Disclaimer: This post contains affiliate links. Financestu does not provide investment or tax advice.

Doctors love it.

The internet is full of former doctors making money by giving personal finance advice to other doctors.

Much of their investment advice swears real estate is the best asset class to put your money to work and retire early.

But is it actually worth it in 2026? Is it safe? And what’s the right way to invest?

I went through 20+ personal finance blogs authored by doctors, signed up for dozens of their newsletters, and scrolled through countless forum discussions and comment sections, where physicians debate the pros and cons of different types of real estate investing.

This post aggregates everything I found.

That being said, I recommend you stick to the end to understand what the biggest limitation of real estate really is.

First, let’s quickly go through…

The problem real estate solves

Real estate is perceived as more reliable for building a nest egg than stocks. And that’s for good reason.

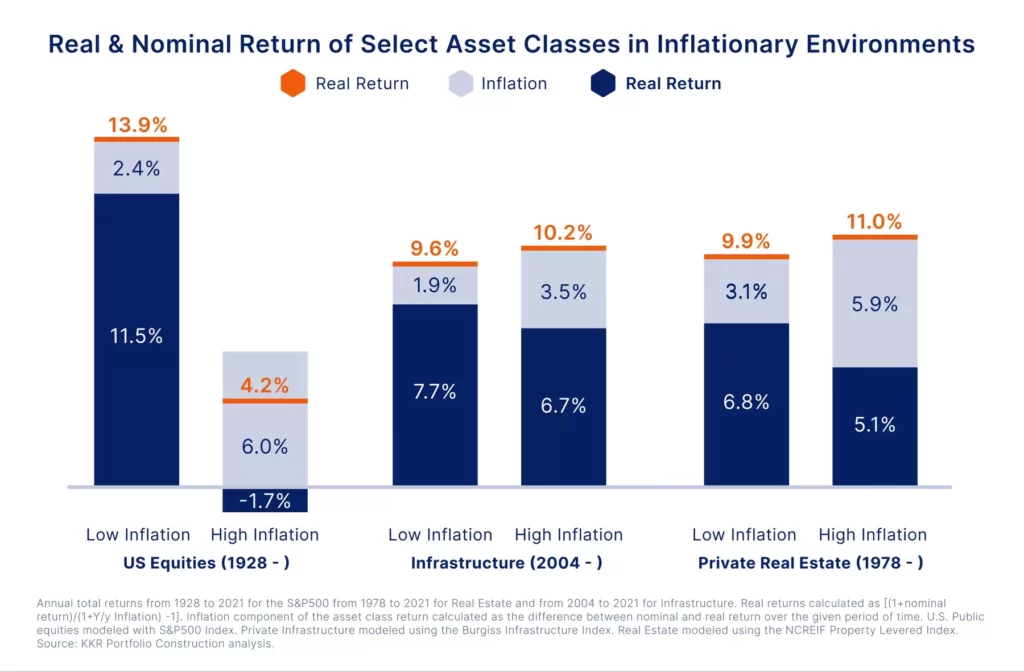

Have a look at this chart:

Historically, real estate is less volatile than stocks.

As an investor, real estate helps you protect your portfolio against risk during times of instability.

People need a house to live. Unlike stocks, it’s the last thing they give up in a recession. During 2008, multifamily real estate had the lowest default rate among other asset classes.

Other key advantages of real estate are:

- More leverage allowed: You can buy a home by putting down only 20% of your own money, but no one will give you a 5x stock trading margin account even if you invest “safely” in index funds only.

- Tax deductions: Real estate allows you to claim valuable tax deductions like depreciation. This is especially worthwhile for high earners like physicians whose W-2 income hits the higher tax brackets. Stocks allow you to deduct nothing, plus they have capital gains and dividend taxes.

- Tangible asset: Stocks are ownership in a company. Gains feel abstract because it’s not a physical asset. Compare that to providing homes to families in your hometown.

- Less volatility: Stocks are more sensitive to market risk due to investors’ emotions and billion-dollar hedge funds exploiting inefficiencies in the market.

