For those who want to invest but don’t know what and when to buy…

“How +600,000 Busy People Are Outperforming the Market by 375% — Without Ever Going to Business School, or Having Previous Investing Experience”

Today: The Motley Fool team reveals how to get rich safely with stocks that fly under Wall Street’s radar…

From The Motley Fool team

Alexandria, Virginia

Crisp and sunny

January 2024

Dear friend,

If you want to build wealth by investing in stocks…

Then the next 3 minutes will be an important read.

Here’s why:

Putting yourself and your family in a better financial situation is not as difficult as you may think.

Making money requires education and guidance.

And fortunately, the Motley Fool Stock Advisor can provide both.

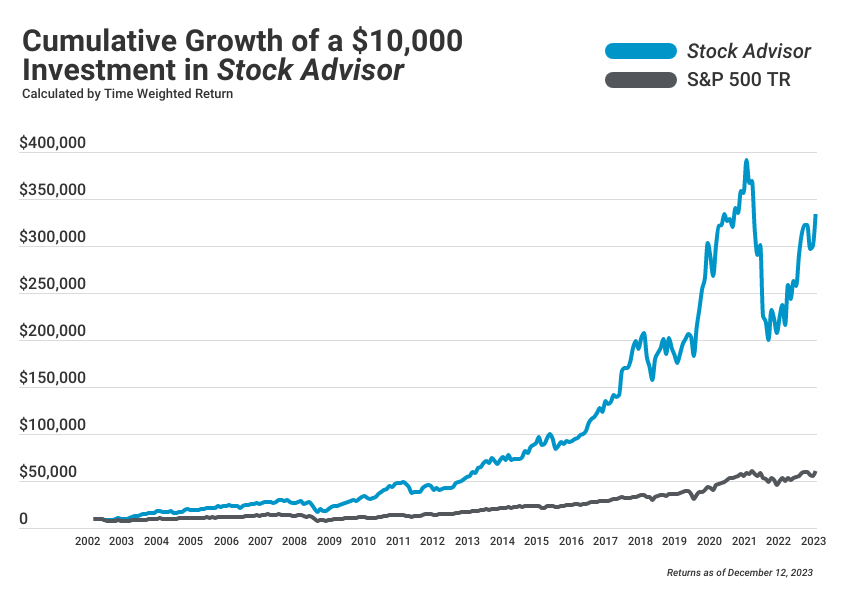

Since the launch of Stock Advisor in February 2002, each stock pick returned on average +508%.

Meanwhile, the S&P 500 generated a total return of 133%.

Meaning:

Stock Advisor’s picks have more than quadrupled the market.

Do you know many professional investment funds with returns like that?

Not a lot.

So to put it in context…

If you had invested $10,000 in the S&P 500 in 2002, you’d have close to $60,000 today.

Not bad, right?

But if you were to put that same $10,000 into Motley Fool’s premium stock picks, your $10,000 would’ve grown to over $330,000 today.

That’s a significant difference.

Now, you may be wondering:

How do Motley Fool analysts manage to beat Wall Street money managers with MBAs, decades of experience, and hundreds of millions of dollars they can use for research…

And most importantly…

“Can I do the same?”

Here’s how you can do better:

Why You Can Beat the Market (But Big Investment Funds Can’t)

You see, the problem with big funds is that their massive size actually becomes a disadvantage.

Think about it:

For a company to grow faster than the market, it must be relatively small.

Why?

Because a smaller company is more agile and nimble than a large corporation.

This agility allows them to adapt quickly to changing market conditions, customer feedback, and emerging trends.

In contrast, established companies have a higher market share already.

This means they have less room for fast growth because they are leaders in their industry already.

They also usually have a ton of red tape, which slows things down even more.

Now, small companies have smaller market capitalizations.

And that’s precisely our advantage as small investors:

The size of these funds doesn’t allow them to invest in smaller companies poised for growth.

Why?

Because they would move the market.

Any significant investment in smaller stocks results in big price fluctuations.

Imagine a fund with $200 billion in assets under management investing in a stock with a market capitalization of $1 billion.

They could easily buy the whole company. And that’s not good.

It’s impossible to accumulate a position in such a company without moving the stock’s price and causing volatility.

And even if they somehow had a good percentage return on the investment?

It would be a very small amount when compared to the $200B in assets.

As such, fund managers often ignore these companies.

These businesses flying under Wall Street’s radar are a great opportunity for small investors.

And they are rarely (if ever!) on CNBC.

Why?

They’re simply not the big, “sexy” tech conglomerates the mainstream likes to talk about. Companies like Google and Facebook.

But that’s not all:

Another Reason Why You Have Better Chances of Beating the Market Than the Big Funds Is…

Many fund managers are limited by the rules and regulations of the fund itself.

