Working capital items such as accounts receivable, inventory, and accounts payable don’t go directly to the cash flow statement. However, the variation in the value of these items from the previous year to the current one is indeed included in the operational activities section of the cash flow statement.

Still confused about the impact of working capital changes on the cash flow statement? Keep reading.

To understand how changes in working capital affect the cash flow of a company, you need to understand the components themselves first.

Ready? Let’s dive in:

Working Capital Meaning

What is working capital?

Working capital (WC), also called net working capital (NWC), is a financial metric that measures a company’s short-term liquidity and financial health.

It’s the money a business has at its disposal to pay its short-term commitments.

Here’s how to calculate working capital:

Working Capital = Current Assets – Current Liabilities

Where:

- Current assets are assets the company can convert into cash easily (within a year). They include cash, marketable securities, money clients owe the company (accounts receivable), and inventories of raw materials and finished goods.

- Current liabilities are bills and financial obligations the company will pay within the next year. They include money the company owes to suppliers for goods and services (accounts payable), short-term debts, and taxes owed.

You can find these items in the company’s balance sheet.

Positive working capital means the company has more current assets than current liabilities. This means the company can fully pay its bills and other obligations due in the next 12 months. It can also invest to stimulate business growth. In general, this is a sign of financial strength.

On the flip side, negative working capital means the company has more current liabilities than current assets. Negative working capital can be both good and bad.

Now, financial analysts are generally more concerned about the variation of working capital from one year to the next. Why?

Because an increase in working capital means cash outflow, which reduces the Free Cash Flow to the Firm (FCFF), and hence the company value. On the flip side, a decrease in working capital is a cash inflow.

The change in working capital formula is simply the difference between the difference in current liabilities and assets from one year to the previous year.

Variations in working capital are present in the cash flow statement:

Understanding the Cash Flow Statement

The cash flow statement summarizes how much money flows out of the company and how much money flows in, within a certain year. It also tells you how much liquidity the company has (cash and cash equivalents) at the end of the year.

It is separated into three sections, for all of which the total can be positive or negative:

- Operating cash flow: Cash flows and outflows directly from a company’s main business activities. Changes in working capital go here.

- Investing cash flow: This section includes investment gains and losses. It’s where you’ll find changes in capital expenditures (CapEx). An increase in CapEx means less cash flow, but it indicates the company is making investments in its future operations.

- Financing cash flow: Cash flow between a company and those who fund it—its owners (equity financing) and its creditors (debt financing). It includes interest paid, net changes in loans, and dividends paid, among other financing activities.

Sum these three sections together and you get the total cash flow. Then add that to the cash and cash equivalents from the previous year to get the current year’s cash balance.

The total cash flow can be positive or negative.

A positive cash flow indicates a company has enough actual cash coming in to reinvest in the business, pay down debt, distribute to shareholders, and face financial struggles.

A negative cash flow happens when the business does not generate enough cash to stay liquid. Common causes for this include:

- Profits tied up in accounts receivable and inventory.

- Lots of money spent on capital expenditures.

- Large amounts of debt paid off in that year.

- Big dividend payments or share buybacks.

Now that you understand the components of the cash flow statement, we can look at the relationship between working capital needs and cash flow:

Is Working Capital Included In Cash Flow Statement?

The value of the items in current assets and current liabilities (all the things that make up working capital such as accounts receivable, inventory, and accounts payable) doesn’t go directly to the cash flow statement. Instead?

As mentioned before, the change in the working capital value from the previous year to the current year is reflected in the cash flow statement. More specifically:

- An increase in a current asset (that is not cash) is subtracted in the cash flow statement. It means there’s less cash available in the company because it bought more inventory or gave customers more time to pay.

- An increase in a current liability item is added in the cash flow statement. It means the company has more cash available thanks to more debt, or more time to pay obligations.

Essentially, an increase in a current asset, such as accounts receivable, means revenue was recorded in the income statement but cash was not actually received. On the other hand, an increase in a liability, such as accounts payable, means an expense was recorded for which there was no cash outflow.

Why does this happen?

Let’s go back a little first:

If a transaction increases current assets and current liabilities by the same amount, there is no change in working capital.

For example, if a company pays off a debt it has with a supplier, accounts payable will fall but so will cash.

In this case, although working capital stays the same, in the cash flow statement the cash flow from operating activities declines (because it doesn’t take into account the variation in the cash balance). By how much?

The difference between the prior current liabilities value and the current value.

Another example. Imagine a company that sells a product and allows the client to pay later, increasing accounts receivable (and subsequently current assets).

Even though the company registers the sale as revenue, it will only receive the actual cash in its bank account later. The impact of this?

Giving out credit to customers means there’s less cash available. Thus, this increase in accounts receivables is reflected negatively in the cash flow statement.

In general, companies earn a profit on the income statement and pay income taxes on it, but the business may bring more or less cash than the “official” net income figure.

Lastly, if a company buys inventory and pays immediately with cash, working capital stays the same because inventory goes up and cash goes down by the same amount. This means current assets (used to calculate working capital) stay the same. However, cash flow will fall thanks to the inventory purchase.

Do you see the pattern of working capital remaining unchanged while cash flow changes?

Working capital movements always impact the operational activities section of the cash flow statement.

And this impact on cash flow is equal to the change in the individual working capital item.

Now, here’s where things may get confusing:

Working capital staying the same is not true if you don’t consider cash in working capital, something many analysts prefer to do.

