Both WACC and APV help you get the present value of a project or asset that will generate future cash flows. The difference between APV and WACC is that APV incorporates the value of the interest tax shield generated from debt financing directly, rather than by adjusting the discount rate, as in the WACC method.

To better understand this, we’ll go through 4 simple steps: what is APV, what is WACC, the similarities and differences between APV and WACC, and an example of a valuation with both approaches.

1) What is APV

The Adjusted Present Value (APV) Method is a valuation method in which you determine the levered value of an investment by first calculating its unlevered value, which is its value without leverage (debt) financing, and then adding the present value of interest tax shields gained from debt.

The adjusted present value shows you the benefits of tax shields that result from deductions of interest payments on loans.

For leveraged transactions, APV is preferred, especially when valuing leveraged buyouts.

How to Calculate APV

To determine the value of a levered investment or project using the APV method, you can follow the following steps:

Determine the investment’s value if it were financed without debt (solely with equity) by discounting its free cash flows at the unlevered cost of capital.

The unlevered cost of capital is given by the following formula:

Unlevered Cost of Capital =

Risk-Free Rate + Unlevered Beta x (Expected Market Return – Risk-Free Rate)

Unlevered Beta is also known as asset beta, and it gives you the volatility of a company’s returns without taking into account its leverage.

The next step to calculate the APV is to determine the present value of the interest tax shield. How so?

Given the expected debt at a certain future date, the interest tax shield is the multiplication of the interest paid on that debt by the corporate tax rate.

After this, you discount the interest tax shield to get its present value. If a constant debt-equity ratio is maintained, using the unlevered cost of capital is appropriate.

But, if you know the exact debt repayment schedule, you can discount it at the debt’s interest rate. This rate is usually lower than the unlevered cost of capital, thus reflecting the lower risk of knowing how much is left to pay in the future.

The final step is to add the present value of the interest tax shields to the unlevered value of the project. This will give you the value of the investment with leverage.

2) What is WACC

The Weighted Average Cost of Capital (WACC) method takes the interest tax shield into account by using the after-tax total cost of capital (cost of equity + cost of debt) as the discount rate for the expected future cash flows of the investment.

When the risk of the new project is similar to the average risk of the company’s previous investments, then its cost of capital is equal to the firm’s weighted average cost of capital (WACC).

How to Calculate WACC

The key steps in the WACC valuation method are the following:

- Determine the free cash flow of the investment.

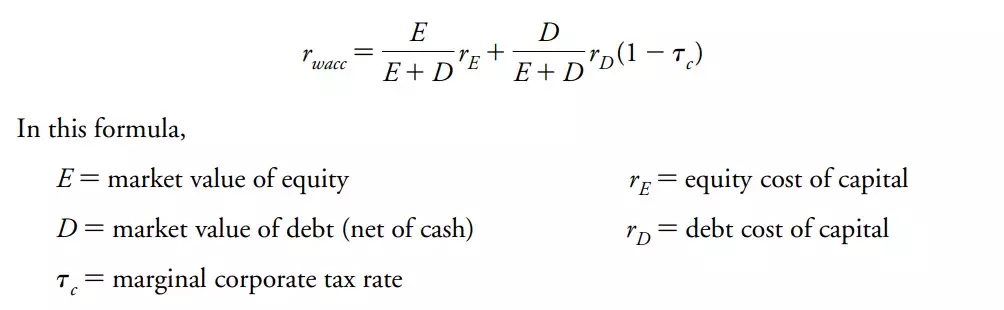

- Calculate the weighted average cost of capital given by the formula below.

- Calculate the value of the investment by discounting the free cash flows of the investment using the WACC rate.

Because you calculate the WACC using the effective after-tax interest rate on loans as the cost of debt, this method includes the tax benefit of leverage implicitly through the cost of capital.

3) Similarities and Differences between APV and WACC

The WACC blends the cost of equity and the after-tax cost of debt, whereas the APV values the effects of the cost of equity and the contribution of the cost of debt separately. Despite providing lots of benefits, APV is used less often than WACC in practice. It is predominantly used in academic settings.

Both methods have a lot in common though:

- They value a project based on its free cash flow, which is computed ignoring interest and debt payments.

- Both APV and WACC are considered Discounted Cash Flow (DCF) methods for capital budgeting.

- Under the same assumptions, both give you the same value for the investment/project.

The basic process of capital budgeting involves forecasting future cash flows and then discounting them to their present value at a rate that reflects their riskiness. If a project’s risk is different from the risk of the company as a whole, you must estimate its cost of capital using data from comparable companies instead of your company.

First, you estimate the free cash flow generated by the investment/company.

Then, you discount the free cash flow based on the project’s cost of capital to determine its net present value (NPV).

Because a company can deduct interest payments as an expense, debt financing creates a valuable interest tax shield.

You can take into account the value of this tax shield in a couple of ways:

The WACC method, in which you discount the free cash flows using the weighted-average cost of capital.

Alternatively, you can first value an investment’s free cash flows without leverage by discounting them using the required rate of return on all-equity capital (unlevered cost of capital).