When a fund is first launched, it defines an investment policy.

And the fund must follow that policy forever. Until it is closed.

If it fails to follow the policy? It’ll be in trouble with regulators.

So it’s not as if fund managers are poor stock pickers.

Many of them probably have very good personal portfolios.

The thing is…

They are forced to underperform for their clients due to restrictions in the investment policy of the fund.

So…

Now that you know why small investors can beat billion-dollar funds, all you need to learn is how to pick winning stocks.

Easy, right?

On US exchanges alone you have 8,000 stocks to pick from. And globally? 60,000.

It’s a massive overload when you consider all of them.

A great first step is to think about companies you use and like.

But digging deeper into a full analysis—including how good is the management team, how good are the potential returns, and what are the risks—will clarify whether the stock is a winner or not.

The stock market moves quickly and information becomes outdated in days.

Do you have the time to constantly monitor what’s going on in the market?

Because that’s what it takes to become a good investor.

You have to have a deep understanding of…

Not only what you’re buying, but also when it’s the right time to buy.

A great company is not a great investment if you pay too much for the stock.

Look:

The stock market is the greatest vehicle to grow your wealth and become financially free.

And you don’t need a lot to get started. As little as $500 is enough.

However, if you may not have the time look through the thousands of stocks available.

There are mountains of information available online. It’s overwhelming.