So real estate is definitely an asset class you should have in your investment portfolio.

Maybe even the main one if your journey turns out similar to Dr. Jordan Frey, who went from $500k in debt to financial freedom. He said:

“We started with 1/3 of our savings going to paying off debt, 1/3 to investing in the stock market, and 1/3 to real estate. Now if you look at our net worth about 80% is real estate and it also generates $10,000 of cash flow a month. So it all started out even but real estate has now become a very big part of our wealth. I still invest in stocks, max out my retirement accounts, and invest in a taxable account, but real estate certainly has accelerated that path for us so I think it’s very reasonable for people to invest now.”

Now, you may be wondering:

Owning property is a lot of work, isn’t it?

It depends. You can hire a property manager to take care of everything.

They will attract potential tenants, prepare lease agreements, collect rent for you, and keep the property in good condition.

Most property managers work with investors who own dozens of properties.

But you can still find some that accept working with beginner real estate investors.

This means direct ownership does not have to be a second job as a landlord.

According to Buildium’s 2025 Property Management Industry Report, 58% of small-portfolio rental owners work with a property manager.

However, you still have to find a property to buy, a property manager you want to work with, and afford the high cost of a down payment.

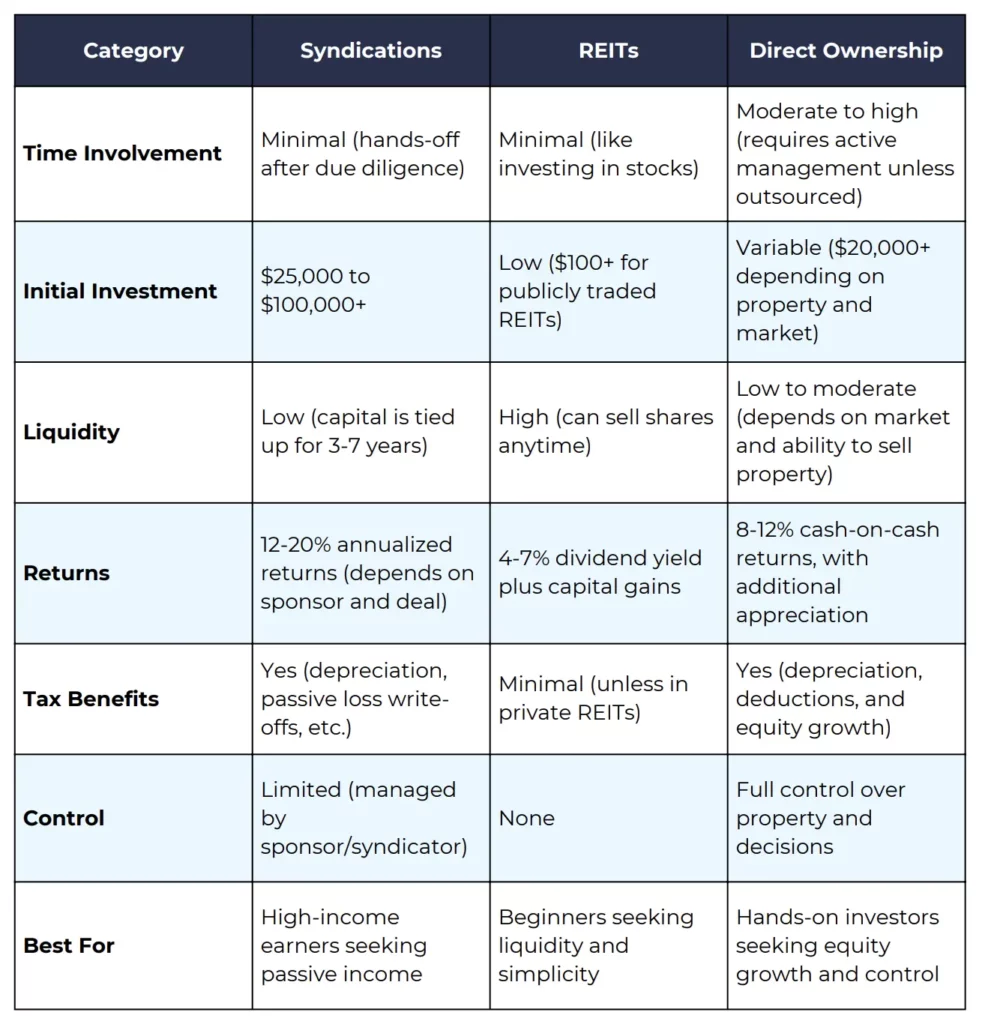

That’s why a lot of physicians also invest in real estate investment trusts (REITs).

