Depreciation should not exceed capital expenditures in the terminal year of a DCF model unless you want to assume the value of the company’s assets will go to zero.

When estimating the Enterprise Value of a firm through a DCF model, the last forecasted year is very important because it serves as a reference for the value of the cash flows beyond the forecasted period and into perpetuity—the terminal value.

Wondering if can depreciation be higher than CapEx? If forecasted CapEx is greater than forecasted depreciation, the business is growing. And if it’s smaller it is shrinking.

Still confused? Keep reading for a more comprehensive answer.

We’ll start by understanding what is CapEx, what are depreciations, and how are they used in Discounted Cash Flow (DCF) analysis—particularly how they affect the terminal value. Then, we’ll go through the relationship between CapEx and depreciation.

Let’s dive right in:

CapEx vs. Depreciation

Let’s go through a quick review of some key concepts and how they’re all connected:

Capital expenditures, or CapEx, are investments a company makes in fixed assets.

It’s money spent buying, maintaining, or improving long-term physical assets used in the company’s operations, such as property, plant, and equipment (PP&E), or technology.

Unlike day-to-day operating expenses (cost of goods, rent, wages, taxes) recorded directly on the income statement, capital expenditures are capitalized on the balance sheet and considered an investment. Why? Because the utility of fixed assets goes beyond just one year.

This means when a company buys new equipment (a capital expenditure), the money it paid is not reflected on the income statement for that year.

Instead, the cost of the asset is spread out over its useful life to reflect the decay in its value over the years.

In other words, no fixed asset lasts forever. At some point, it becomes ineffective and loses its value. The yearly rate at which the asset decays is the depreciation (D&A).

Now, depreciation doesn’t represent actual cash leaving the company.

Hence, when calculating the Free Cash Flow to the Firm (FCFF) to build the Discounted Cash Flow (DCF) model and estimate the Enterprise Value (EV) of a company or the fair value of a project, you:

- Add back depreciation to NOPAT.

- Subtract capital expenditures.

- Subtract changes in working capital.

For the DCF analysis, you should include a number of forecasted years you’re confident enough to make assumptions for—usually 3-10 years.

The last year in the forecasted period (called cruise year) is especially important. The values you assume for this last year are a reference for the terminal value—generally the most significant component of the enterprise value of the business.

The terminal value represents the present value of all expected future cash flows beyond the forecast period.

It is calculated assuming a stable perpetual growth rate for the business—typically a conservative number aligned with inflation or GDP growth to average out potential future years of both economic downturns and prosperity.

When calculating the perpetuity value using the last forecasted year’s FCFF, the terminal growth rate is applied to everything in the modified income statement.

As such, you need to pay close attention to the values you have for each item in that last year—especially CapEx and depreciation.

Here’s why:

CapEx and Depreciation in Terminal Value

In most DCF calculations, the terminal value is the most important component of the total value (EV). And the terminal value builds upon the FCFF for the last year of projected cash flows.

Thus, you should normalize it, rather than unrealistically assume a company’s short-term circumstances into infinity.