When considering only operational items in working capital (accounts receivable, inventory, and accounts payable) and excluding cash and cash equivalents (or just excess cash), the change in working capital from the examples above will always go along with the impact on the cash flow statement.

In other words, in this case, the change in working capital corresponds to the impact on the cash flow statement.

Let’s go through a quick example to see these concepts in action in real life:

Working Capital In Cash Flow Statement Example

Let’s look at the financial statements of Moderna, Inc. (MRNA) in the last few years to understand the relationship between working capital and cash flow:

Above we have the cash flow statement (cut short with just the operating activities) for Moderna for the last three years.

So, where is working capital on the cash flow statement?

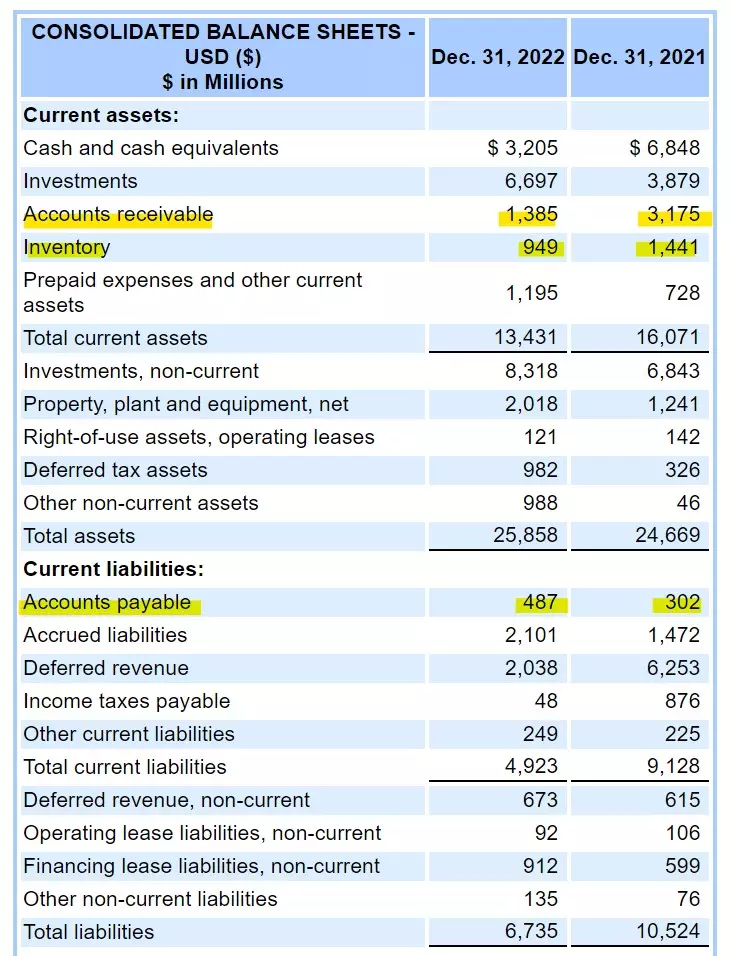

Highlighted in yellow is the variation in the main working capital items.

Let’s look at the 2022 numbers and keep them in mind. Then we go to the balance sheet to see if what we learned previously checks out:

- Change in accounts receivable of positive 1,790.

- Change in inventories of positive 492.

- Chance in accounts payable of positive 240.

Where do these numbers come from? The balance sheet:

The “changes” in the cash flow statement are the difference between the balance sheet items from one year to the next.

Starting with accounts receivable, if you calculate 1,385 minus 3,175 you get -1,790.

This is the value that’s in the cash flow statement, only it is positive instead of negative. Why?

Because the variation in accounts receivable is always subtracted from the cash position. In this case, accounts receivable decreased from 2021 to 2022, which means Moderna collected cold hard cash from clients as they paid off the credit the company gave them.

The same applies to inventory. A positive variation would mean the company spent more money on inventory—a cash outflow. In this case, the negative number 949-1,441=-492 gets subtracted in the cash flow statement. Minus and minus equals plus.

Things change for accounts payable, since it’s a liability. There was a positive variation from 2021 to 2022 of 487-302=185. This means the company received more credit from suppliers, resulting in more cash available since it can delay the actual payment. Thus the positive variation is added in the cash flow statement.

Note that the accounts payable variation in the cash flow statement is different (240). This is common and happens because the statement sometimes includes amounts from related parties or some other accounting technicality. The value should be close though. In this case 185 is relatively close.

In fact, it’s rare for the values in the cash flow statement to match the difference in working capital items from the balance sheet from one year to the other. Moderna is a nice example I found to illustrate the concepts in this post.

In conclusion:

Understand that working capital is an important element of cash flow from operations, and companies can manage it by accelerating the collection of bills from customers, delaying the purchase of inventory, and also delaying the payments to suppliers. All these measures allow the business to retain cash.

Frequently Asked Questions (FAQs)

Why is an increase in working capital a cash outflow?

An increase in working capital means the company extended more credit to clients, purchased more inventory, or paid off obligations it had with suppliers. All of these reduce the cash available in the business.

Where does working capital go on cash flow statement?

Variations in working capital are included in the cash flow statement under the operating activities section. Understanding the cash flow statement is essential for assessing a company’s liquidity, flexibility, and overall financial performance.

Is working capital an operating activity?

Yes. The main working capital items (accounts receivable, inventory, accounts payable) are related to the underlying operational activity of a company. In other words, how the core business makes money and generates cash flow. Thus, working capital variations go to the operating cash flow section of the cash flow statement.