Then, you estimate the present value of the interest tax shields from debt and add them to the previous calculation. Explicitly adding the value of the interest tax shields to the project’s unlevered value is what we call the adjusted present value (APV) method.

Even though their details differ, both methods deliver the same estimate of an investment’s value when under the same assumptions.

The difference between APV and WACC is in the details of their execution, and how they account for the value created or destroyed by financial decisions, as opposed to operations.

Both methods have a couple of assumptions:

- The project has average risk. You assume the initial risk of the project is equivalent to the average market risk of the firm’s investments. This means you can assess the project’s cost of capital based on the risk of the firm.

- The company’s debt-equity ratio is constant. This implies the risk of the firm’s equity and debt, and therefore its weighted average cost of capital, will not fluctuate due to leverage changes.

- Corporate taxes are the only imperfection. The main effect of debt financing on valuation is the corporate tax shield. We ignore other consequences of leverage like personal taxes, issuance costs, financial distress, and agency costs.

While these assumptions are restrictive, they are a good approximation for many investments and businesses.

4) WACC vs. APV Example

Say a project requires an initial investment (capital expenditure) of $25 million. The company is buying some new equipment and expects it to be obsolete in 4 years. After the initial investment, the project will generate free cash flows of $10-16 million per year.

| Year | 0 | 1 | 2 | 3 | 4 |

| FCFF | -25 | +10 | +12 | +14 | +16 |

The company intends to maintain a similar debt-to-equity ratio for the foreseeable future, including any financing related to this new project. It has about $200 million in debt on its balance sheet and $300 million in equity. Thus, the total value of its assets is $500 million.

As to its cost of capital, the cost of debt is 4% and the cost of equity is 7%.

Considering a corporate tax rate of 40%, the weighted average cost of capital is:

You can determine the value of the project, including the tax shield from debt, by calculating the present value of its future free cash flows using the WACC of 5.16%:

Because the upfront capital expenditure is $25 million, the project’s NPV is 45.48 – 25 = $20.48 million.

If you use the adjusted present value approach, you first start by calculating the unlevered cost of capital. Because this company maintains a constant target debt-to-equity ratio, the unlevered cost of capital can be estimated as the weighted average cost of capital computed without taking into account taxes (pretax WACC):

If you discount the cash flows at the pre tax WACC of 5.80%, the project’s value without leverage is the following:

$44.76 million is the value of the unlevered project, as it doesn’t include the value of the tax shield generated by the interest payments on debt.

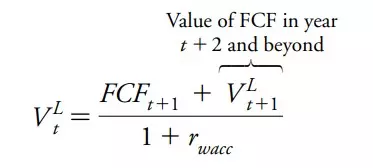

To calculate this, you need to know the debt capacity, which is how much debt is required each year to maintain the constant debt-to-equity ratio. Starting with the project’s FCF, you compute its levered continuation value each year.

Because the continuation value includes the value of all cash flows for the following years, it is simpler to compute the value at each year by working backward from the 4th year, discounting the next year’s free cash flow and continuation value:

Once you have the VL for each year, you can compute the project’s debt capacity:

| Year | 0 | 1 | 2 | 3 | 4 |

| FCFF | -25 | +10 | +12 | +14 | +16 |

| Levered Value (VL) @ rWACC = 5.16% | 48.48 | 37.83 | 27.78 | 15.21 | – |

| Debt Capacity (200/500 = 40%) | 18.19 | 15.13 | 11.11 | 6.09 | – |

| Interest Paid (rD = 4%) | 0.73 | 0.61 | 0.44 | 0.24 | |

| Interest Tax Shield (40% tax) | 0.29 | 0.24 | 0.18 | 0.10 |

To get the interest paid, you multiply the debt by its cost (interest rate). The interest tax shield is equal to the interest paid multiplied by the corporate tax rate.

When the company maintains a target leverage ratio, its future interest tax shields have a similar risk to the project’s cash flows, so they should be discounted at the project’s unlevered cost of capital. If it were a fixed debt schedule without the goal of a fixed debt-to-equity ratio, you should use the interest rate as a discount rate.

Thus, the present value of the interest tax shields is:

To determine the levered value of the project, you add the $720,000 of tax shields to the unlevered value of the project of $44.76 million and get $45.48 million.

Again, taking into account the initial investment, the project’s NPV is $20.48 million, which matches precisely the value we computed before with the WACC approach.

The APV method is more complicated than the WACC method because you have to compute two separate valuations: the unlevered value of the project and the interest tax shield.

APV vs. WACC Frequently Asked Questions

Is APV or WACC better?

Both methods give you the same valuation for the investment if they’re under the same assumptions. Thus, the choice is mostly a matter of convenience. As a general rule, the WACC method is the easiest to use when the business maintains a fixed debt-to-equity ratio over the life of the investment. But if the company adjusts its debt every year according to a fixed schedule known in advance, the APV method is better because you will need to calculate a different WACC for each year.

What is the difference between APV and NPV?

NPV generally uses the weighted average cost of capital (WACC) as the discount rate, while APV uses the unlevered cost of capital as the discount rate and later adds interest tax shields. The value of a debt-financed project can be higher than just an equity-financed project, as the cost of capital falls when you use leverage. Using debt can actually turn negative NPV projects into positive.