And that’s precisely where The Motley Fool Stock Advisor can help…

See How Hundreds of Thousands of People Just Like You Are Getting Rich Safely…

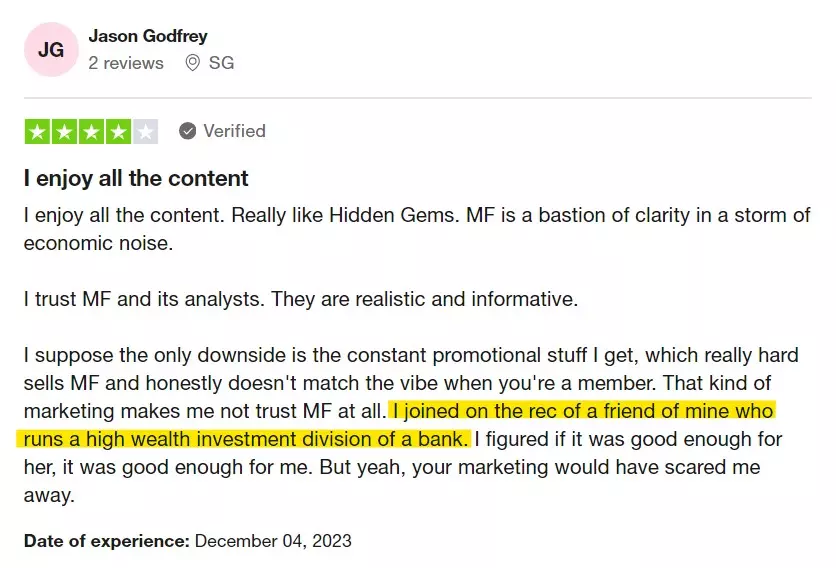

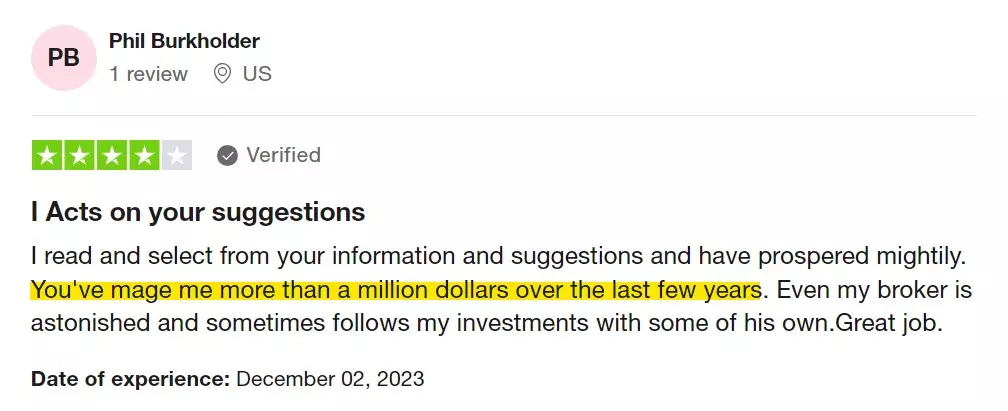

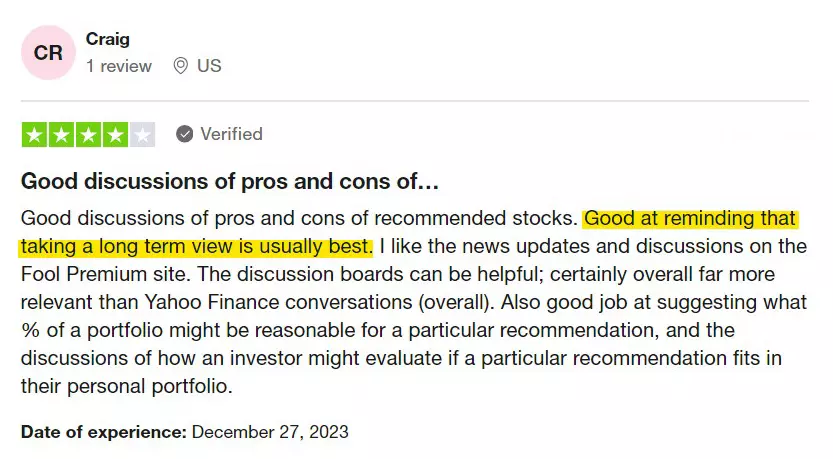

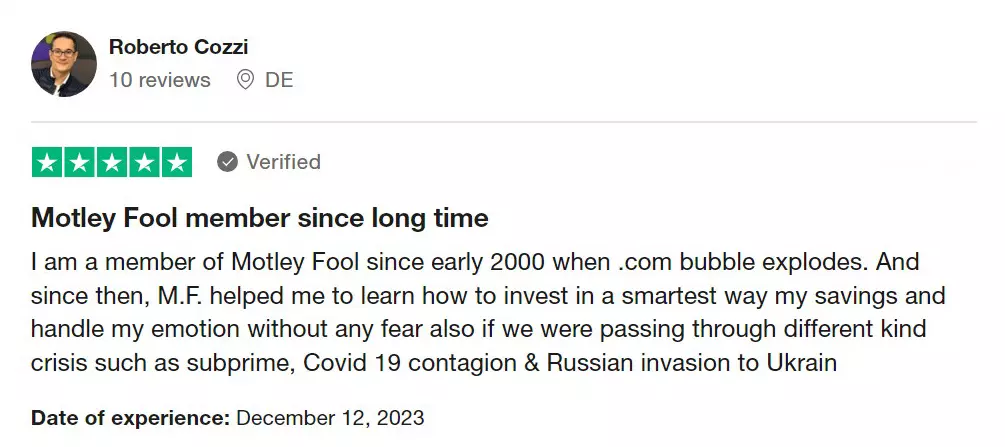

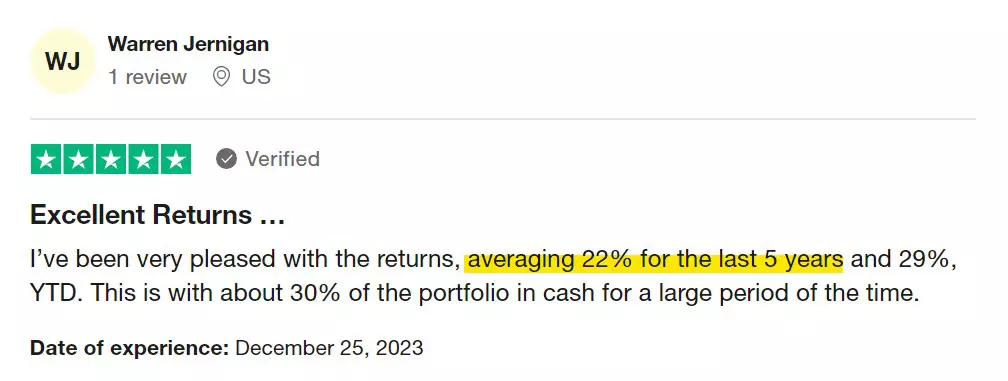

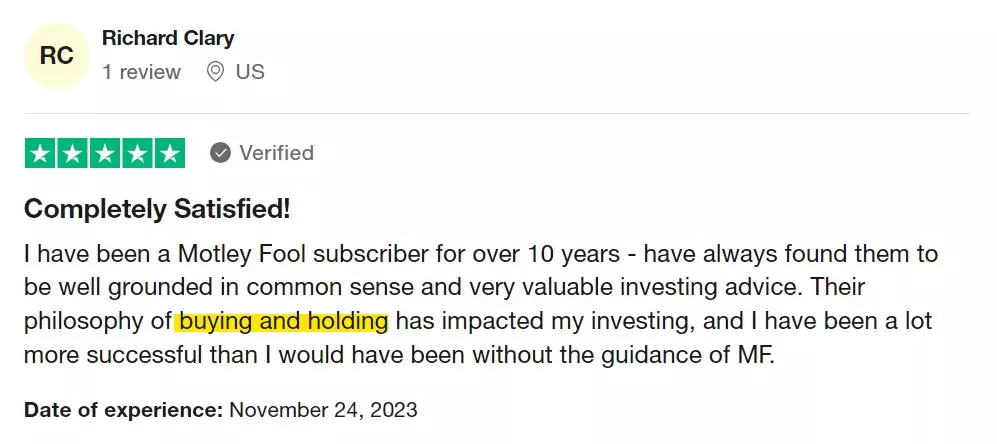

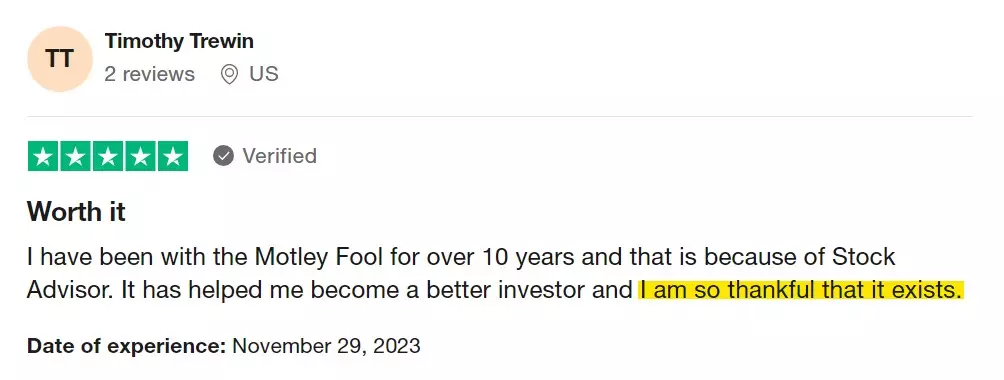

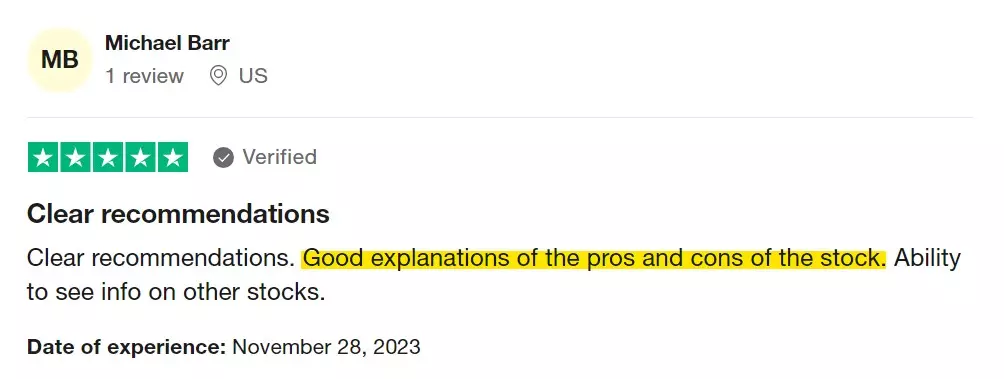

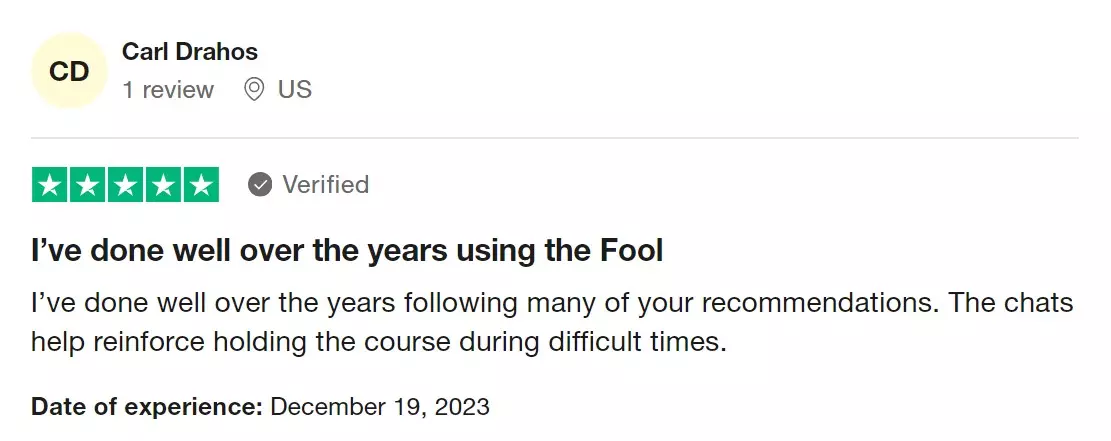

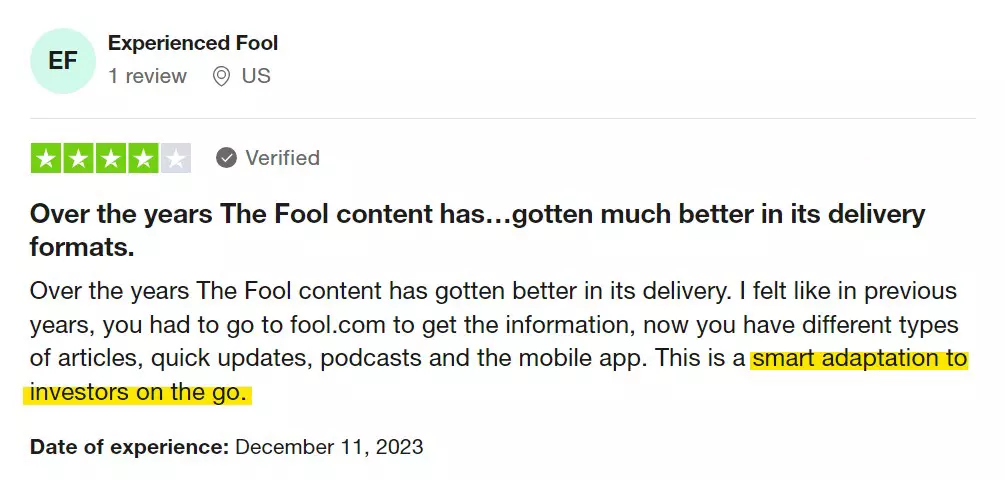

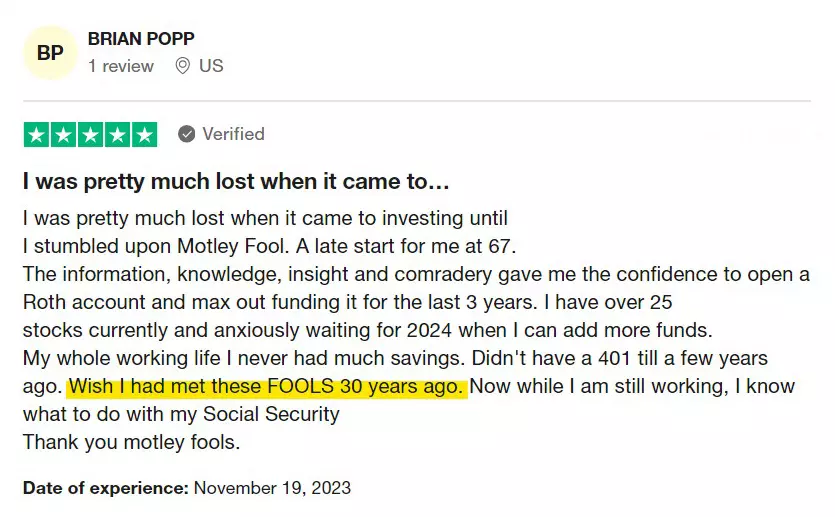

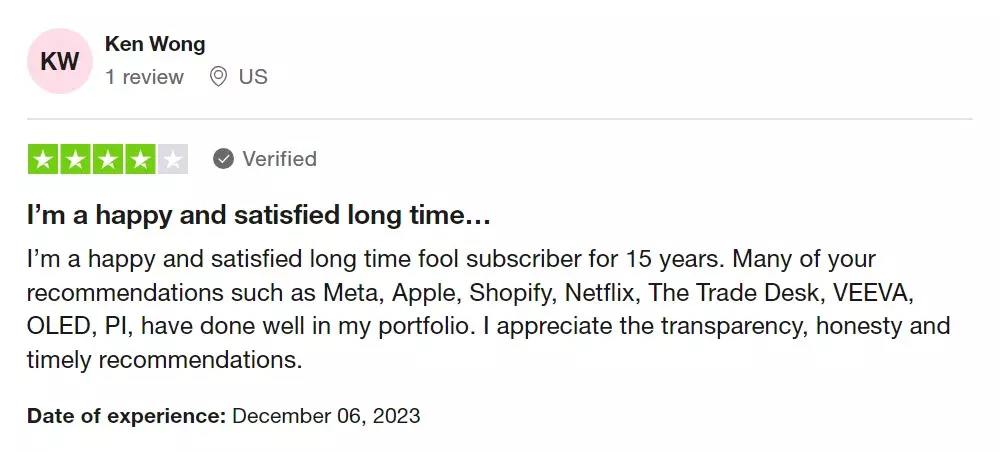

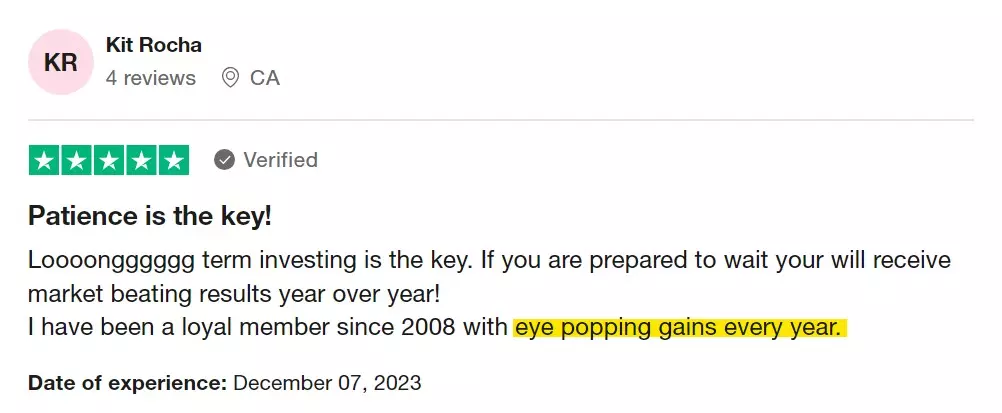

And those are just a few among thousands of 5-star reviews for Stock Advisor.

The Motley Fool is a private financial and investing guidance company with over 30 years of experience.

And Stock Advisor is its finest service.

It’s an online resource for stock research and recommendations for both newbies and experienced investors alike.

You get an expert team of analysts working for you.

These analysts hunt the world for companies ready to skyrocket and give you a fat return.

