Disclaimer: This post contains affiliate links. Financestu does not provide investment or tax advice.

Doctors earn a high income.

But burnout and hundreds of thousands in student debt were the cost of that high income.

Because of this many physicians invest in real estate to dig themselves out of that hole and get to a position where paid work is 100% optional.

Take the example of Dr. Jordan Frey, a plastic surgeon and financial educator who went from $500k in debt to financial freedom:

“We started with 1/3 of our savings going to paying off debt, 1/3 to investing in the stock market, and 1/3 to real estate. Now if you look at our net worth about 80% is real estate and it also generates $10,000 of cash flow a month. So it all started out even but real estate has now become a very big part of our wealth. I still invest in stocks, max out my retirement accounts, and invest in a taxable account, but real estate certainly has accelerated that path for us so I think it’s very reasonable for people to invest now.”

Well, “roundtable” investing is growing to become physician’s favorite way to invest in real estate. Below I explain why.

Ready? Let’s dive right in:

What Is “Roundtable” Investing

Imagine a giant roundtable of individual investors just like you.

An investment opportunity is being presented to everyone.

And anyone happy about the deal can simply raise their hand to invest.

It may sound random but it’s how private real estate syndications were explained to me, and since then it’s how I think about them.

Syndications are a way to passively invest in real estate without adding extra work to your day-to-day personal and professional life.

They’re very attractive for high-income busy professionals like physicians:

“Every year I see the benefits of real estate more and more and I think it suits us [physicians] as a profession. You know, if you’re a professional with a busy day job you cannot be a day trader, you’re not sitting by a computer all day long. I think real estate has even more advantages because it gives you peace of mind, you know it will have steady flow returns. Every now and then there’s a little hiccup but I think the hassles are so less.”

Dr. Subhasis Misra

You get tax benefits of direct real estate ownership without the burden of becoming a landlord.

This reduction in your tax bill is especially good when your W-2 income hits those higher tax brackets, which is the case for physicians.

Syndications also increase your passive income, which will enable you to work a part-time schedule giving you weeks off at a time.

Now you may say: “This sounds good but you haven’t told me how it works.”

Here it is:

How Syndications Work (3 Steps)

Before telling you the 3 steps, here are the entities involved in the process:

With that in mind, here are the 3 basic steps to any online syndication (also called crowdfunding):

- A professional investment firm (the sponsor) finds a good real estate deal and needs investors.

- A managing entity—such as EquityMultiple, Yieldstreet, Fundrise, RealtyMogul, or CrowdStreet—presents the deal to a “roundtable” of thousands of individual investors on their platform.

- Interested investors “raise their hand” to buy an ownership stake in the investment.

The heavy lifting happens before and after these 3 steps though.

I say before because first, the sponsor needs to identify a deal where they have an unfair advantage. After that, the managing entity runs extensive due diligence on both the deal and the entity.

EquityMultiple for example, presents to investors only 5% of the investments that sponsors bring to them. They explained their entire process from investment selection to approval in a public whitepaper.

It’s an eye-opener to how syndications work behind the scenes.

I say after because the managing entity has to create the necessary legal structures (typically a Special Purpose Vehicle) to pool the investors’ money together and protect you as an individual investor from liabilities that may come from the investment.

Then they have to actually execute the investment in coordination with the sponsor.

And then closely monitor the investment throughout the years to ensure a profitable exit.

All this is done for you.

Syndications are essentially group real estate investments where you buy fractional ownership of property (typically large property such as an apartment complex).

You earn cash flow, appreciation, and tax benefits without being a landlord.

But direct real estate ownership can also provide this financial independence. So what’s better?

Syndications vs. Traditional Real Estate Investing (Pros & Cons)

Most advice online makes this comparison unfair.

They compare syndications to direct ownership without a property management company and conclude direct ownership is more work.

But is this actually true?

According to Buildium’s 2025 Property Management Industry Report, 58% of small-portfolio rental owners work with a property manager.

Just like most small investors, the syndicator won’t be the boots on the ground collecting rents and fixing broken toilets. They hire a property management company too.

So to make an accurate comparison, we should look at a situation where you buy the property yourself and hire a property manager to take care of everything.

With that in mind, the disadvantages of roundtable investing compared to direct real estate ownership are:

- Flexibility: Owning real estate directly allows you more flexibility on when/how you want to exit the investment. Meanwhile, the sponsor sells or refinances the syndication when they choose, not on your schedule.

- Taxes: Direct ownership over a long time (decades) allows you more write-offs as you’re more involved with the property and 1031 exchanges. It also minimizes capital gains taxes compared to syndications.