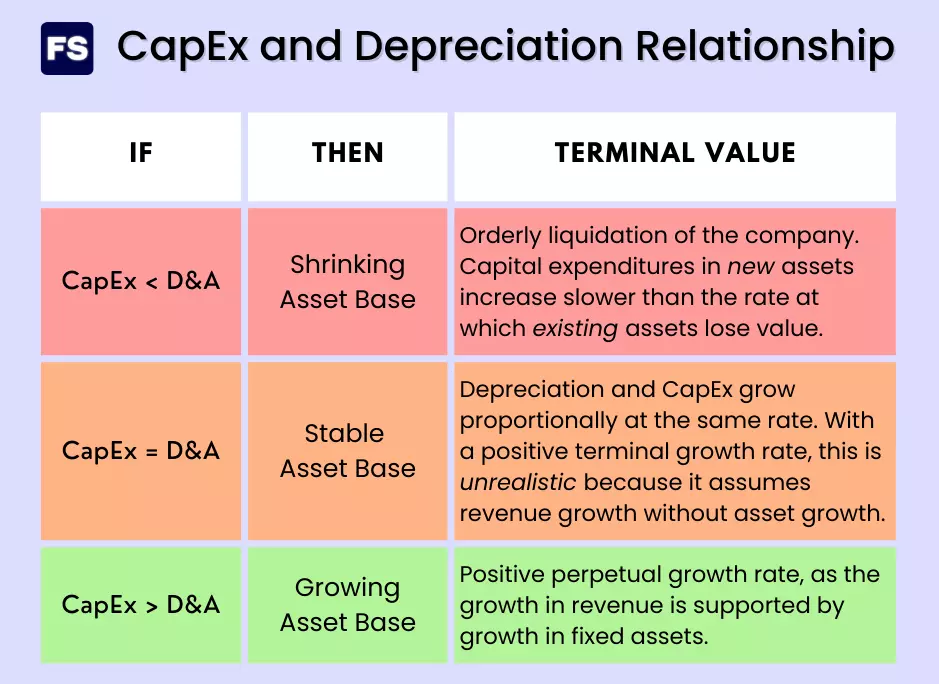

More specifically, the relationship between CapEx and depreciation determines if you are forecasting a growing or shrinking business.

Remember, CapEx is the difference between PP&E year over year minus depreciation.

Depreciation and CapEx can be higher or lower than each other during the projection window of the DCF model—implying if PP&E is growing or contracting.

Now, in the final year of the forecasted period, you set the company’s financial performance for forever—assuming it doesn’t go out of business.

Therefore you need to know what each case implies:

CapEx Higher than Depreciation

This is the most common case, as CapEx typically exceeds depreciation. Why?

A growing company needs CapEx greater than depreciation in order to sustain its growth.

Additionally, the longer the depreciation period of an asset, the greater the difference between CapEx and depreciation.

In the last year of the projection period, capital expenditures must exceed depreciation by an amount that assumes assets grow at least at the company’s long-term growth rate.

Why?

Because if you suppose a positive perpetual growth rate but capital investments are lower or equal to depreciation, you are assuming sales growth without additional investments in assets, which is very unrealistic.

Capital expenditures must outpace depreciation if the company needs to increase its output to achieve terminal value revenue growth assumptions.

By the way, inflation can increase both capital expenditures and depreciation, not just capital expenditures.

CapEx Equal to Depreciation

An analyst can also assume depreciation and CapEx are equal in the last forecasted cash flow.

In this case however, a positive terminal growth rate implies growth in revenue without asset base growth, which is unrealistic.

Maintenance CapEx is when capital expenditures and depreciations converge. Meaning, there are just enough investments to maintain and replace existing assets. This is the case when capital expenditures equal depreciation.

In contrast, growth capital expenditures are investments in new assets that grow the asset base.

Depreciation Greater than CapEx

CapEx below depreciation means mathematically the book value of fixed assets is decreasing.

It’s an orderly liquidation of the company, as having depreciation higher than CapEx in the last forecasted year implies the company will eventually have no tangible assets in the future.

CapEx lower than depreciation is not a problem in the middle years of the forecasted DCF model period. It can happen because:

- A recently completed investment program that results in low capital expenditures in the following years due to a lack of new investment opportunities. This is especially true in asset-heavy industries that don’t require much additional capital investment after the first installation cost, such as the energy sector.

- When a company acquires another in an M&A deal, it must allocate the acquisition price to the assets and liabilities of the acquired company (Purchase Price Allocation, or PPA). This important step in accounting reporting may increase total assets to reflect their fair value. The result? An acceleration of the depreciation expense over the useful life of the assets, surpassing CapEx in the short term.

- Newer equipment is less expensive. In some industries, equipment becomes more efficient and cheaper to manufacture over the years.