Our award-winning analysts do the heavy lifting for you.

With their research and analysis, you can build a portfolio that reflects your interests and budget—without having to wonder what’s missing in your decisions.

Stock Advisor takes the guesswork out of investing.

As a member, you can spend less time researching the market and more time enjoying it.

That’s why:

Thousands of individual investors just like you save time and make money our stock picks.

You see, Stock Advisor is beating the market by over 4x since it first launched.

Along the way, it tipped investors off to stocks like Shopify in July 2016, now up an astounding 2,144% since then…

Tesla in November 2012, up 11,387%…

And Nvidia, recommended April 2005, now up 29,817%…

Stocks that can single-handedly turn a few thousand dollars into a life-changing nest egg.

And as a member, these recommendations are delivered directly to your inbox.

It takes just a few minutes a month to keep up to date.

Rather than offering short-term picks that require more active trading, the Motley Fool brings you long-term stocks to buy, hold, and watch the profits grow.

You won’t have to be glued to your computer constantly monitoring buy and sell triggers.

But that’s not even the best part…

Stock Advisor’s award-winning team of analysts breaks down the why behind every single recommendation. In simple terms.

No jargon!

When you join? You get immediate access to world-class educational material and a private community of like-minded investors.

These resources will teach you…

How to Build a Long-Term Buy-and-Hold Portfolio of Hidden Gems on Your Own — While Avoiding Garbage Companies That Will Kill Your Returns…

You see:

The principles of good investing are fixed and enduring.

You will never need to unlearn what you learn about them.

While other stock-picking services promote day trading, automatic signals, and blind systems.

The Motley Fool focuses on the fundamentals of good investing.

Don’t get me wrong:

You can make a lot of money day trading and blindly following short-term signals.

That’s just not our thing, you know?

The Motley Fool has a different approach…

Our team finds undervalued stocks that are primed to outperform the market in the long run.

Before the billion-dollar investment funds buy and drive the price up.

The Motley Fool Stock Advisor portfolio is a blend of small, medium, and large-cap stocks…

Stocks in a select few industries positioned to thrive—not only during the current unique 2024 market environment, but in any market environment.

These aren’t your common names.

You won’t see them being mentioned on CNBC (at least for now).

Instead, they’re “growthier” stocks expected to move faster than their respective broader industries.

Rock-solid fundamentals are the most important thing our analysts look for.

And this means…

The picks are strong, successful businesses—not just any company with potential.

You’ll be recommended long-term wealth-building stocks to hold for years to come—not short-term stocks going up massively in days, but tumbling down just as quickly to a few cents a share.

But that’s not the only advantage Stock Advisor has over other services:

Our team is constantly sharing helpful content with members.

You get deep dives on many companies.

Plus:

You learn the way our expert analysts think and how they approach investing.

So you can learn how to make killer stock picks yourself. And protect yourself against the newbie mistakes.

Still not sure if Stock Advisor is for you?

Here’s a breakdown:

Who Needs This Magic Stock Picking Service?

