.

If this happens a lot, institutional investors and retail investors alike may become more cautious and hesitant to participate in future SPAC opportunities.

In the worst-case scenario, investors may seek legal compensation if they believe the SPAC and its management violated securities laws or failed to fulfill their fiduciary duties.

As always, thorough due diligence is needed before investing.

This includes evaluating the track record and expertise of the SPAC sponsors, analyzing the target company’s financial statements and prospects, and understanding the terms of the SPAC acquisition.

Now, you may be wondering:

Why Do SPACs Fail

Here are the most common reasons why SPACs fail to merge:

- Failure to identify a suitable target company within the determined time frame.

- Inability to negotiate favorable terms with the target company—such as valuation or deal structure.

- Due diligence reveals issues with the target’s financials or operations that make the transaction unsuitable.

- Regulatory hurdles or other legal issues prevent the merger from happening.

- Market conditions change, making the merger less attractive than originally anticipated.

- Investor sentiment towards SPACs changes, leading to a lack of interest in investing in the SPAC or its target company.

Frequently Asked Questions (FAQs)

What is a SPAC?

A SPAC is an entity whose founders, after forming the company, raise capital through an IPO. The intent? To buy another company with the raised funds. The chosen company will merge with the SPAC and become a public company. Time to completion is 18 months to two years, after which the SPAC liquidates if no acquisition occurs. When a SPAC proposes a merger, SPAC shareholders have the option to redeem their shares rather than participate in the merger.

What happens if a SPAC doesn’t find a target?

If no acquisition occurs within the usual 2 years the sponsors have to find a suitable target, the SPAC liquidates. This means the investors receive their money back.

Is SPAC better than IPO?

One advantage of a SPAC compared to a traditional IPO is that it can be a faster and more efficient way for a company to go public. This is because the SPAC has already raised capital through its IPO, which is then used to fund the acquisition of a target company and take it public. Additionally, the SPAC structure allows for greater flexibility in terms of valuation and deal structure, as the sponsors have more control over the negotiation process with the target company. The SPAC also provides more certainty regarding valuation and equity raised. Disadvantages include founders’ loss of control over the process and loss of visibility.