On the flip side, roundtable investing does have clear advantages:

- Larger, Institutional-Grade Investments: By pooling your money together with other individual investors you can participate in high-value commercial properties (like apartment complexes and industrial buildings) that used to be exclusive to small wealthy groups and Wall Street fat cats.

- Less work: Direct ownership with a property manager can be considered a passive investment, but all the work before you hire them (finding a property, vetting the seller, paying a large down payment, and finding a trustworthy property manager) is still significant.

For many physicians taking the time to learn what syndications are, and how they work is paying off.

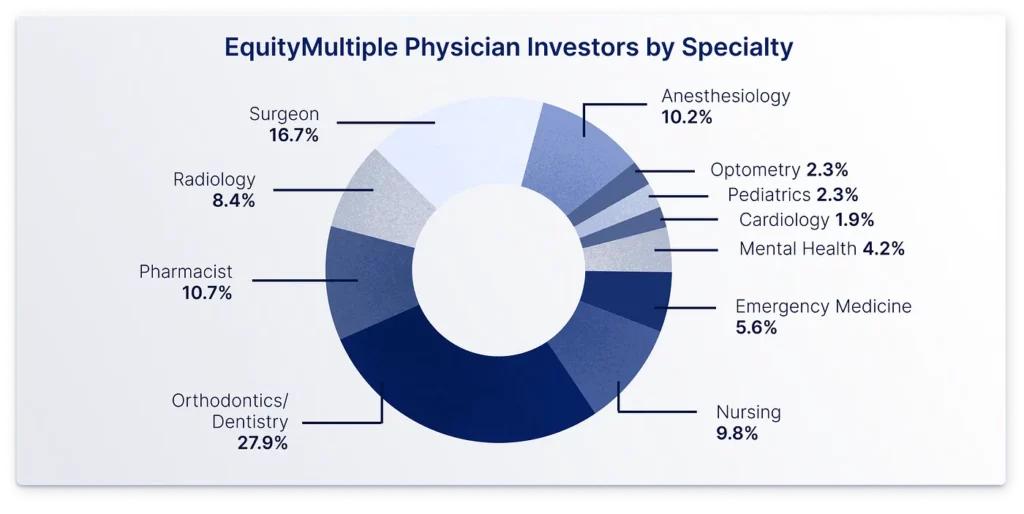

Taking EquityMultiple as an example again, they revealed a significant portion of the thousands of investors on their platform are physicians:

If you look at their Investors’ Stories page (as of March 2025), you will see they have 59,209 investors nationwide. If we take the 25% mentioned in the whitepaper linked above, around 20,000+ physicians are investing with EquityMultiple.

Now, you may be wondering:

How to Join the 20,000+ Physicians at the “Roundtable”

The easiest way is through an online commercial real estate investing platform.

I’ve mentioned EquityMultiple, but you also have Yieldstreet, Fundrise, RealtyMogul, and CrowdStreet.

These are the main platforms people are using in 2025. Here’s a comparison:

| Feature | EquityMultiple | Yieldstreet | Fundrise | RealtyMogul | CrowdStreet |

|---|---|---|---|---|---|

| Investment Types | Direct commercial real estate equity, preferred equity, and debt (short-term notes to longer-term senior loans) | Broad range of alternative investments including commercial, real estate, legal finance, art, and more | Diversified portfolios via proprietary eREITs and eFunds covering residential and commercial properties | Private REITs and direct property investments in residential/commercial property | Individual commercial real estate deals, plus diversified funds option |

| Minimum Investment | Typically $5k but can be $30k+ (depends on the deal) | $10k+ (deal-dependent) | $10 for a brokerage account, $1,000 for IRAs | $5k for REITs, $25k-$50k for individual deals | Typically $25k+ |

| Fees | Annual fees on direct investments are 0.5%-1.5% depending on the deal (sponsors pay fees too) | 1 to 4% management and administrative fees depending on the investment | Annual 0.15% advisory fee + 0.85% management = 1% total | 1-2% asset management and servicing fees depending on the deal | Sponsors pay 1.5% platform fees and may subtract it from investors’ returns |

| Liquidity | For short‑term notes 3-9 months, for longer‑term deals 3-7+ years hold periods | Often 1-5+ year lock-ups | Quarterly redemptions (with penalties) | Typical investment horizon 3-7 years, REIT redemptions not guaranteed | On average 3.5 years, sponsors target 3-5 years but may reach 10 |

| Investor Requirements | Accredited only | Mostly accredited (some non-accredited options) | Open to all, including non-accredited | REITs allow non-accredited, individual deals for accredited only | Accredited only |