- Do you want to invest but don’t know what or when to buy? Or don’t have the time to do the research?

- Are you looking to start investing but have no clue where to start?

- Do you have a goal to save and invest your money over the long term so you become financially free, retire in your 40s, and take your family on lavish trips to Europe?

- Are you working a regular 9-5 office job and looking to grow your wealth sustainably—without get-rich-quick schemes, or having to be glued to your computer all day every day?

- Have you saved a nice amount of cash and now want to learn how you can consistently beat the average market returns on your own?

If you answered “yes” to any of the above questions…

You should try out Stock Advisor for yourself…

And see the balance in your brokerage account consistently grow year after year—while the distance between you and your financial goals shrinks.

Now:

The earlier you join, the better.

You’ve probably heard this quote before:

“Time in the market beats timing the market.”

The best time to start investing was yesterday, but the next best time is today.

This is because:

The longer your money is invested, the more it benefits from the compounding effect.

When you start investing early, you can reinvest the money from early wins.

This allows you to grow your initial investment a lot more than if you start late.

Because…

When you start investing late, you miss the chance to easily reinvest your earnings.

Your hard-earned money will grow only based on the initial investment, and not the accumulated returns.

Now, you may be wondering:

“What Exactly Do I Get When I Join Stock Advisor?”

Here’s a full breakdown:

#1) You get two new stock picks each month, delivered directly to your inbox.

No more guesswork, no more hours upon hours wasted researching the wrong stocks, no more missing out on overlooked stocks.

All you have to do is log into your brokerage account and buy the stock.

It literally takes just a few minutes a month to stay up to date.

#2) You’ll also get unlimited access to our library of previous stock recommendations.

This includes over 183 stock recommendations with 100%+ returns, each one carefully aimed at multiplying your net worth and peace of mind.

This means you can log in at any time during your 12-month subscription, and look everything over.

#3) You’ll learn the step-by-step process our analysts used to pick these stocks.

For those who eventually want to manage their portfolio completely on their own…

These are the exact same steps that resulted in stock picks that have returned +508% each on average.

Each stock pick includes a detailed report of the why behind the choice—teaching you what to look for when building a portfolio on your own if you want to.

#4) You can join us on Motley Fool Live every single day.

Each weekday, we’re live covering market news, stock deep dives, special guest interviews, and more!

Staying up to date with the latest market gossip will never be a problem thanks to our member-only live streams.

You’ll get 12 months of access to our expert analysts’ cover of the freshest market developments before they hit the mainstream mass media.

#5) You’ll be invited to a private community of like-minded people.

You can chat with fellow Fools.

In the community forum, you can see what other investors have to say about your favorite companies.

It’s the perfect place to network and have all your questions answered by experts and small investors alike.

(Bonus!) You also get access to dozens of stock reports exposing market trends—before they become mainstream knowledge.

And how about a treasure trove of insights?

As a Stock Advisor member, you get immediate access to a goldmine of stock reports and educational articles.

These include:

- The Long-Term Investor’s Guide to the 5G Revolution: An investor’s guide to this once-in-a-lifetime business disruption. This technology could be worth $17 trillion by the year 2035 and is a game-changer. If there’s one stock for the coming 5G boom, this could be it.

- AI Disruption Playbook: This $15.7 trillion market could be “bigger than the internet,” “worth 35 Amazons,” and create the “world’s first trillionaire.”

- 4 Stocks for the Digital Payments Revolution: People are leaving their wallets at home in China, and the trend is starting to make its way across the globe. You’ll see the four stocks we think can benefit from this revolution that’s still flying under the radar in the US.

- The Next Amazon.com: Jeff Bezos said it himself to his employees “One day, Amazon will fail.” While it feels like Amazon is conquering the world, we believe it is just the first among dozens of huge winners in the e-commerce space. And we’ve identified one we think could be the next Amazon, plus four additional e-commerce stocks to buy.

- And many many more…

You see:

Stock Advisor isn’t just about immediate gains.

It’s about equipping you for long-term financial success.

Our goal is to help you build wealth, not just for 2024, but for many years to come.

And we want to make sure Stock Advisor is right for you.

That’s why:

You Get a 30-Day “Test Drive” with Our Money Back Guarantee

You read that right:

If you are not 110% happy with Stock Advisor… If you get absolutely no value from it… Or if you figure it simply isn’t for you…

You can cancel within 30 days and you’ll receive your membership fee back.

No questions asked.

See:

We’re not asking you to decide yes or no today…

We’re asking you to make a fully informed decision, that’s all.

And the only way you can make a fully informed decision is on the inside, not the outside.

You can’t make this decision right now for the same reason you don’t buy a house without first looking at the inside of it.