These are companies that own, operate, or finance income-producing real estate.

REITs are publicly traded like stocks, which makes them highly liquid unlike a direct real estate investment. You can also invest as much (or as little) as you want.

It’s true passive real estate investing, but here’s the problem:

You don’t get any of the depreciation tax deductions from the properties the REIT invests in.

Not to mention REITs are correlated with the stock market, meaning they don’t give you the diversification benefits (which is the whole point of investing in real estate).

For example in 2022, the S&P 500 had a negative return of -18.1%, as well as U.S. REITs which had -25.1%. At the same time, home values jumped up 10.49%.

This is why physician real estate investors are also big on syndications...

Is this the best way to invest in real estate?

Syndications give you a lot of the benefits of direct real estate investing without the work.

They are essentially group real estate investments where you buy fractional ownership of a larger property such as an apartment complex.

You earn cash flow, appreciation, and tax benefits without being a landlord.

Most online syndications (also called crowdfunding) work in 3 steps:

- An investment firm finds a good real estate deal.

- A managing entity—such as EquityMultiple, Yieldstreet, Fundrise, RealtyMogul, or CrowdStreet—presents the deal to individual investors on their platform.

- Interested investors buy an ownership stake in the investment.

For example, EquityMultiple runs extensive due diligence, presenting to investors only 5% of the investments they consider.

And they will show you everything about a deal:

Using the Mixed-Use Building in Manhattan deal as an example, EquityMultiple shares all the nitty-gritty details to help you decide if you want to invest.

Below you can check out more of their deals currently available (February 2025) but you probably need to create an account:

For accredited investors only ($200,000 individual income, $300,000 joint income, or $1 million net worth).

Physicians are the largest professional segment investing in EquityMultiple.

According to their 2024 whitepaper "How Physicians Can Build Stronger Portfolios with Real Estate" they represent more than 25% of EquityMultiple’s entire investor community.

Before you join them though, let's look at the disadvantages of syndications compared to direct investments so you know what's best in your specific situation:

- Flexibility: Owning real estate directly allows you more flexibility on when/how you want to exit the investment. Meanwhile, the sponsor sells or refinances the syndication when they choose, not on your schedule.

- Taxes: Direct ownership over a long time (decades) allows you more write-offs as you're more involved with the property and 1031 exchanges. It also minimizes capital gains taxes compared to syndications.

A lot of the advice online comparing direct real estate investing and syndications doesn’t tell the real story.

They compare syndications to direct ownership without a property management company, which is not fair because it overstates the difficulty of direct ownership.

On the flip side, syndications do have clear advantages:

- Larger, Institutional-Grade Investments: By pooling your money together with other individual investors you can participate in high-value properties (like apartment complexes and commercial buildings) that used to be exclusive to small wealthy groups and Wall Street fat cats.

- Less work: Direct ownership with a property manager can be considered a passive investment, but all the work before you hire them (finding a property, vetting the seller, paying a large down payment, and finding a trustworthy property manager) is still significant.

It's important that you weigh the pros and cons of both ways of real estate investing according to your lifestyle and money goals.

Questions? Thoughts? Feedback? Let me know in the comments below.

Hugo,

Again, spot on! You do a great job highlighting syndicators are more short-term real estate flippers than long-term investors. I do both but we need to be clear. More people like you should be talking about this. In medical blogs, I am concerned to some extent by the level of conflict of interest that may exist with these syndicator operators in the medical community. Regards.