However, all these reasons are exceptions to the rule—in general, CapEx is higher than depreciation because it means the asset base is growing along with the business.

Therefore, you should not project an off year into perpetuity.

If the cruise year values are not aligned with your expectations for the future of the business, and as such you don’t want to use them as a reference, adjust them.

On a separate note, corrosion in asset base accounting value can be disconnected from the real value of the assets:

Depreciation could be totally meaningless economically. For instance, if a company owns a building, it depreciates it every year in the income statement, while its market price could have doubled.

CapEx and Depreciation in Terminal Year Example

Let’s go through a quick DCF valuation example employing the FCFF methodology to calculate the equity value.

Imagine a company with the following cash flow projections for the next 3 years:

| Year | 1 | 2 | 3 |

| EBITDA | 400 | 430 | 450 |

| Depreciation | -100 | -110 | -125 |

| Capital Expenditures | -150 | -200 | -100 |

| Net Working Capital Variation | -18 | -20 | -20 |

The WACC (Weighted Average Cost of Capital) of the company is 8%, the corporate tax rate is 20%, and the perpetual growth rate after year 3 is estimated at 4%.

The growth rate is crucial for the terminal value calculation, as it assumes CapEx and depreciation along with all the other items grow at a 4% rate after year 3.

Notice that the depreciation (125) in the last forecasted year is higher than the capital expenditures (100).

On the other hand, the perpetual growth rate is positive.

Therefore, to compute the terminal value, year 3 cannot be used as a reference year.

Instead, the value of CapEx must be equal to the annual depreciation times the constant growth rate (4%), at least.

| Year | 1 | 2 | 3 |

| EBITDA | 400 | 430 | 450 |

| Depreciation | -100 | -110 | -125 |

| EBIT | 300 | 320 | 325 |

| Income Taxes (20%) | -60 | -64 | -65 |

| NOPAT | 240 | 256 | 260 |

| Depreciation | +100 | +110 | +125 |

| Operational Cash Flow | 340 | 366 | 385 |

| Capital Expenditures | -150 | -200 | -125x(1+4%)=-130 |

| Working Capital Variation | -18 | -20 | -20 |

| Free Cash Flow to the Firm | 172 | 146 | 235 |

With this new adjusted CapEx, you can calculate the present value of cash flows and terminal value (using the WACC as the discount rate) to get the intrinsic value of the business:

An alternative solution to adjusting CapEx in year 3 is to construct an additional year 4 where everything in year 3 grows at the growth rate, and adjust the CapEx to depreciation plus the growth rate.

Now, you may be wondering:

What happens if CapEx is disproportionally higher than depreciation?

It depends on the assumed growth rate after the projected cash flows.

If the company invests a lot more in CapEx than what is needed to renovate its fixed assets (depreciation) it should have a higher perpetual growth rate.

Do you really understand the relationship between CapEx and depreciation now? Test your knowledge with these 5 questions.

Key Takeaways (FAQs)

Is CapEx equal to depreciation in terminal year?

It depends on what you want to assume happens after the forecasted period in the DCF model. When capital expenditures equal depreciation, the company is reinvesting just enough to maintain its existing fixed assets. Its asset base won’t grow in the future.

Why are CapEx and depreciation important in the terminal year?

When a company makes a capital expenditure and adds a new asset to its balance sheet, that asset depreciates over time until its book value is zero. This means if CapEx is higher than depreciation in the terminal year, the company is expanding into infinity. Why? Because its assets grow faster than they depreciate. If CapEx is lower, the asset base will go to nothing as it is depreciating faster than it is growing.

Should CapEx be higher than depreciation?

As a rule of thumb, capital investments should slightly exceed depreciation to sustain perpetual growth. Most businesses are growing and need capital investments to do so. A depreciation bigger than CapEx in one year is not a problem. This can happen when there’s a lack of opportunities to invest. However, if CapEx is below depreciation for many years in a row, it means the business is slowly liquidating itself.