So, get on the inside and see if everything laid out in this letter about Stock Advisor is true and valuable to you.

If it is, that’s when you decide to stay.

If it’s not for you, no hard feelings. We’ll still be friends.

Now, let us be clear:

We’re not guaranteeing you’ll hit your goals and change your financial situation in 30 days.

We can’t press the buy button for you. We can’t read and apply the knowledge from all the materials inside for you. We can’t be patient for you.

But we are guaranteeing you will get a lot more than $99 worth of value from Stock Advisor to support you.

And if you don’t feel like we gave you that level of value, we’ll refund you.

Whether it’s 29 minutes or 29 days from now…

If you’re not happy, we’re not happy. And we only want to keep your hard-earned money if you’re happy.

All you have to do is request to cancel. No questions asked.

(By the way, since the launch of this service in 2002, very few people have asked for this.)

With all that said, we just want to leave you with this:

Sure, we’re known for making great stock picks, beating the market, and well…

Having more fun than anyone else while we do it.

But jokes aside:

Our mission is to make the world smarter, happier, and richer.

In other words, we’re here to help individual investors—just like you—make the smartest decisions on the path toward wealth and financial independence.

The fact is, sometimes living up to that mission goes beyond the fun of picking great stocks… and taking a stand for you.

It’s why The Economist called us “an ethical oasis” in the financial industry.

It’s why we’ve been called before Congress… not once, but twice… to testify on the rights of individual investors.

It’s why Arthur Levitt, former chairman of the SEC, stopped by our offices to personally tell us we’re “as close to being an effective investor advocate as any organization in America.”

Look, no one likes taking unnecessary risks.

We all want to feel like we’re fully ready to make important decisions in life.

That’s why we wait for those “perfect moments.”

So get started today by tapping the button below, and lock in a new member discount backed by our 30-day, 100% membership-fee-back guarantee.

And with that said…

Thanks for taking the time to read this letter and we look forward to hearing from you soon!

All the best,

The Motley Fool team

P.S.:

Aaaaaah you made it, to the warm and cozy place in the PS section.

And, in case you’re one of those people who just skip to the end, here’s the deal:

Imagine being able to…

Pay off student loans for you or your kids early.

Jet off to a dream vacation without worrying about how to pay for it.

Say goodbye to the stress of working and enjoy an early retirement.

And that’s just the tip of the iceberg…

When you become a Motley Fool Stock Advisor member, you’ll be joining a thriving community of like-minded investors who love this service.

And we’re confident you will love it too:

Because you’ll receive updated expert coverage on all Stock Advisor recommendations.

(No need to go digging through financial reports—our expert team has broken it all down for you).

Because you can instantly download a boatload of free reports including the AI Disruption Playbook and The Next Amazon.com.

Because you’ll gain instant access to the latest stock picks from our analyst team.

They’ll literally hold your hand through the full process of dissecting a company from top to bottom.

You’ll learn what makes a company a good investment—so you avoid the mistakes they made in their hundreds of years of investing experience combined.

Wish you knew about Netflix or Amazon before they got big?

Well, we told our members about them years before.

Because you’ll instantly discover what 10 stocks our analysts think are the most undervalued right now.

(We can’t believe so many investors are missing out on these opportunities).

Don’t miss another long-term market uptrend.

Don’t miss the chance to build wealth regardless of where the market turns…

And no matter how much it shakes with volatility.

Years from now you’ll look back and be delighted that you took advantage of 2024’s unique market environment.

Is $1.52 a week really too much for how much time and effort you save?

Is it worth it not making a move now, and potentially miss out on all the huge buying opportunities hiding in plain sight right now?

Is the 2 minutes it takes to sign up too much time to waste, even with our 30-day 100% membership fee-back guarantee?

If you’re ready to get in on this sale, click the button above.

Copyright Financestu 2024 | Need help? Let us know at hello@financestu.com The Fine Print Disclaimer: The guidance provided in this publication is general guidance only. It has been prepared without taking into account your objectives, financial situation, or personal needs. Before acting on this guidance you should consider the appropriateness of the guidance, having regard to your own objectives, financial situation, and personal needs. To the maximum extent permitted by law, the author and related entities and the publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based on the information provided. Financestu.com is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through the links above, the Ficancestu.com team will get a share of the revenue from your purchase (at no extra cost to you). The Finnacestu team has had an active Stock Advisor subscription for years. We’d gladly recommend Motley Fool to you with no benefit to us, and have been doing so to friends and family for years. But our friends at Motley Fool gave us that affiliate link. And we’re happy to recommend them to you. It’s better than any online stock-picking service we’ve ever joined. The opinions of the Financestu.com team remain our own and are unaffected by The Motley Fool. © 2024 Financestu. All Rights Reserved