| Track Record* | All-time net IRR of 11.9% over 250+ deals totaling over $9.6B capitalization and $478M in returns distributed to investors | Net annualized returns (IRR) of 9.6% across 400+ deals ($4B in funded investments) and $2.4B returned to investors (principal and interest) | 4.6% annualized return on flagship fund, 222 active projects (233 completed) totaling $7B+ portfolio value, and $423M cumulative net distributions | Overall realized IRR of 16.9% over 236 deals totaling $1B+ invested capital ($8B property value) and $236M total realized investment amount | 11.2% realized IRR on $4.4B invested across 800+ deals (216 sold), meaning around $254M in returns realized to investors |

| Unique Features | Curated institutional-quality deals, investor education, extensive transparency and due diligence | Diversified alternative investments beyond real estate, non‑correlated and flexible opportunities | Diversified passive exposure to real estate, low barrier to entry | One of the pioneering platforms offering both REITs and individual property deals, direct deals with sponsors, 1031 exchanges | Extensive due diligence on sponsors, marketplace model, direct sponsor access |

| Platform Members* | 59,209 | 490,980 | 385,000+ | 300,000+ | 300,000+ |

Joining any of these platforms is free. There are no fees for joining. You only pay (indirectly, as it is deducted from your returns) when you invest in a deal.

For a variety of alternative investments (not only commercial real estate), you should choose Yieldstreet. However, some of these investments have led to the SEC suing Yieldstreet in 2023 for misleading investors.

If you want to start small and invest in real estate investment trusts (REITs) you can go with Fundrise.

REITs are more liquid than syndications but don’t diversify away from stocks, don’t counteract inflation, and have zero tax benefits. As this doctor said:

“I’ve been underwhelmed by the performance and volatility of REITs, which has been the main way I’ve invested in real estate outside of our actual home(s). I believe the fund I’m in, a popular index fund, lost 78% in the last recession. I’ve started to shift some of the money I’ve had in REITs to debt and equity deals in the crowdfunded real estate space.”

Source: Interview with Physician on FIRE

RealtyMogul also offers REITs and has had the strongest percentage returns (16.9% IRR) of the platforms above, but has a higher barrier to entry with a $25k minimum. It’s almost a down payment on a house.

For experienced investors who are ok with +$25k minimum investments, CrowdStreet is also a good option. It focuses on institutional-quality deals and does extensive due diligence for you, providing all the details. Unfortunately, in 2024, they had some serious fraud allegations against the platform’s sponsors.

For the best of both worlds, meaning institutional-quality deals with extensive sponsor vetting and detailed due diligence, plus a lower barrier to entry (a typical deal has a minimum investment of $5k-10k) that allows you to test the waters, you can go with EquityMultiple.

Below you can check some of their deals currently available (March 2025):

For accredited investors only ($200,000 individual income, $300,000 joint income, or $1 million net worth).

You’ll notice the focus on high-grade commercial real estate, whereas other platforms feature single-family and sub-institutional properties.

With an account, you can scroll through the deals and see all the details of how million-dollar investment firms run their due diligence. It’s free game.

Using the Mixed-Use Building in Manhattan deal as an example, EquityMultiple shares all the nitty-gritty details to help you decide if you want to invest.

And the deals you see are part of a small 5% who make it through multiple layers of due diligence before becoming available to the public, so you’re getting high-quality opportunities.

Roundtable investing used to be exclusive to the super-rich doing business behind closed doors, but now it’s open to everyone.

Many physicians are taking up seats at the table, raising their hands often to participate in unique deals.

If you take the time to learn about syndications (have a look at all the resources linked in this article), you too can create an additional stream of diversified income and save big on taxes.

Hope this post gives you something to think about.

Frequently Asked Questions

How do I make money from syndications?

There are typically two ways. Through the cash flow generated from the project and/or the gains through the appreciation of the property. Each project has different variables such as purchase price, rent, expenses, and strategy. The money you make depends on this. For example, a multifamily provides immediate cash flow while a new development may only earn cash flow after year 2 or 3.

What happens if the syndication makes a lot more money than expected?

It depends on how the deal is structured. Typically, the extra money is distributed to you as well. A common syndication structure is 70/30, meaning 70% of the profits go to the individual investors, while 30% go to the sponsor. You will hear this referred to as the “split,” referring to the General Partner (GP) / Limited Partner (LP) split of the profits.

Do syndications give me the same tax benefits as direct real estate ownership?

With both, you will benefit from depreciation and interest deductions. However, with syndications investment losses can only offset passive income (other investments), not ordinary income. Direct ownership over a long time (decades) allows you more write-offs as you’re more involved with the property and 1031 exchanges. It also minimizes capital gains taxes compared to syndications, which are essentially real estate flips.

good work!